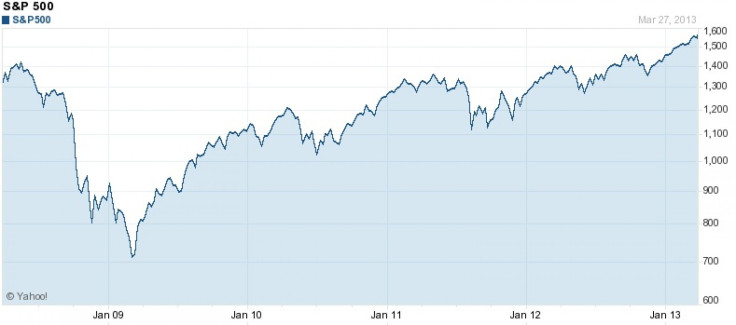

S&P 500, Dow Jones Industrial Average Stock Indexes Close At Record High, Market's Recovery From Great Recession Lows Now At 131%

The two main indexes of the U.S. stock market smashed through their record highs Thursday, extending the market's rebound from the Great Recession to a robust 131 percent.

The broad-based S&P 500 index of shares in the largest U.S. companies closed at 1,569.19, slightly above the previous record of 1,565.15 set on Oct. 9, 2007, just before the Great Recession, and a whopping 131 percent above the 666.79 that the index had fallen to by March 2009, when the economy was nearing its bottom.

The blue-chip Dow Jones Industrial Average of 30 large industrial stocks closed at 14,578.54, up from its previous record of 14,559.65 set on Tuesday.

U.S. economic reports Thursday were mixed. The fourth-quarter's growth was revised upward to 0.4 percent from 0.1 percent, but jobless claims last week were larger than expected and business activity in the Midwest appeared to be slowing.

But economic data aside, the real wind in the equities' wings has been the $85 billion per month asset purchases by the Federal Reserve. Known as quantitative easing, the purchases aim to pump liquidity into the U.S. economy and keep interest rates at ultra-low levels.

“It’s been a Fed rally. You never fight the Fed, and we are seeing cash coming into the market, but we are not yet seeing a big rotation out of bonds,” Anthony Conroy, head of trading at BNY ConvergEx, told the Financial Times.

Animal spirits, as the boldness to risk assets for greater gains is sometimes called on Wall Street, were in clear evidence after the markets closed.

“It’s about time,” Robert Lutts, president and chief investment officer at Cabot Money Management Inc., which oversees $500 million in Salem, Mass., told Bloomberg News.

“We’ve gone through two bear markets in the last decade and equity investors have been really challenged in their conviction to hold through that period of time, but I think that we’re at the beginning of a very strong phase for equities, not at the end.”

But not all analysts were so sure the current bull market had further to run.

"I am detecting two new developments, which are not altogether constructive -- March came in as the worst for global mergers and acquisitions in three years (down 4.4 percent on a year-on-year basis) and share buybacks are subsiding rapidly, according to S&P, as the market all of a sudden may be seen by corporate CEOs as being stretched, with prices elevated at or near new highs and lofty earnings estimates coming down," said David Rosenberg, chief strategist for Gluskin Sheff + Associates Inc., a Canadian money management firm.

© Copyright IBTimes 2025. All rights reserved.