Your 2020 Guide To Social Security Benefits

Social Security is the largest retirement plan in the United States, providing income to more than 63 million people. And the vast majority of working Americans will receive Social Security benefits at some point in their life.

Unfortunately, the Social Security program isn't well understood by millions of Americans. For example, most people don't know their full Social Security retirement age (the majority of people think it's 65), or what it even means. There's a lot to know about Social Security, but the good news is that most of it isn't terribly complex and is rather easy to understand.

With that in mind, here's a guide to Social Security benefits in 2020 that can help you navigate this important program and make wise financial decisions for you and your family.

Are you eligible for Social Security benefits?

If you've worked for at least 10 years, the short answer to this question is "probably." Most types of work (including self-employment) are covered by the Social Security program.

Specifically, in order to qualify for Social Security retirement benefits, you'll need to earn 40 quarters of coverage – also informally known as Social Security "credits." In 2020, you earn one quarter of coverage with earnings of $1,410, and this figure changes each year with inflation (for example, it was $1,360 in 2019).

The catch is that you can only earn four Social Security credits in a given calendar year. This is why they are officially known as quarters of coverage. So, since you need to earn 40 quarters of coverage to qualify, this means that you'll generally need to earn at least $5,640 (in 2020 dollars) in at least 10 different calendar years.

Also keep in mind that this is the basic eligibility requirement for Social Security retirement benefits. As we'll see in the coming sections, your Social Security benefit is based on 35 years of earnings, so if you've only worked for 10 years, you can be sure that you'll have a relatively small monthly benefit.

When can you claim Social Security?

Americans who meet the eligibility requirement (either on their own or based on a spouse's work record) can claim Social Security as early as age 62 or as late as age 70. In other words, you have an eight-year window during which you can choose to start your Social Security benefit.

However, as we'll outline in the next section, your age when you start collecting your retirement benefit has a big impact on how much you'll get.

How is Social Security calculated?

This question is far more complicated than you might think. It depends on a few factors, specifically:

- How many years you worked in Social Security covered employment.

- How much you earned each year.

- How old you are when you start benefits.

- When you were born.

With that in mind, here's a rundown of how your Social Security benefit will be calculated in 2020 (or whenever you decide to claim):

Your full Social Security retirement age

As mentioned earlier, you can start your Social Security retirement benefit anytime between the ages of 62 and 70. However, it's also important to realize that you have a full retirement age for Social Security purposes. You don't necessarily have to claim your benefit (or do anything else, for that matter) once you reach full retirement age, but it plays a major role in the benefit calculation.

Your Social Security full retirement age depends on what year you were born, so here's a quick chart to help you find yours:

To be clear, the Medicare retirement age is a different topic. Americans are eligible for Medicare at 65 years of age, regardless of what year they were born and whether they've claimed Social Security or not.

Your primary insurance amount: The "base" Social Security benefit

The first step in the Social Security benefit is to calculate your primary insurance amount, or PIA. Think of the PIA as your Social Security retirement benefit if you claim at exactly your full retirement age.

The Social Security Administration maintains a record of all earnings from Social Security-covered employment throughout your lifetime. You can view yours by accessing your most recent Social Security statement, which we'll explain how to do later.

Each year's earnings, up to an annual maximum that is set by the Social Security Administration ($137,700 in 2020), is listed, and the 35 highest-earning years are considered in the calculation. In a nutshell, your 35 highest inflation-adjusted years are averaged together, and if you've worked for fewer than 35 years, zeros are used in the calculation. The result of this calculation produces your average indexed monthly earnings, or AIME.

Your AIME is then applied to a formula to determine your primary insurance amount. For 2020, this formula is:

- 90% of the first $960

- 32% of the amount greater than $960 but less than $5,785

- 15% of the amount greater than $5,785

If this sounds mathematically complex, it's important to note that the Social Security Administration does this calculation for you. Even so, there are a couple things that are important to know:

- This benefit formula changes every year, and whatever formula was in effect when you turned 62 will be used to calculate your PIA regardless of when you claim Social Security. Your PIA will then be increased for any cost-of-living adjustments that occur between the year you're 62 and when you decide to claim.

- If you want to calculate your Social Security benefit manually, the SSA provides a worksheet each year that shows how to index all of your earnings for inflation.

As an example, let's say that you turn 62 in 2020. After performing the calculation described here, you determine that your AIME throughout your working life has been $4,500. Applying this to the 2020 benefit formula, your primary insurance amount will be:

- 90% of $960, or $864

- Plus, 32% of the amount greater than $960 ($3,540), or $1,132.80

So, your primary insurance amount, or PIA, would be $1,996.80. To be perfectly clear, this is not the amount you would get if you claim Social Security in 2020. This is just the base that is used to determine your initial benefit, depending on when you claim. In other words, if you claim Social Security before full retirement age, you can expect less than this. And if you wait until after full retirement age to claim, you can expect to receive more.

If you claim early, your benefit will be permanently reduced

The last step in determining your actual Social Security benefit is to adjust your PIA depending on when you claim.

