American financial firms are allowed to operate in Europe because U.S. financial rules have been deemed "equivalent" to E.U. rules.

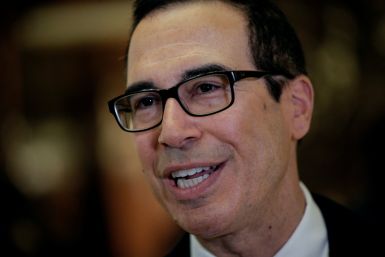

Goldman's two-month rally weakened Friday, ahead of the Senate confirmation hearing for its former chief information officer, Steven Mnuchin.

Trump has reportedly asked Gary Cohn, Goldman Sachs president and COO, to lead his National Economic Council. As Trump's cabinet fills with Goldman-related people, the bank's shares are soaring.

Bernie Sanders and Elizabeth Warren say the nomination of Steve Mnuchin as treasury secretary is a betrayal of the working class.

The former Goldman Sachs partner could play a key role in domestic economic policy as well as foreign policy decisions on such issues as the Iran nuclear deal and easing relations with Cuba.

The Vermont senator says the Democratic party needs to remake itself in the wake of Hillary Clinton's loss to Donald Trump in the presidential election.

Things are looking up for Morgan Stanley.

“We saw solid performance across the franchise that helped counter typical seasonal weakness,” Goldman CEO and Chairman Lloyd C. Blankfein said of its third-quarter performance.

According to newly released emails, the Democrat promoted a commission that backed Social Security cuts, and said America must “resist” opposition to free trade.

By stashing $2.5 trillion in profits overseas, corporations like Apple, Nike and Goldman Sachs are avoiding $717.8 billion in taxes, according to a new study.

Amid worries in the financial sector, the Dow Jones declined 195.79 points.

A study suggests traders with connections to regulators and politicians were able to translate those relationships into cash during the financial crisis.

The Wall Street mega-bank predicts that markets could become more volatile as the election tightens — but says there's still money to be made.

It is one of the several banks under investigation over allegations of giving unsecured mortgages to unqualified borrowers that triggered the 2008 financial crisis.

The investment bank prevents all partners from making donations to certain political campaigns.

Analysts said the falls were a result of a price rally which lifted crude by over 20 percent between the beginning of this month and late last week.

New York’s financial regulator is seeking trading records and research documents from the Wall Street firm over its bond dealings with the Malaysian fund.

The bank, like other Wall Street firms, has been focusing on cutting costs amid concerns about slowing growth.

“We have not made any changes to our real estate requirements in Frankfurt as a result of the referendum result,” Goldman said in a statement.

After the biggest daily fall in the pound in modern history Friday, both U.S. banks were forced to slash their forecasts for the rest of 2016.

U.S. stock index futures eased slightly in early trading on Sunday after Britain’s vote to leave the European Union sparked a sharp sell-off in global markets on Friday

Software programs that big banks and financial firms use to monitor employees for legal breaches may also uncover attempts to report suspected wrongdoing.