Xiaomi, Meet America: Chinese Smartphone Upstart Courts Tech Journalists As It Weighs Move Into US

There's a good chance the word “Xiaomi” means nothing to you right now, but in a few years you might well own a smartphone branded with that name. Xiaomi is a Beijing startup worth $45 billion that sold more smartphones in China last year than everyone but Samsung, according to analyst firm Canalys.

Currently, the upstart brand only sells its devices in Asia, but on Thursday it will hold its first public event in the U.S., marking its first step in the grueling process of breaking into the American consumer market.

Though the Chinese consumer electronics company has already said it will not be announcing its entrance into the U.S. market at its event in San Francisco, the press gathering will serve as its formal introduction to the American public. Speaking at the event will be Co-founder and President Bin Lin along with Vice President of International Hugo Barra, both of whom trace their roots to Google.

At the event, Xiaomi’s leaders will give demos of their various products and hold a Q&A session, the company told the International Business Times. Lin and Barra will also give a presentation on the company's history and explain how "Xiaomi is doing things differently."

What exactly makes Xiaomi so special and its event Thursday worth keeping an eye on? For starters, Xiaomi didn’t exist five years ago yet it is already the best-selling domestic brand in China -- pushing past the likes of Lenovo, Huawei and ZTE, companies that have been around since the mid 80s. Every quarter, Xiaomi dukes it out with the likes of Samsung and Apple for the most smartphone sales in the Chinese market.

Xiaomi was able to reach those heights by taking a very different approach than any of its competitors. The company offers consumers top-of-the-line devices at budget-conscious prices, allowing Chinese consumers to buy quality smartphones without breaking the bank. Xiaomi does this by selling its devices at near-cost prices, opting instead to make its profits through the sale of accessories and customizable software. The company also keeps its expenses down by limiting marketing to social media and selling its gadgets to consumers directly through its website rather than maintaining costly physical retail stores.

But more important than the company’s business strategies is the loyalty that Xiaomi has built with its customers. The company’s fans are crazy about Xiaomi, and frequently, the brand sells out of its devices within minutes, if not seconds, of their release.

“They’ve just been doing things a bit differently than the traditional Chinese vendors who have been struggling to establish their brands outside of China,” said Chris Jones, principal analyst at Canalys. “Xiaomi has come in with decent devices at very good prices in the Chinese market, and they’ve become a cult brand.”

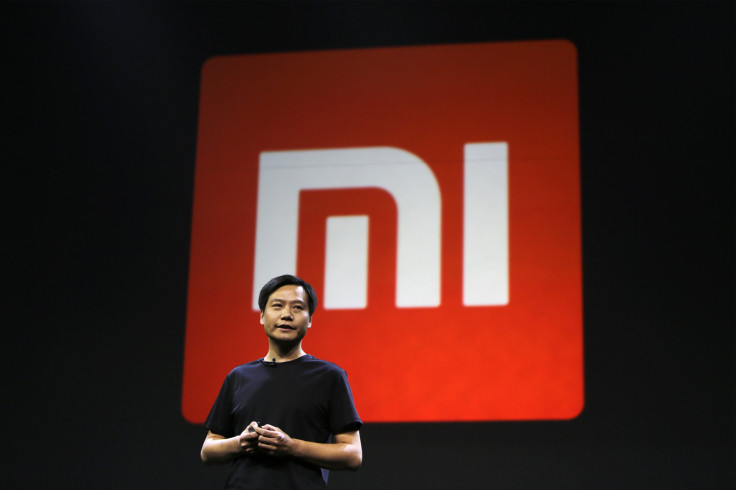

Xiaomi’s way of doing things has led to it being described as the “Apple of the East” while Chief Executive Lei Jun is often referred to as the “Steve Jobs of China.” And like Apple, Xiaomi has grand ambitions, explaining why it has now turned its eye toward the U.S. market.

“So many companies from overseas look at the U.S. as the prime market, and they want to be able to sell here and provide products as much for the money they can make but even more so to brag at home of their success in the United States,” said Roger Entner of Recon Analytics, an analyst of the wireless industry. “You can’t be a global brand without being present in the United States.”

Some analysts say Xiaomi could enter the U.S. as early as this year while others believe that moment is still a ways off, but by meeting with American media this week, Xiaomi will get a chance to dip its toes and see how the water is, said said Bill Rom, managing partner at 151 Advisors, a tech consulting firm that specializes in helping international brands break into the U.S.

“They just want to see what kind of reception they get,” Rom said, explaining that Xiaomi is hoping to “establish a base camp -- get the brand out in front of people and then slowly bring products into the [U.S.] marketplace.”

Most vulnerable to Xiaomi’s looming U.S. entrance are Android brands, according to various analysts. Xiaomi’s low-cost devices also run on Android, and if the brand can manage to carry its fan loyalty stateside, that could impact companies like Samsung, LG and Motorola. For Samsung, that’s already happened in China.

For now, Apple appears to remain safe, thanks to its exclusive iOS software and its own set of fanboys. Over the holiday period, Apple notched the most sales in China, and just this week, CEO Tim Cook brushed aside any talk of being outdone by Xiaomi. But if Xiaomi’s momentum continues to build, Apple, too, could become vulnerable.

“Every new competitor can affect an Apple,” Rom said.

Nothing will come easy for Xiaomi. Many other Chinese brands have tried coming into the U.S., and all of them have struggled. The most successful one thus far is ZTE, and its modest gains have only come after years of work.

Xiaomi has also already seen that what worked in China won’t necessarily work in other markets, Canalys’ Jones said. The Chinese startup has yet to duplicate its success in China in other countries, and there are still many other emerging markets for it to tackle -- including Mexico, Russia and Brazil -- that would be of higher priority than the U.S.

“They have many markets to try and conquer and get established in before they even really need to get into thinking too much about the U.S.,” Jones said.

There’s a lot of work on Xiaomi’s plate if it ever wants to make it in the U.S. and establish itself as a global brand, and it starts on Thursday.

© Copyright IBTimes 2025. All rights reserved.