Spotify Turns To Emerging Markets For Growth

While still growing, the paid music-streaming market in the U.S. is maturing. The RIAA estimates that paid subscriptions in the U.S. generated $2.5 billion in revenue in the first half of 2018, and that there was an average of 46.4 million paid subscriptions during that period. Apple recently overtook Spotify (NYSE:SPOT) as the dominant service in the U.S., even as Spotify has the largest paid subscriber base worldwide at 87 million.

This article originally appeared in the Motley Fool.

The Swedish company is now increasingly looking to emerging markets for growth.

Launching in the Middle East and North Africa

Spotify has just launched its music-streaming service in the Middle East and North Africa, adding 13 new markets, including Saudi Arabia, the United Arab Emirates, Morocco, and Egypt. Apple Music is also available in some of those markets. In an interview with Music Ally, Spotify's managing director of the Middle East and Africa said the regions offer promising growth opportunities thanks to younger demographics and a high level of smartphone ownership.

Spotify has also done a lot of work localizing the service "to a very detailed level." That includes launching a new Arab Hub, a collection of Arab music playlists. Spotify features similar collections for other genres, such as a Latin Hub and an Afro Hub, and content discovery is one of its greatest competitive strengths.

Piracy is still rampant in the region, and Spotify hopes that it can offer more legal alternatives, including its free ad-supported tier. Additionally, Spotify is pricing its premium subscriptions more aggressively to accommodate lower income levels, charging roughly half of what it does in developed markets. That strategy has worked extremely well in other emerging markets like Latin America.

Emerging markets are growing faster

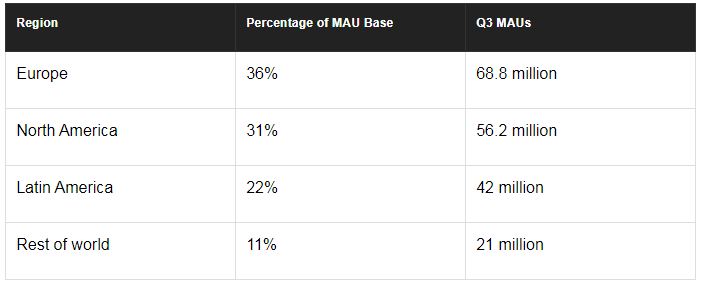

"Growth in our emerging regions of Latin America and Rest of World continues to outpace growth in our more established markets," Spotify wrote in its third-quarter shareholder letter. For context, here's a current breakdown of Spotify's 191 million MAUs:

Monetization will be another challenge, though, as it's much harder to turn a profit on ad-supported users compared to premium subscribers. Ad revenue was just 10% of sales last quarter, even as Spotify had 109 million ad-supported MAUs. However, Spotify's ad business will become more profitable as it scales while also transitioning to programmatic and self-serve ad products, which now represent 20% to 24% of ad revenue, CFO Barry McCarthy said on the last earnings call.

Growing MAUs while building its brand locally always comes first. Spotify can worry about monetization later.

Evan Niu, CFA owns shares of AAPL and Spotify Technology. The Motley Fool owns shares of and recommends AAPL. The Motley Fool has the following options: long January 2020 $150 calls on AAPL and short January 2020 $155 calls on AAPL. The Motley Fool has a disclosure policy.