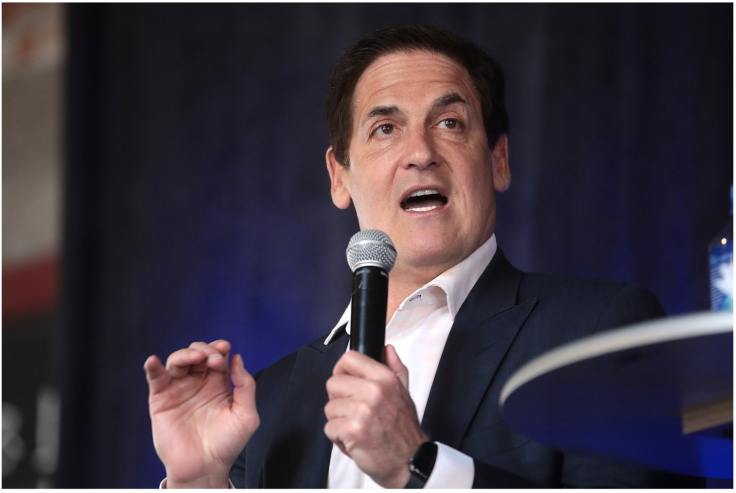

Mark Cuban Slapped With Class-Action Lawsuit For Helping Promote Voyager Digital

KEY POINTS

- Voyager Digital froze trading and withdrawals on July 1

- It declared Chapter 11 Bankruptcy on July 5

- Mark Cuban is known as a staunch supporter of Voyager Digital

Billionaire Mark Cuban has been slapped with a class-action lawsuit for allegedly luring consumers to invest in Voyager Digital, which the prosecution now calls a "Ponzi scheme."

Cuban and his team Dallas Mavericks, along with Voyager Digital CEO Stephen Ehrlich, are named defendants in a class-action complaint filed by the Moskowitz Law Firm at the US District Court in Southern Florida on Wednesday. The lawsuit claimed Cuban misrepresented the cryptocurrency services and offerings and used his years in various industries to entice consumers to invest their life savings into the platform.

The defendants "went to great lengths to use their experience as investors to dupe millions of Americans into investing—in many cases, their life savings—into the Deceptive Voyager Platform and purchasing Voyager Earn Program Accounts ("EPAs"), which are unregistered securities," the complaint read.

Moreover, the class-action lawsuit alleged that the TV personality hyped Voyager Digital's products and encouraged retail investors to invest even if he knew what was really happening. The complaint also called Voyager Digital a "massive Ponzi scheme" that relied on the "vocal support" of Cuban and his team Dallas Maverick.

"Put differently, the Deceptive Voyager Platform was a massive Ponzi scheme, and it relied on Cuban's and the Dallas Maverick's vocal support and Cuban's monetary investment in order to continue to sustain itself until its implosion and Voyager's subsequent bankruptcy," the class-action lawsuit further alleged.

The plaintiffs also documented Cuban's endorsement of the failed stablecoin project, Titan, by Iron Finance, which surprisingly crashed a few days after the billionaire endorsed it. "Cuban previously endorsed the cryptocurrency, Titan, by Iron Finance, a coin he publicly endorsed that was trading at $65 promising over 200% APY which then crashed to $0.000000024 within a few days of his endorsement," the 92-page lawsuit noted.

Voyager was among the crypto lenders of Three Arrows Capital that went bust. The firm froze withdrawals and trading activity on July 1 and filed Chapter 11 Bankruptcy four days afterward, disclosing there were over 100,000 creditors. At present, more than 3.5 million Americans have nearly $5 billion in crypto assets on the frozen platform.

© Copyright IBTimes 2025. All rights reserved.