Xiaomi's Slow Shift In India To Premium Smartphones Helps Samsung Steal Its Crown

Xiaomi Corp is overhauling its India strategy after misjudging consumer tastes in mobile phones, a costly lapse that has allowed Samsung Electronics to pip the Chinese company to the top spot in the world's second biggest market for the devices.

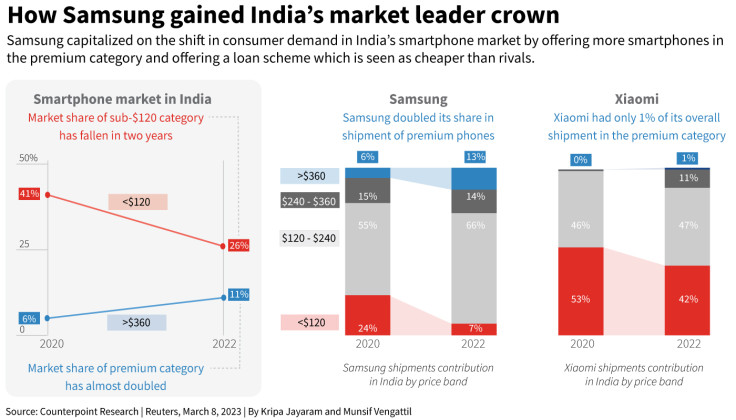

While Xiaomi remained focused on selling mobile phones under 10,000 rupees ($120), Indian consumers were willing to pay up for better looking models with richer features. South Korea's Samsung launched products to meet those aspirations and offered innovative financing schemes that made them affordable to most.

Those moves have helped Samsung wrest leadership of India's competitive mobile phones market from Xiaomi, with data from Hong Kong-based Counterpoint Research showing it had a 20% market share for the last quarter of 2022 compared to the Chinese company's 18%.

"The Indian market is witnessing a 'premiumisation' trend. (But) Xiaomi has been caught underprepared for the shift with a budget phones-heavy portfolio," said Tarun Pathak, a research director at Counterpoint.

The loosening of Xiaomi's vice-like grip on the 626 million Indian smartphone users - the second biggest after China - shows how companies that fail to cater to changing consumer preferences in a fast-growing economy with rising disposable incomes are being punished.

Most famously in India, Tata Motors' 100,000 rupees ($1,200) Nano, billed as the world's cheapest car, was shunned by consumers who associated the low price tag with inferior quality.

Indians' push for more expensive mobile phones to consume videos and other content will also benefit social media app providers such as Meta, and iPhone maker Apple Inc, which so far has a tiny market share in the country due to its sole focus on high-end phones, priced from $605 to as high as $2,304, according to its website.

According to Counterpoint, the market share of the sub-$120 phones in India fell to 26% in 2022 from 41% two years ago. And premium phones - priced above 30,000 ($360) - saw their share double to 11% in the same period.

Xiaomi and Samsung both count India as a key growth market, with smartphones their top selling electronic device. The Chinese company recorded total revenue of $4.8 billion in 2021-22 in India, while Samsung registered $10.3 billion in sales, of which $6.7 billion came from smartphones.

Xiaomi, though, is already facing heat in India due to the departures of at least five senior executives, and increased government scrutiny amid frosty relations with neighbouring China. The company has $674 million of its funds frozen by the country's financial crime agency for alleged illegal remittances to foreign entities, which Xiaomi denies.

A Reuters check on product listings on Xiaomi's website showed the mismatch between consumer needs and the products the company has been offering. Xiaomi showed six smartphones priced above $360, compared with Samsung's 16. Under $120, Samsung had seven models, while Xiaomi listed 39 - most of which were shown to be out-of-stock.

And premium phones accounted for only 0%-1% of Xiaomi's total India phone shipments in the last two years, when Samsung's higher-end phones more than doubled their share to 13%, Counterpoint data showed.

But Xiaomi, which has acknowledged it introduced "too many" models in the past, is revamping its product line-up to focus on premium smartphones.

It launched in January the Redmi Note 12 whose top-end variant is priced above 30,000 rupees, and more recently the Xiaomi 13 Pro at 79,999 rupees ($970) - its highest priced phone in India. The strategic shift seems to have paid immediate dividends, with the Redmi Note 12 clocking sales of $61 million within two weeks of its launch.

"We have laid out a streamlined and cleaner portfolio with a focused approach to building expertise in the premium segment, and the launch of our latest flagship, Xiaomi 13 Pro, is a step in that direction," said its India President Muralikrishnan B.

"We understand that we have a long way to go in this journey, and therefore are bringing in much stronger products."

Graphic: How Samsung gained India's market leader crown

LOANS FOR PHONES

A Samsung scheme, run with its financing partners that says it offers "convenient and assured" loans, played a significant part in its recent success in India, helping generate $1 billion in device sales last year.

A poster of Samsung's offering that Reuters spotted on a dusty street used by fruit sellers in Uttar Pradesh state said that even those with no loan history, low credit scores or without salary slips could get a phone.

Sanjeev Kumar Verma, owner of a nearby multi-brand phone shop, has benefitted from the company's loan scheme. Speaking to Reuters in his shop, where hundreds of phones are stacked on shelves, Verma said he used to sell five Samsung phones each month, but has quadrupled that to 20 now, 18 of which are via the loan scheme.

Verma, and another smartphone vendor in Mumbai, said that unlike rivals, Samsung required no local address proof, making it easier for migrant workers or those working outside their home state to acquire phones on loans. Samsung did not comment on the remarks by the vendors.

The growth in premium segment phones was much higher in small towns than in big cities, Samsung's India mobile unit head Raju Pullan told Reuters in February, adding almost half the consumers who opted for its financing scheme were first-time loan seekers.

Samsung says its financing app installed on smartphones can lock the device and block outgoing calls for missing loan payments.

Xiaomi has also tapped partnerships to offer loans, calling them a key growth driver for sales of phones priced above 15,000 rupees ($183) and adding it will explore more such offerings.

Muralikrishnan said the company will also open more stores beyond its current network of 20,000 retail partners, and boost local procurement of mobile phone parts, likely reducing costs.

Some industry analysts said the new strategy could help the Chinese company return to solid growth in India.

"Xiaomi has historically enjoyed a strong brand equity, has a robust online and offline channel presence, and can spring a comeback with a potentially strong premium and value-for-money product mix," said Prabhu Ram, head of industry intelligence at CyberMedia Research.

© Copyright Thomson Reuters {{Year}}. All rights reserved.