BlueBenx Announces Suspension Of Withdrawals Following Supposed $32M Hack

KEY POINTS

- BlueBenx suspended withdrawals of funds for at least 180 days

- A former BlueBenx employee revealed the company fired around 30 employees last week

- BlueBenx offers a 66% profit for investors who opt to have their funds locked up in a year

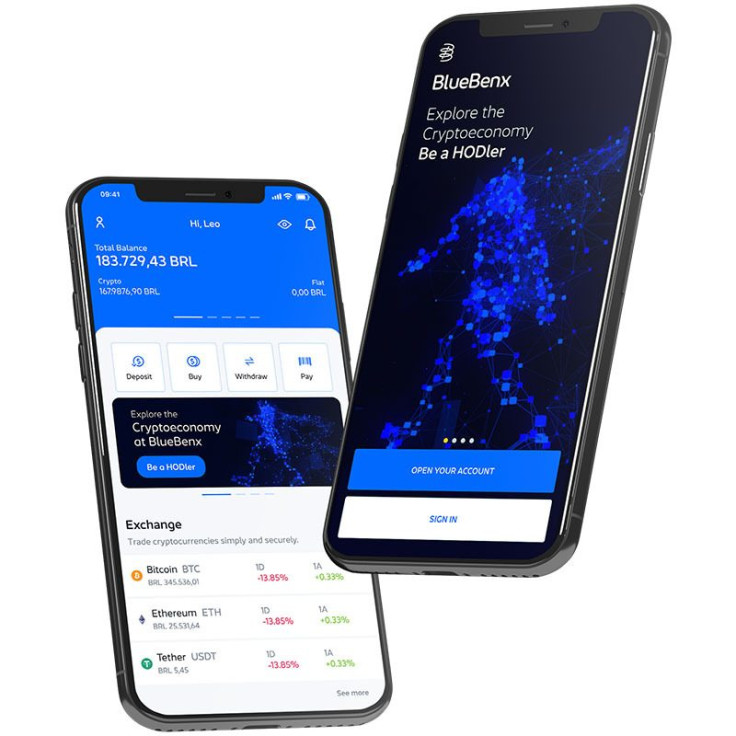

Users of blockchain-linked multi-financial services Bluebenx, which was founded in 2018, reported last Thursday they were unable to withdraw funds from the platform with the local media reporting that the company claimed to have been a victim of an "extremely aggressive" hack that siphoned around $32 million in funds. And, while the claim was plausible, a lot of investors are suspicious and do not buy the firm's hacking narrative.

In an email sent to customers, BlueBenx said, "Last week we suffered an extremely aggressive hack in our liquidity pools on the cryptocurrency network, after incessant attempts at resolution, today we started our security protocol with the immediate suspension of operations of BlueBenx Finance products, including withdrawals, redemptions, deposits and transfers."

Unfortunately, no other details about the hack were disclosed, other than the timeline of at least 180 days, which the company said, would be the length of time of the measures they put in place. Local media reported that the company also fired over 30 employees, citing the firm's former employees as a source.

The mass lay-off and the $32 million hack the company experienced are two major events reflecting the financial condition of the firm. The company was investigated by the Brazilian Securities and Values Commission in the past because of allegedly offering unregistered securities in its investment portfolio.

With these in the background, a lot of investors were suspicious and did not buy the company's narrative. "I think there's a high probability that it's a scam because this whole hacking thing seems like something they made up," a local media quoting a BlueBenx user reported.

BlueBenx joins the growing list of cryptocurrency firms that were not able to deliver on their promise of unbelievable profits. The blockchain-linked crypto platform offers up to 66% yield for investors who opt to have their funds locked up in a year.

It is worth noting that BlueBenx is not the first Brazil-based firm to claim that it was hacked and suspended withdrawals. Trust Investing did the same and blocked withdrawals for nine long months because of the same narrative.

© Copyright IBTimes 2025. All rights reserved.