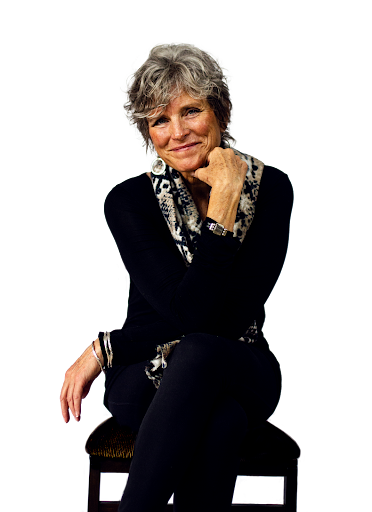

Real Estate Is Either a Trap or a Barrier to Entry: Dawn Rickabaugh Offers Powerful "Non-Bank" Solutions

Dawn Rickabaugh shows tired landlords, anxious sellers, and frustrated buyers, as well as their agents, how to close win-win transactions regardless of market conditions. By introducing seller financing and unveiling the hidden market for private mortgage notes, Dawn makes powerful solutions accessible to everyday people and sophisticated investors alike.

Dawn has positioned herself at the intersection of property and paper (private real estate finance), offering a path for real estate owners, investors, and agents to bypass the confining constraints of traditional bank financing. Dawn Rickabaugh, also known as ''Note Queen'' provides education, consulting, and services around seller financing and note investing, helping clients to turn rentals into passive mortgage income streams, secured by properties they know intimately.

At its core, Note Queen addresses a problem many in real estate face: the burden of active property management and the limitations of relying on banks for financing. Dawn observes that many landlords grow tired of managing tenants, maintenance, and unpredictable expenses. Through seller financing, property owners can offload those responsibilities while still generating predictable, annuity‐style income. Rickabaugh says, "Every day, weary landlords are using seller financing to turn their property nightmares into income dreams, but it's got to be done the right way."

''Note Queen'' teaches that notes secured by real estate are some of the safest, most coveted investments in the market today. She says, "Many property owners find that they can make more as a lender than they did as a landlord." For owners, this means they can engineer sales transactions in which they sell quickly for the highest price, defer capital gains, earn interest on the IRS's money, and create stable retirement income. This annuity-style income stream can be sold for lump sum cash in the secondary market if structured intelligently and intentionally.

Dawn's business model is multi‐faceted. She provides books, courses, coaching, and consulting. She provides a free monthly Q&A mastermind called "Property & Paper LIVE" that is hosted on YouTube and a Podcast. Dawn frequently teaches sellers, buyers, agents, and investors how to create notes worth holding or selling.

Buyers can learn how to tap into equity-rich sellers, which represents trillions in invisible financing available for real estate. The company doesn't just teach; it also acts. It actively buys mortgage notes and real estate, which gives it a keen pulse on the market.

One of Note Queen's unique value propositions is its insistence that the notes created must be well‐engineered. She emphasizes factors like strong down payments, shorter amortization, proper servicing, and clean, enforceable paperwork. These make the notes "healthy," in her words. A seller-financed transaction done poorly can cost the seller tens, if not hundreds, of thousands of dollars.

For agents, Dawn helps them "rescue" listings or commissions by offering owner financing terms when buyers can't qualify for traditional bank loans. For investors, she offers ways to buy discounted notes; for owners, strategies to sell notes or hold them for income. For brokers and attorneys, she provides expertise that many in those professions lack, unless they actively buy notes for their own portfolio.

Ethics and protection are woven into the Note Queen's brand. Dawn Rickabaugh is vocal about the need to do this work legally, ethically, and intelligently. She warns of the consequences when deals are structured sloppily, or when seller financing is used by people who don't understand the secondary market, disclosure laws, or servicing.

Financially, the model works because there is a growing demand. Traditional financing is more difficult to obtain for many buyers (self‐employed, past credit issues, etc.). Meanwhile, many homeowners have equity trapped in their properties that they cannot use. Seller financing and notes open a bridge between what sellers need (price, cash flow, deferred capital gains) and what buyers need (access to homes when banks decline). Note Queen helps both sides.

Challenges do exist: regulatory environments vary by state; investors need discipline; servicing of notes must be reliable; sellers must be realistic and go in with their eyes wide open so that they are not blindsided if they ever need to sell their note. Dawn provides tools and insight so clients can avoid common rookie mistakes.

Dawn Rickabaugh unveils a powerful parallel paradigm of real estate that does not depend on banks, governments, or other Wall Street players. In her visionary model, every day, people create meaningful financial solutions, from one ''Mom 'n' Pop'' to another.

© Copyright IBTimes 2025. All rights reserved.