First, we'll look at what happens if you claim Social Security before you reach full retirement age. In this case, your benefit will be permanently reduced. And the amount of the reduction depends on exactly how early you decide to start receiving benefits.

- If you claim your retirement benefit early, but within 36 months of your full retirement age, your benefit will be reduced by 6.67% per year (approximately 0.56% per month). For example, if you claim 15 months before reaching full retirement age, your PIA calculated in the past step will be reduced by about 8.35% to determine your actual initial benefit.

- If you claim your retirement benefit more than 36 months before reaching full retirement age, your benefit will be reduced by 20% plus 5% (about 0.42% per month) for each additional year. Since you can claim as early as age 62, this can result in a permanent reduction of as much as 30% if your full retirement age is 67.

If you can wait to claim, your benefit will be higher

On the other hand, if you wait until after your full retirement age to claim Social Security, your benefit will be increased by 8% per year (about 0.67% per month) until as late as age 70. If your full retirement age is 67, this means that you can increase your initial Social Security benefit by as much as 24% if you choose to wait.

Will Social Security be enough income for you to live on?

To be clear, Social Security is not intended to be retirees' only source of income. The SSA says that Social Security retirement benefits replace about 40% of the average retiree's income. The idea is that Social Security, when combined with other types of retirement income such as from a pension or 401(k), can help retirees make ends meet.

Of course, every person is different. If you plan to live a very frugal lifestyle in retirement, your house and car are paid off, or you plan to move to a lower-cost part of the world like some retirees do, it's entirely possible to live on the money you get from Social Security. But for most people, Social Security isn't enough all by itself.

To help you get a better idea of why, consider this:

- The average retiree gets about $1,431 per month from Social Security. This translates to $17,172 per year.

- The maximum Social Security benefit a 65-year-old retiring in 2020 can get is $2,857 per month.

- The absolute maximum a new 70-year-old retiree can get in 2020 is $3,790 per month.

Social Security spousal benefits can provide couples with extra income

Social Security benefits are more than just income for retired workers. One program that you should be aware of is known as Social Security spousal benefits.

In a nutshell, this is intended to provide retirement income to spouses who didn't work much, or who earned much less than the primary-earning spouse.

The short version is that if one spouse's calculated primary insurance amount is less than one-half of their spouse's, a spousal benefit kicks in to make up the difference. For example, if one spouse's benefit is $2,200 at full retirement age and the other's is $700, a $400 spousal benefit will be added to the latter to make it one-half of the higher earner's benefit.

There are some rules that are specific to spousal benefits. For example, a spousal benefit cannot be paid unless the higher-earning spouse has claimed their own benefit. And just like with retirement benefits, if a spouse claims Social Security before full retirement age, their spousal benefit can be lowered (although there are different reduction rules). If you think a spousal benefit might apply to your household, be sure to check out our spousal benefits guide.

Social Security survivors benefits can help provide for your loved ones if you die

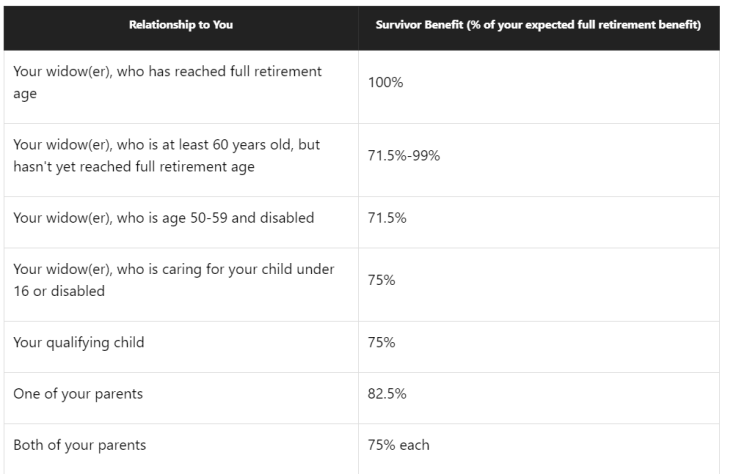

Another program administered by the SSA is Social Security survivors benefits. This is designed to provide benefits to certain dependent individuals if you die.

Be sure to check out our survivors benefits guide if you're interested in learning more, but there's one important concept to know when it comes to surviving spouses. You'll notice in the chart that a widow(er) of full retirement age can receive 100% of the deceased spouse's benefit as a survivors benefit.

It's important to note that they don't get this in addition to their own benefit. The surviving spouse receives either their own benefit or the deceased spouse's – whichever is higher.

Can you claim Social Security if you're still working?

The short answer is yes, but if you have not yet reached full retirement age, your benefit can be reduced if your earnings exceed certain thresholds. This is known as the Social Security earnings test, and there are two groups of people who could potentially be affected:

- If you will reach full retirement age after 2020, your Social Security benefits can be withheld at a rate of $1 for every $2 you earn in excess of $18,240 in 2020.

