Roche Completing Foundation Medicine Buyout In $2.4 Billion Transaction

Swiss multinational healthcare company Roche Holdings has entered a definitive merger agreement with Foundation Medicine in a transaction that values the Cambridge, Massachusetts, company at $5.3 billion. Roche already owns a majority stake in Foundation, and the deal to acquire the remainder of the latter’s outstanding common stock would complete the merger between the two companies.

Roche would pay $137 in cash for each stock of Foundation, totaling to a transaction value of $2.4 billion, the companies said in a statement Tuesday. The value decided for Foundation’s shares is almost 29 percent higher than Monday’s closing price of $106.45 on Nasdaq, where it rose 4.41 percent through the day’s trade. The company’s current market capitalization is $3.94 billion.

The merger transaction has already been agreed upon unanimously by the boards of directors of both companies (with the two directors on Foundation’s board who are from Roche abstaining), the statement said.

Daniel O’Day, CEO of Roche Pharmaceuticals (one of two of Roche’s verticals), said: “This is important to our personalized healthcare strategy as we believe molecular insights and the broad availability of high quality comprehensive genomic profiling are key enablers for the development of, and access to, new cancer treatments. We will preserve FMI’s autonomy while supporting them in accelerating their progress.”

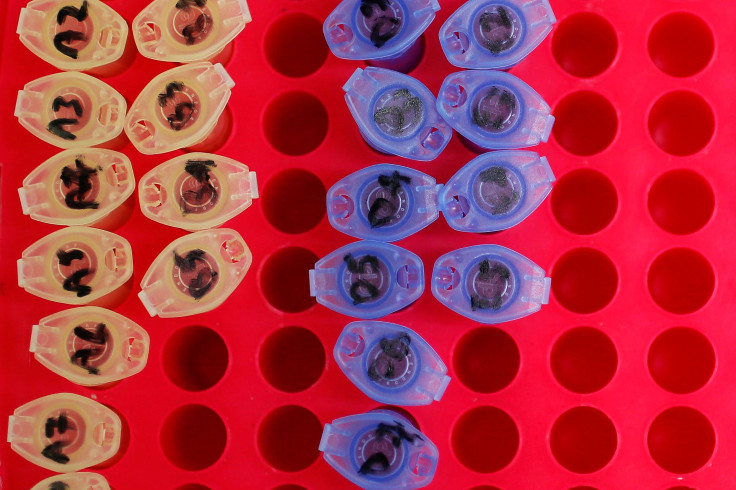

The Swiss company had bid for the majority stake in Foundation in January 2015, and acquired it three months later. Foundation specializes in cancer care, using molecular information gathered from comprehensive genomic profiles of patients, to match them with therapies, immunotherapies or clinical trials suitable to their specific cancers.

Troy Cox, CEO of Foundation, said in the statement: “Foundation Medicine and Roche share the philosophy that every cancer patient should have access to personalized care informed by validated molecular information. Joining forces with Roche as an independent operating company allows Foundation Medicine to continue its collaboration with Roche, as well as our biopharma partners, to drive ubiquitous access to CGP testing and innovative data services.”

The transaction is subject to all common stock of Foundation being tendered in the offer made by Roche, and other customary regulatory approvals. All Foundation directors have already agreed to tender their shares. The entire deal is expected to close in the second half of 2018.

© Copyright IBTimes 2025. All rights reserved.