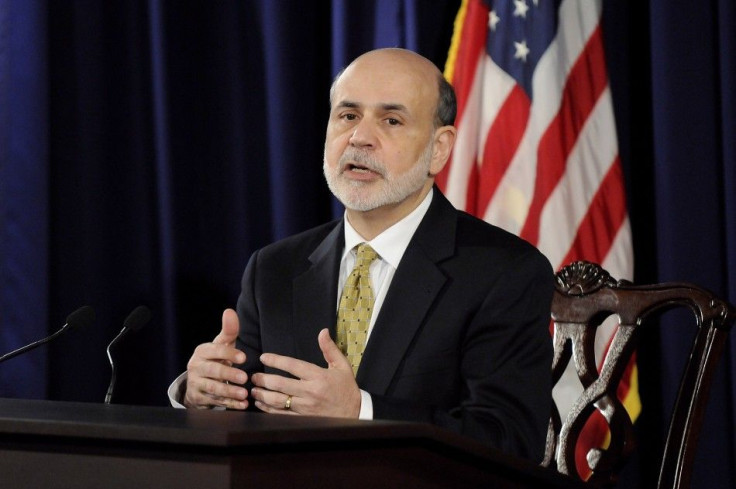

Bernanke's Speech at Jackson Hole: 6 Key Take-Aways

No new round of monetary easing from Fed

Among the bearish pundits, those who had predicted Fed Chairman Ben Bernanke would disappoint the financial world by failing to announce a new round of asset purchases on a speech Friday morning, there was a lot of back-patting. Bernanke made it clear there would not be anew round of quantitative easing any time soon.

But among the bullish pundits, the ones who had forecast Bernanke's words would spark a rally in the markets, there was considerable high-fiving as well.

Indeed, it seemed everyone was claiming their crystal ball has been right in anticipation of a much-hyped speech by the world's most powerful central banker, who managed to turn the attention of traders from as far away as Shanghai, Frankfurt and New York to his podium in bucolic Jackson Hole, Wyo. for at least a few minutes Friday.

They were all right and, as usually happens in such cases, they were also all wrong.

Bernanke's speech ended up being neither a call for further asset purchases nor a staunch denial that such an action would happen but instead, a highly professorial assessment of the state of central banking that, while openly doubting the infallibility of the men and women who control the world's money supply, still position monetary policy as the last best hope of Earth's economy.

"The speech comes across as a staunch defence of the effectiveness of unconventional monetary policy," Paul Dales, a senior U.S. economist at Toronto-based Capital Economics, wrote in a note shortly after the embargo on prepared notes was lifted.

That full-throated championing of what central bankers can do for the economy concluded, after much deliberation in what Goldman Sachs analysts, in their own note to clients called "a dovish tone" with the Chairman noting the Federal Reserve was ready to "provide additional policy accommodation as needed to promote a stronger economic recovery."

Below, some choice quotes from Bernanke's speech, as well as an interpretation of what they mean:

On the general effectiveness of making up policy on the fly:

"As the crisis crested, and with the federal funds rate at its effective lower bound, the FOMC turned to nontraditional policy approaches to support the recovery. [...] As the Committee embarked on this path, we were guided by some general principles and some insightful academic work but--with the important exception of the Japanese case--limited historical experience. [...] As a result, central bankers in the United States, and those in other advanced economies facing similar problems, have been in the process of learning by doing."

Bernanke admitted central bankers might not always know what they're doing when they're doing it, which Goldman called "noteworthy for [its] frank admission." The fact the Japanese case is mentioned is a nod to Bernanke's experience in academia. These sentences were in a highly technical part of the speech that also tipped its hat to economist Milton Friedman, among others. In essence, the suggestion was that, while the world's central bankers have had to wade into uncharted waters over the past few years, they have been guided by strict academic moorings.

On the power of policy signaling:

"For instance, [policy statements] can signal that the central bank intends to pursue a persistently more accommodative policy stance than previously thought, thereby lowering investors' expectations for the future path of the federal funds rate and putting additional downward pressure on long-term interest rates, particularly in real terms. Such signaling can also increase household and business confidence by helping to diminish concerns about "tail" risks such as deflation."

In the chicken-and-egg argument of "which comes first, The Fed intervention or the market movement?," Bernanke came out solidly as a defender of central bankers. While this very argument is known to have been expounded at length, it is remarkable Bernanke would choose such a prime-time moment to state what could be later criticized as a logical fallacy. Here and in later parts of the speech, the Chairman showed that, while careful not to take decisions that 'break' the transmission channels central bankers have, he is not taking account ideological critics.

On what would have happened if the Fed had not acted:

"While there is substantial evidence that the Federal Reserve's asset purchases have lowered longer-term yields and eased broader financial conditions, obtaining precise estimates of the effects of these operations on the broader economy is inherently difficult, as the counterfactual--how the economy would have performed in the absence of the Federal Reserve's actions--cannot be directly observed. [...] Has the forward guidance been effective? It is certainly true that, over time, both investors and private forecasters have pushed out considerably the date at which they expect the federal funds rate to begin to rise; moreover, current policy expectations appear to align well with the FOMC's forward guidance."

Translation: We have no idea what would have happened if we hadn't been decisive in the past BUT we're still certain it would have been worse.

On when he'll take the foot off the throttle:

"The views of Committee members regarding the likely timing of policy firming represent a balance of many factors, but the current forward guidance is broadly consistent with prescriptions coming from a range of standard benchmarks, including simple policy rules and optimal control methods. [...] It is noteworthy, however, that the expansion of the balance sheet to date has not materially affected inflation expectations, likely in part because of the great emphasis the Federal Reserve has placed on developing tools to ensure that we can normalize monetary policy when appropriate, even if our securities holdings remain large. The FOMC has spent considerable effort planning and testing our exit strategy and will act decisively to execute it at the appropriate time."

Translation: We have no idea when easing will need to stop, but we're certain we'll know when we get there. Trust us.

On whether the financial markets will remain distorted permanently due to Fed action:

"In assessing this risk, it is important to note that the Federal Reserve, both on its own and in collaboration with other members of the Financial Stability Oversight Council, has substantially expanded its monitoring of the financial system and modified its supervisory approach to take a more systemic perspective. We have seen little evidence thus far of unsafe buildups of risk or leverage, but we will continue both our careful oversight and the implementation of financial regulatory reforms aimed at reducing systemic risk."

Translation: We are keeping our eye on this.

On what the Fed sees as the eventual endgame:

"Extensive analyses suggest that, from a purely fiscal perspective, the odds are strong that the Fed's asset purchases will make money for the taxpayers, reducing the federal deficit and debt.[...] The stagnation of the labor market in particular is a grave concern not only because of the enormous suffering and waste of human talent it entails, but also because persistently high levels of unemployment will wreak structural damage on our economy that could last for many years. [...] However, following every previous U.S. recession since World War II, the unemployment rate has returned close to its pre-recession level, and, although the recent recession was unusually deep, I see little evidence of substantial structural change in recent years. [...] Monetary policy cannot achieve by itself what a broader and more balanced set of economic policies might achieve; in particular, it cannot neutralize the fiscal and financial risks that the country faces. It certainly cannot fine-tune economic outcomes."

Translation: Years from now, when we're enjoying prosperity again, we'll look back at 2012 as the golden era of central banking. That, or we'll look at it as the epoch that allowed our politicians will foolishly throw away all our hard-earned gains with internecinine squabbling. Have a nice day.

© Copyright IBTimes 2025. All rights reserved.