- If you will reach full retirement age during 2020, your Social Security benefits can be withheld at a rate of $1 for every $3 you earn in excess of $48,600 in 2020, and only the months before your birthday month will be considered.

- If you reached full retirement age before 2020, it doesn't matter how much you earn. You can collect your entire Social Security benefit.

It's also important to mention that these rules don't just apply to retirement benefits. People who receive a spousal benefit or a survivors benefit are subject to the earnings test as well.

Once you claim Social Security, does your benefit change over time?

One important concept to know is that your Social Security benefit can change from year to year. There are several reasons this can happen, but most can be attributed to two main causes:

- Cost-of-Living Adjustments (COLA): Social Security benefits are adjusted for inflation every year. In 2020, beneficiaries received a 1.6% increase. It's important to mention that the lowest an annual COLA can be is 0% -- if there's deflation in the economy, Social Security benefits won't be adjusted downward.

- Medicare premiums: Social Security beneficiaries generally pay their Medicare Part B premiums directly out of their Social Security benefits. In 2020, the average Social Security beneficiary who has reached Medicare age will pay $130 per month for their premiums, but this is adjusted annually. Technically, this isn't a change to the Social Security benefit, but it does change the effective benefit amount you'll receive, so it's worth knowing.

Social Security disability benefits

In addition to retirement benefits and the other programs we've discussed, the SSA also administers disability benefits. And there are two programs:

- Social Security Disability Insurance (SSDI) is based upon Americans' work history and is paid to individuals with qualified disabilities.

- Supplemental Security Income (SSI) is a need-based program that can provide disability income, regardless of the recipient's work history.

If you retire while your kids are young, they could get benefits too

Benefits for children are a lesser-known part of the Social Security program, and for good reason – most people who collect Social Security retirement benefits don't have young children.

However, if you have children under 18, still in high school and no older than 19, or that are disabled, they can receive a benefit equal to as much as 50% of what you receive. In other words, if you receive a $1,800 monthly Social Security benefit and have a 16-year-old child, they could be entitled to as much as $900 per month from the program. As of November 2019, about 700,000 children of retired workers were receiving a benefit (average of $701 per month), so this provides additional income for many American households.

The family maximum can limit benefits

With retirement benefits, spousal benefits, survivors benefits, and benefits for children, you can probably imagine that there are situations where this could translate into a large monthly benefit. For example, consider a 67-year-old with a spouse of the same age who never worked, and three adopted children under 18. That's five people collecting Social Security on one person's work record.

Because of situations like this, there's a maximum that the SSA will pay out on any given worker's record at any time, and depending on your specific situation, it ranges from 150%-180% of your full retirement benefit.

If the total benefits claimed on your work record exceed the limit, all auxiliary beneficiaries (everyone but the worker themselves) will have their monthly benefit proportionally reduced.

How do you apply for Social Security in 2020?

The easiest way to apply for Social Security by far is online. You can apply for Social Security at www.ssa.gov. It should take you about 15 minutes, and in most cases there is no additional documentation requirements.

Alternatively, you can apply for benefits by phone or in person at your nearest SSA office. However, it's strongly recommended that you call first and make an appointment, as wait times can get quite lengthy.

Can you change your mind after applying for Social Security?

It's not uncommon for U.S. workers to apply for Social Security retirement benefits and regret their decision later. Maybe you decide to go back to work and would rather wait for a higher benefit. Or maybe you decide that you pulled the trigger too early and that it's simply in your family's best interest to wait.

You can reverse your decision to apply for Social Security in some cases. Specifically, there are two situations where you can potentially get a do-over.

Withdrawing your Social Security application

You have the ability to withdraw your Social Security benefit application if you claimed within the past 12 months. This effectively makes it like you never applied at all.

The biggest drawback to doing this is that you'll have to pay back any benefits you've already received. If you just started collecting benefits a month or two ago, this may not be a big deal. On the other hand, if it's been almost a year since you claimed Social Security, this can be a big sum of money.

Suspending your retirement benefits

If you've already reached full retirement age, you have the ability to suspend your Social Security benefits. You can do this regardless of how long it's been since you've claimed your retirement benefit, and you don't have to pay back any of the benefits you've already received.

You can choose to suspend your benefit until as late as age 70, and they will automatically restart at that point if you haven't requested them. And, while suspended you'll accumulate deferred retirement credits, making your benefit larger once you decide to restart.

How can you estimate your future Social Security benefits?

As a final point, it's important for all Americans to know about their Social Security statement and review it regularly.

Your Social Security statement is issued annually, and you can access yours at www.ssa.gov by creating a free mySocialSecurity account if you don't already have one. Your statement can give you an estimate of your future Social Security retirement benefits at full retirement age, as well as if you choose to claim early or late.

The statement will also contain your complete earnings record, eligibility information for Medicare benefits, as well as eligibility and estimates for disability and survivors benefits.

Aside from calculating it manually, your Social Security statement is the best way to estimate your future retirement benefits based on your actual lifetime work record, plus it contains tons of other important information that you should know about your status with the program.

This article originally appeared in the Motley Fool.

The Motley Fool has a disclosure policy.