The stakes are high. Friday's August jobs report will be the last major data point for the Federal Reserve to consider ahead of the Sept. 12-13 FOMC meeting.

The U.S. stock index futures point to a higher open Thursday as investor sentiment was underpinned by the expectation that the European Central Bank would announce stimulus measures to ease the euro zone debt burden.

While the presidential candidates' plans to tackle unemployment, the national debt, health care reform, immigration, gay marriage and gun control might be the topics that have Main Street voters buzzing ahead of this year's election, a new report by the global equity research team at Standard & Poor's shows Wall Street investors have very different policy debates in mind.

The United States is getting ready to finalize a deal for $1 billion in debt relief for Egypt, a move that could set a new tone for Egypt-U.S. relations.

Asian shares and the euro eased Wednesday, with investors waiting for a European Central Bank meeting on Thursday and U.S. payrolls on Friday for signs of more action to counter European debt woes and support growth.

Banco Santander's announcement that it would be spinning off nearly one quarter of its Mexican unit in an initial public offering later this month was greeted by the markets as a seemingly win-win-win proposition. But the move by the large Spanish bank only highlights the increased dependence Iberian banks have had on their overseas branches over the past few years and how, in an effort to now package off those units and sell them, they could be killing the hen that's been laying the golde...

The fact that the Democrats are preparing to convene in North Carolina highlights how shifting demographics are changing America's electoral map.

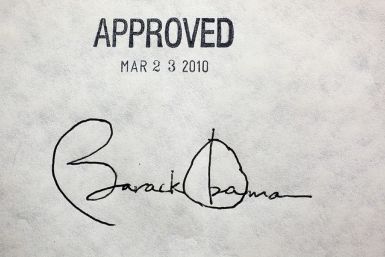

Republican critics jumped on President Obama's remarks as more evidence that the he is not capable of reviving the economy.

During the holiday week, economy-watchers are likely to focus on Friday's August nonfarm payrolls report and the European Central Bank’s governing council meeting, on Sept. 6.

A car filled with explosives rammed into a U.S. government vehicle near the U.S. Consulate in the northwestern Pakistani city of Peshawar Monday, killing two people and injuring five others, media reports said citing Pakistani authorities.

The worst drought to hit U.S. cropland in more than half a century could soon leave Americans reaching deeper into their pockets to fund a luxury that people in few other countries enjoy: affordable meat.

He's practically the devil incarnate to the Republican Party, but no president since President Franklin D. Roosevelt has had to address as many serious economic, financial and foreign policy problems as President Barack Obama. Further, Obama's relative success addressing these problems, and the Republican Party's callousness, will lead to Obama's re-election in November.

Fast-food franchise owners say the Affordable Care Act could virtually put them out of business with its requirements that they provide health-care coverage.

It seemed everyone was claiming their crystal ball has been right in anticipation of a much-hyped speech by the world's most powerful central banker, who managed to turn the attention of traders around the world to his podium in bucolic Jackson Hole, Wyo. Friday. They were all right and, as usually happens in such cases, they were also all wrong.

The Bank of Spain announced on Friday that capital outflow from the country had increased by almost 40 percent in June 2012.

As Clint Eastwood made his "surprise" appearance at the Republican National Convention and delivered his speech supporting Republican Mitt Romney and mocking President Obama, star power came to the fore ahead of November 6 elections even as Twitterati blasted his speech.

Mitt Romney has moved into a narrow lead over President Barack Obama in a small bounce for him from the Republican National Convention, a Reuters/Ipsos poll found Thursday.

Market-watchers continued to use words like "anticipation," "expectations," "disappointment" and "excitement" Thursday, less than 24 hours ahead of a speech by Federal Reserve chairman Ben Bernanke that is being hyped up as a make-or-break moment for economic affairs in 2012.

Following the Congressional Budget Office's (CBO) predictions of the imminent "fiscal cliff" that will send the U.S. economy into a recession after January 1, 2013, analysts are struggling to identity the true extent of the oncoming threat. While the CBO estimates that unemployment will increase to about 9 percent in the fallout from proposed "fiscal tightening" measures, Capital Economics suggested in a U.S. Employment Report published today that the effect on hiring may be more ...

A comparison of past RNC platforms truly demonstrates how far the party has swung to the right.

U.S. consumer spending got off to a fairly firm start in the third quarter, rising by the most in five months and offering hope economic growth could pick up this quarter.

Britain in the early 1980s found itself in dire need of a happy jolt

![2012 Election: Mitt Romney Favored Over Barack Obama To Advance The Technology Industry [FULL TEXT]](https://d.ibtimes.com/en/full/756971/2012-election-mitt-romney-favored-over-barack-obama-advance-technology-industry-full-text.jpg?w=385&h=257&f=d3e0cbed12087c6c51b46538394e47c8)