Apple Pay Could Be Tipping Point For Mobile Payments

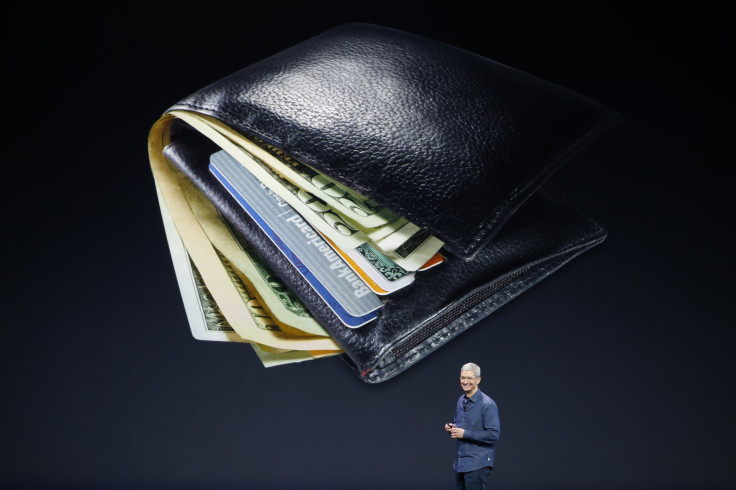

Apple’s Apple Pay mobile payments service, unveiled Tuesday by CEO Tim Cook at a high-profile launch event in San Francisco, may provide a much-needed boost to a highly fragmented industry that’s drawn lots of interest but not many users. “We’ve created an entirely new payment process,” said Cook.

Entirely new? Not so fast.

Android power users will instantly recognize Apple Pay as a straightforward NFC (Near-Field Communication) payment system like Google Wallet -- through which a phone securely stores credit card details and lets users pay retailers by holding their device near a sensor at checkout.

The mobile payments space also features numerous other players. Walmart revealed this week that it would forego participating in Apple Pay in favor of CurrentC, a payments platform under development by Merchant Customer Exchange.

MCX is owned by a number of major retailers, including Walmart itself.

Another mobile payments platform provider, Softcard, chose to change its name recently as its previous moniker has become distinctly infamous. Softcard was previously called ISIS.

There’s also eBay’s PayPal unit, Square, SinglePoint, Dwolla and numerous others.

Despite the plethora of vendors, relatively few consumers are paying for goods and services with their smartphones. “Everyone agrees that mobile payments using these phones will make our plastic cards obsolete. But this has not taken off,” notes Gartner analyst Rajesh Kandaswamy, in a recent blog post.

Kandaswamy says it’s a chicken-and-egg problem. More people will start using mobile payments only when … more people start using mobile payments. “The value to any one user depends on the total number of users,” said the analyst.

There’s hope that Apple’s entry into the market will prove to be a tipping point.

The company has put significant effort into onboarding various retailers to support Apple Pay. The list includes Bloomingdales, McDonald’s, Staples, Disney and Macy’s.

Dwolla CEO and co-founder Ben Milne says it's clear that "Apple decided it would be the one to usher in the ubiquity of mobile payments.”

Consider the accommodations that various mobile service providers made for Apple when it announced that it was going to make a smartphone. AT&T and others upgraded their wireless infrastructure. Apple's involvement in the space grew until it was impossible to talk about smartphones without talking about the iPhone.

Apple Pay will support credit cards already linked to a user's iTunes account, and as the company already has one of the largest stores of credit card numbers (some 800 million numbers), they're no doubt interested in building something to more easily facilitate people using them.

"Dwolla's point of view is that this is exciting," said Milne. "Any time you can create habitual behavior with 800 million credit cards, you're doing something interesting."

© Copyright IBTimes 2025. All rights reserved.