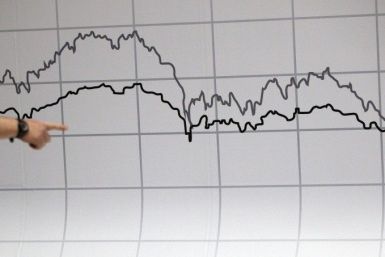

European stocks lost big Thursday as Greek banks were cut loose from European Central Bank support and Spain's borrowing costs kept skyrocketing. The head of the International Monetary Fund, Christine Lagarde, also warned today of the extremely expensive consequences of Greece leaving the currency bloc.

U.S. investors bought shares of industrials, airlines, gold mining companies and agricultural assets Wednesday as robust economic data offset fears stoked by the likelihood of Greece leaving the euro zone.

Simon Property Group Inc. (NYSE: SPG), the largest U.S. mall landlord, said Friday its profits more than tripled in the first quarter as the value of its properties rose and higher rents and occupancy rates boosted its revenue.

Newmont Mining Corporation (NYSE: NEM) said Friday first-quarter profit fell 4.7 percent diminished gold production and higher costs offset higher selling prices.

The Brooklyn Nets new logo and merchandise have leaked online as photos circulate the internet. Check them out here.

The Securities and Exchange Commission launched a probe on Thursday of a program by Chesapeake Energy Corporation (NYSE: CHK) that let its founder and CEO get an ownership interest in any well drilled by the second-largest U.S. natural gas producer.

One World Trade Center, currently under construction in Lower Manhattan at the site of the 9/11 terrorist attacks, could end up being the tallest building in New York City, surpassing the Empire State Building as soon as next week. In honor of the construction process, EarthCam, an international webcam technology company, released a two minute-long time-lapse of the progression of the tower.

The Dow and the S&P 500 rose on Tuesday after strong earnings and upbeat outlooks from big manufacturers like 3M Co , but Apple's slide ahead of its results drove the Nasdaq down.

Here we go again. Orlando Magic center Dwight Howard will request yet another trade, this time, to possibly take place in the offseason.

Texas Instruments (Nasdaq: TXN), the No. 1 maker of communications chips, reported first-quarter net income dipped a worse-than-expected 60 percent but said revenue was better than predicted.

The Boeing Company (NYSE: BA), the largest U.S. airplane and defense manufacturer, is expected to report higher first quarter earnings as the sale of more high-profit aircraft types offsets rising pension costs.

MetLife Inc. (NYSE:MET), the largest life insurer in the U.S., will pay $500 million to settle a multi-state investigation after regulators reviewed whether companies were holding funds that should go to beneficiaries, according to media reports.

One of the best aspects of the annual Tribeca Film Festival in New York is its showcase of brilliant short films. This is especially true of Curfew, which is being screened as part of the Men-Hattan program this year. The harrowing drama is richly crafted and profoundly affecting -- with elements of comedy.

Kimberly-Clark Corp. (NYSE: KMB), which makes Scott brand tissues, reported on Friday an increase in revenue and profits in its first quarter as cost-cutting and a boost in overseas sales made up for slow growth in the domestic market.

Upbeat economic reports from Britain and Germany combined with surprisingly strong first-quarter earnings reports in the U.S. to foster a risk-on sentiment that lifted stocks and commodities while weighing on safe-haven investments.

McDonald's Corp. met analysts' expectations in first-quarter revenue and profit growth, as economic troubles in Europe did not to put a dent in the world's largest restaurant chain's balance sheet, the company reported on Friday.

Johnson Controls Inc. (NYSE: JCI), the world's No. 1 maker of car batteries, said Friday its fiscal second-quarter profit rose but excluding one-time benefits the company's profit fell 5 percent.

Stocks closed firmly lower Thursday following a choppy start, as rumors of a possible French sovereign debt downgrade and a batch of mixed U.S. data overshadowed improving corporate earnings.

One of the three men who had plotted to blow up the New York City subway system in September of 2009 appeared in Brooklyn Federal Court Tuesday to testify in the trial of co-conspirator Adis Medunjanin.

Mayor Michael R. Bloomberg and Schools Chancellor Dennis Walcott announced the city's plan to open 54 new schools this fall, including a high school academy for software engineering. Come September, the Bloomberg administration will have closed 140 schools and opened 589 new ones since 2002, through a longstanding policy that has set out to replace poorly performing schools. The new schools will eventually serve more than 21,000 students.

An exhibit at the Mark Miller Gallery on the Lower East Side offers New Yorkers insight into one of Manhattan's most exciting endeavors: The Delancey Underground. The Let There Be Light Exhibit displays renderings of an underground park that a pair of NYC architects have set out to create in an abandoned trolley terminal in the Lower East Side.

Goldman Sachs Group Inc. (NYSE: GS) Chief Financial Officer David Viniar took questions from analysts on Tuesday morning in a wide-ranging call that touched on government regulation, risk, departures of the firm's partners and the firm's standing on Wall Street. Here are five key points.