Saudi Oil Minister Ali Al-Naimi Wades Into Price Debate, Denying ‘War’ On US Shale Production In IHS CERAWeek Speech

Saudi Arabia’s top oil official was in enemy territory Tuesday, addressing a room packed with U.S. oil producers at a conference smack in the heart of America’s shale-drilling boom: Houston.

The crowd wasn’t entirely amiable. Saudi Arabia in the last year was criticized for ramping up crude oil output and crowding out competitors — including U.S. shale drillers — to maintain its market share as the price of oil sank. The strategy has helped push crude prices down to near- 13-year lows, leaving many American oil companies scrambling to cover costs, pay off debts and stay in business. Tens of thousands of workers have lost their jobs, and bankruptcy filings are rising across the oil patch.

Yet Saudi Oil Minister Ali Al-Naimi struck a conciliatory tone in his morning address, calling for unity within the oil sector and denying any Saudi campaign to squash U.S. competition.

“We have not declared war on shale, or on production from any given country or company,” Al-Naimi said Tuesday following a keynote speech delivered during the annual IHS CERAWeek conference. “We are not chasing a greater market share,” he added. “We are all in it together.”

Despite recent pain in the U.S. oil sector, shale drillers have proved more resilient than many analysts expected at the start of the oil-price collapse. U.S. production has fallen in recent months as companies canceled projects and capped existing wells. But American output is projected to soar within five years as drillers become more efficient and prices improve, the International Energy Agency said Monday during the Houston conference.

For some U.S. oil industry leaders, Al-Naimi's collaborative message seemed like a tacit recognition of the shale sector’s staying power.

“Trying to run us out of business is not going to work,” said Alex Mills, president of the Texas Alliance of Energy Producers, the state’s largest association of independent oil and gas producers. “I think, from the minister’s comments, that [OPEC has] come to that realization. The crude oil business has changed, and U.S. oil production from shale has been a major factor in that change.”

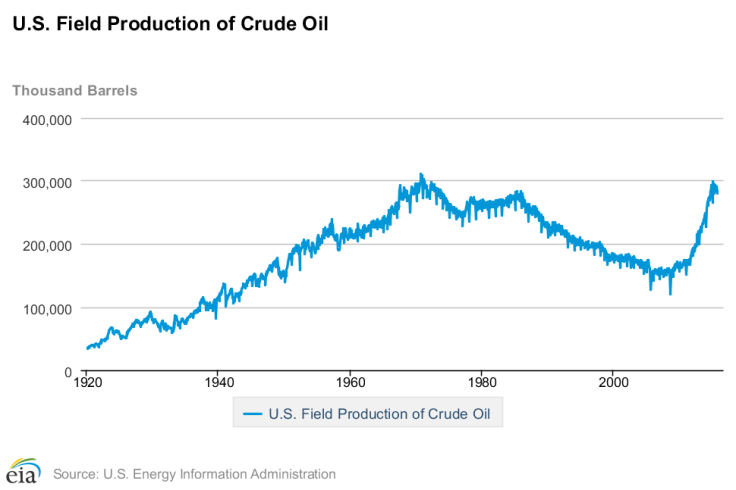

America’s oil output has roughly doubled since 2008, peaking at 9.7 million barrels a day in April 2015 — its highest level since 1971. Oil prices around $100 a barrel and cheap and easy financing enabled producers to deploy more expensive hydraulic fracturing (fracking) technologies to tap hard-to-reach hydrocarbons in shale formations.

The surge in U.S. crude has helped boost the overall global supply at a time when slower-than-expected growth in China and emerging markets fueled fears of softening demand.

Worries about a growing supply glut have driven prices down from their mid-2014 peaks above $100 to around $30 a barrel today. But Saudi Arabia, the world’s largest oil exporter, has resisted calls from poorer OPEC members to slash production and shore up prices, as the cartel has done in the past. The Saudis instead have accelerated production — a move many oil experts said was an attempt to further depress prices and eliminate competition. In January, Saudi Arabia’s output was near its record high around 10.2 million barrels a day.

Energy analysts have estimated the world now has between 1.5 million and 2 million barrels a day in excess oil supply.

Al-Naimi’s call for unity with U.S. producers Tuesday doesn’t mean Saudi Arabia will change this strategy. The oil minister said Saudi’s oil sector could survive at even lower prices — around $20 a barrel — and he confirmed that production cuts are off the table for the Saudis and other OPEC members.

“That is not going to happen,” he said at the Houston conference.

Instead, Saudi Arabia is pushing a proposal for major oil-producing nations to freeze their output to January levels. Al-Naimi and his counterparts in Venezuela, Qatar and non-OPEC member Russia agreed last week to such a deal on the condition that Iran, Iraq and other big oil exporters agree to a production freeze.

That’s a similarly unlikely bet, at least for now. Iran’s Oil Minister Bijan Zanganeh reportedly called the Saudi proposal “a joke” Tuesday. An Iranian oil ministry official separately said Tehran would only consider curbing production once its output reaches pre-sanction levels of roughly 4 million barrels a day, the Wall Street Journal reported. Iran now produces just under 3 million barrels of oil a day.

Fadel Gheit, a senior energy strategist at Oppenheimer in New York, said the production freeze would do little to rebalance the oil markets and could end up crushing some U.S. oil producers anyway.

“It is a stalemate, a face-saving resolution that is unbinding and difficult to enforce,” he said of the proposed freeze. “I believe one more year of low oil prices would hurt Iran and Russia economically … while forcing 30 to 50 percent of U.S. oil producers into bankruptcies.”

For Saudi Arabia, it’s “mission accomplished,” he added.

Still, America’s oil industry isn’t expected to stay down for long. Output of U.S. shale oil — also called light tight oil — is projected to drop by 600,000 barrels a day in 2016 and by a further 200,000 barrels a day in 2017, the International Energy Agency said Monday. But U.S. output could reach an all-time high of 14.2 million barrels a day by 2021 thanks to “a gradual recovery in oil prices, combined with further improvements in operational efficiencies and cost-cutting,” according to the Paris institution’s medium-term oil market report.

Despite Al-Naimi’s call for unity Tuesday, Mills said he believes OPEC's days of dominating oil markets are over. U.S. shale “is going to be a factor in the way the world produces crude oil and natural gas in the future,” the Texas industry group leader said.

© Copyright IBTimes 2025. All rights reserved.