CPI Report: Cheaper Gas Helps Keep January Inflation Rate In Check

The gradual rise in consumer prices held steady for a third straight month, according to a report out Wednesday, which pointed to a continued lack of serious inflationary pressure in the U.S. economy.

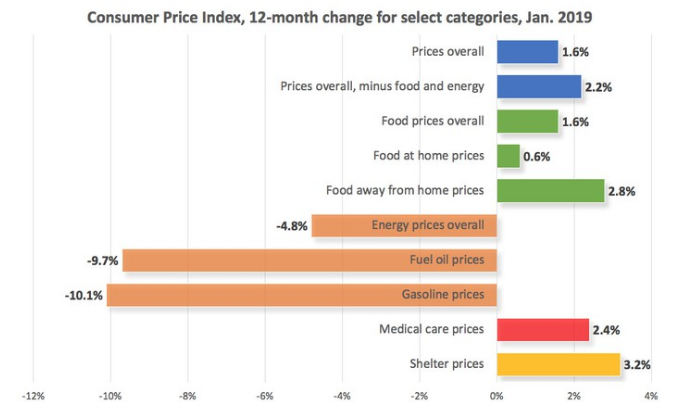

According to the Bureau of Labor Statistics, the Consumer Price Index for All Urban Consumers was unchanged in January after factoring in regular seasonal adjustments. The inflation rate for the past 12 months dropped to 1.6% -- the smallest gain since June 2017. The CPI rose 1.9% year over year in December.

January's rate was below both the historical average for CPI growth and the informal 2% year-over-year target that the Federal Reserve uses as a benchmark for judging whether the risks of inflation and deflation are evenly balanced.

But underlying the headline inflation number are several key takeaways that can be useful to investors and consumers. Because the CPI gets factored into a variety of policy purposes, its movements don't just affect how much you pay for what you need. It also can have indirect affect on other essential parts of your financial life. Let's take a closer look.

What rose and what fell

Just because the overall CPI was unchanged for the month doesn't mean the prices people pay for everything stayed the same. The CPI is designed to track a basket of different goods and services, so price increases in one area can offset decreases in other areas.

In January, there weren't a lot of major upward price changes among the categories that the BLS tracks.

Consumers got a big break from downward moves in energy prices. The overall energy category saw prices fall 3.1% in January, following declines in the 2.5% to 3% range in both November and December. Gasoline prices were once again the big mover, falling 5.5% in January. Reduced prices for heating oil, electricity, and natural gas also helped to keep overall energy costs lower.

Another big increase came in apparel, which climbed 1.1% from December's levels. That move follows several months of downward-trending apparel prices.

Food prices also moved higher, but its impact was minimal, with a 0.2% increase. This was the third straight month of food category increases. Within the category, prices of nonalcoholic beverages and various meat products were higher, while reductions in prices of fruits and vegetables, dairy products, and cereals and bakery products moderated the overall move.

Prices for housing and shelter were higher by 0.3% and medical care prices rose 0.2%.

When you exclude food and energy components, which tend to be volatile, the "core" CPI gained 0.2%, a rate that has stayed steady for five straight months.

Good news for investors

For investors, a flat CPI is important because it gives the Federal Reserve greater latitude in deciding the course of monetary policy. Coming into the report, economists anticipated that the central bank was starting to consider a pause in the interest rate increases that it's made over the past couple of years. Economic pressures have started to affect the prospects for growth. And after five straight quarterly increases to the key Federal Funds rate of a quarter percentage point each, the possibility of the Fed not making an increase in March -- and thereby breaking the streak -- had started to rise.

The Fed sees its role as balancing healthy economic growth with containing inflation. With unemployment at historic lows, the central bank's recent actions have expressed confidence in the economy's strength. With some market participants talking more seriously about the possibility of an economic recession, though, the fact that there's no apparent inflation threat means that the Fed is more likely to leave rates alone. That's what investors in both the stock and bond markets want to hear, and it could prompt further gains for stocks even after a strong start to 2019.

Bad news for Social Security recipients?

However, the CPI news does have some potential negative implications. Every year, Social Security recipients get cost of living adjustments (COLAs) based on inflation, and when official price readings are flat, it means that the likelihood of getting a positive COLA goes down for the following year. Social Security uses a slightly different measure of the consumer prices, known as the CPI-W, and that measure was up 0.1%.

The problem, though, is that the January level of the CPI-W is 0.5% less than the average price level from the summer months of 2018, which act as the baseline for calculating the Social Security COLA that will take effect in January 2020. Even if prices rise modestly from current levels, there could still end up being a 0% COLA for 2020 if they don't rise enough. Despite a healthy 2.8% increase that took effect at the beginning of this year, Social Security recipients have had to deal with three years of 0% COLAs in the past decade, and increases of 2% or less have been extremely common.

The CPI doesn't always get a lot of attention, as the monthly moves it makes often seem insignificant. However, the impact that the CPI has on a much broader range of issues makes it worth paying attention to each month.

This article originally appeared in the Motley Fool.

The Motley Fool has a disclosure policy.