Manufacturing activity in New York state improved moderately in May as shipments rose and employment levels and hours expanded, a report from the New York Federal Reserve Bank said Tuesday.

U.S. stock index futures pointed to a higher open on Wall Street on Tuesday, with the futures for the S&P 500 and the Dow Jones up 0.6 percent and Nasdaq 100 futures up 0.8 percent at 0733 GMT.

As the leader of JPMorgan Chase & Co's hedging unit quit after trading losses that could end up exceeding $3 billion, the board seemed to be rallying behind CEO Jamie Dimon before the huge bank's annual shareholder meeting Tuesday.

The Glass-Steagall Act of 1933 was a Depression-era law that separated investment and commercial banks. It was repealed in 1999 during the Clinton administration.

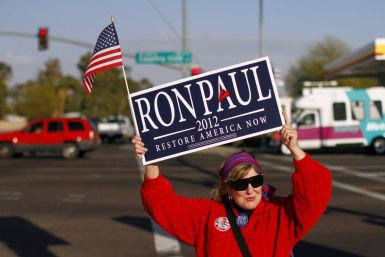

Republican presidential candidate Ron Paul will not campaign in states with upcoming primaries, the Paul campaign said Monday.

JPMorgan will move to limit the fallout from a shock trading loss that could reach $3 billion or more by parting company with three top executives involved in its costly failed hedging strategy, sources close to the matter said.

First JPMorgan Chase & Co. lost an estimated $2 billion in derivatives trading, and now it has lost one of CEO Jamie Dimon's top lieutenants: Ina R. Drew, JPMorgan Chase's chief investment officer and a bank employee for three decades, will step down on Monday. Matt Zames will take over for Drew, Bloomberg News reported.

JPMorgan Chase & Co. (NYSE: JPM) CEO Jamie Dimon offered a mea culpa on NBC's Meet The Press Sunday, saying the mammoth money-center bank was dead wrong to dismiss concerns over a series of hedges that ended up costing the company $2 billion.

Since hitting 52-week lows last October, U.S. financial-sector stocks have staged a strong comeback -- rising some 34 percent. Despite this uptick, they still look like bargains, at first blush.

U.S. Securities and Exchange Commission investigators are probably in the process of drafting subpoenas against JPMorgan Chase & Co. (NYSE: JPM), if they have not already filed them, regarding the bank's loss of $2 billion through proprietary trading, said ex-SEC New York Regional assistant director Joseph Dever.

Ron Paul ate with Ben Bernanke, chairman of the Federal Reserve, on Wednesday, and after their meal Paul joked that he's for the gold standard now.

Federal Reserve Chairman Ben Bernanke, speaking via teleconference to a Chicago bankers' conference, took an uncharacteristic swipe at community banks on Thursday, suggesting that those institutions might not be as sure-footed as their balance sheets would have them appear.

The Industrial and Commerce Bank of China (Hong Kong: 1398; Shanghai: 601398), the world's largest bank, is set to buy an 80 percent stake in Bank of East Asia (BEA) USA, based in New York.

U.S. consumer credit expanded in March at the fastest pace since late 2001, boosted by a rebound in credit-card use, and higher student and car loans, data from the Federal Reserve showed Monday.

Ron Paul's supporters have made their intentions clear: changing the Republican Party from within surpasses any devotion they may have towards the Libertarian Party and its candidate, Gary Johnson.

The U.S. Treasury Department will sell $5 billion in shares of American International Group Incorporated (NYSE: AIG) as it continues to divest its balance sheets of the bailed-out insurance company, which has agreed to purchase $2 billion of its own shares as part of the stock offering, the company announced Monday.

CEOs of major U.S. corporations have seen their pay increase by 725 percent between 1978 and 2011. In the same time, worker compensation grew by a painfully slow 5.7 percent.

The U.S. economy added far fewer jobs than expected in April, while the unemployment rate edged down as more people gave up hope of finding jobs, reinforcing the fear that the job market recovery could be losing steam.

Employers likely increased hiring in April, although not enough to lower the country's 8.2 percent jobless rate, keeping pressure on President Barack Obama ahead of his November re-election bid.

The part-nationalized bank is expected to make the announcement on Friday during its first-quarter update, where it will also announce pre-tax losses of under £50 million, down from losses of £106 million this time last year.

The risk of inflation is keeping the Federal Reserve from doing more to support the U.S. economy, even though the threats to price stability are reasonably contained at present, a Fed official said Thursday.

European Union finance ministers failed Thursday to hammer out new global banking regulations, highlighting the resistance regulators on both sides of the Atlantic face as they push for tougher banking rules to ensure banks won't spark another great recession, as they did in 2008.

![Maine Republican Caucus 2012: Ron Paul's Speech [FULL TEXT & VIDEO]](https://d.ibtimes.com/en/full/34527/maine-republican-caucus-2012-ron-pauls-speech-full-text-video.jpg?w=385&h=257&f=4dfc2ecd4916406e88674e66007c4615)