Although many criticized the SEC for its most recent move against a crypto company, others took the chance to gloat and hit Coinbase back.

A filing in the U.S. bankruptcy court in Delaware detailed that Modulo Capital agreed to relinquish any claims to the $56 million in assets held in FTX and FTX US accounts with the remaining $404 million in assets converted into cash at J.P. Morgan.

Edge's beta build uncovered this month revealed that Microsoft is exploring integrating a crypto wallet into its browser.

Industry watchers believe that one of the main reasons behind crypto firms' sudden interest in Swiss banks is because of their clear regulations, something which financial regulators in the U.S. are still arguing about.

The Treasury Department and the IRS announced that "they are soliciting feedback for upcoming guidance regarding the tax treatment of a nonfungible token (NFT) as a collectible under the tax law," the announcement read.

According to a former Ethereum Foundation developer, while the motive behind the message is unclear, it could be an attempt to see if Euler Finance's exploiter would fall for the ploy.

Sony's latest patent filing underlines its push to revolutionize the gaming experience as the world embraces emerging technology.

Coinbase offered Circle a lifeline, an interesting act considering that the CEX was once Circle's rival, although both now share management and profits of the stablecoin USDC.

"Today's announcement will protect Florida consumers and businesses from the reckless adoption of a 'centralized digital dollar' which will stifle innovation and promote government-sanctioned surveillance," DeSantis said.

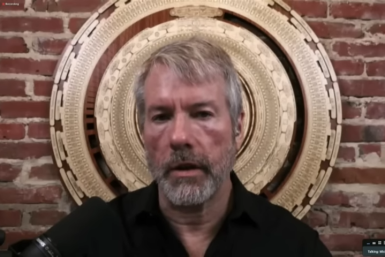

"MicroStrategy has survived a crypto ice age and now has an opportunity to take advantage of growing interest in DeFi and all the other crypto protocols with better growth potential," a senior market analyst said.

Last week, the NYDFS said that it intervened in the business of Signature bank because regulators lost faith in its management.

FTX has been at odds with Bahamian officials ever since filing for bankruptcy protection on Nov. 11.

Software giant Microsoft could be testing an Ethereum-based cryptocurrency wallet in its Edge browser, according to a software sleuth who goes by the Twitter handle @thebookisclosed.

Bitcoin investors are now bullish, especially as former Coinbase Chief Technology Officer Balaji Srinivasan predicted that the impending global banking crisis could take the world's largest crypto asset to $1 million in less than 90 days.

"Euler has always been a security-minded project. The Euler smart contracts, including the vulnerable lines of code, were audited," Eluer Finance CEO said in a tweet following the $197 million hack.

In one of the leaked emails, Wetjen informed the FDIC chair about FTX's risk model, which was about its pending application at the CFTC, seeking to amend regulations that would foster more federally authorized crypto products.

Financial regulators and law enforcement agencies in the United States have also started investigating the collapse of Terra's so-called algorithm stablecoin.

"I'm going to roast these Low IQ plebs and their lawyers," tweeted BitBoy Crypto, one of the named "defendants" in the lawsuit.

The crypto lender has already secured court approval to sell its assets to Binance US, which, over the past weeks, has been objected to by financial regulators like the U.S. SEC and the FTC.

Coinbase said that the decision was the result of its periodic monitoring of assets, which includes assessment and subsequent review to make sure they follow the platform's listing standards.

Regulators are increasingly keen for oversight of a sector which boomed during the Covid pandemic when many people were stuck at home.

Signature Bank's closure was due to a "crisis of confidence" in its leadership, the New York State Department of Financial Services said.

A U.S. bankruptcy judge declined to delay the $1.3 billion sale of crypto lender Voyager Digital to Binance.US, saying Voyager customers should not be forced to wait out a challenge by the Department of Justice that is unlikely to succeed.

Bankman-Fried's legal counsel requested the court through a motion to permit insurers to advance or reimburse defense costs and fees under directors and officers (D&O) insurance policies held with Beazley and Realm Insurance.

Gensler's stance on proof-of-stake crypto assets as securities received an unexpected assist when the New York Attorney General's Office filed a lawsuit against the centralized cryptocurrency exchange KuCoin.

FTX administrators noted that their efforts are "expected to result in the further identification of assets, liabilities and transfers."

A month after the first testnet was released to the community, Degen Zoo has become the game on every blockchain players' lips.

"It passes a simulated bar exam with a score around the top 10% of test takers," OpenAI said while describing the new G-4 ChatGPT AI model.

For the lead developer, "SHIB: The Metaverse," which is planned to launch on multi-platforms, including mobile devices, will be the medium available to people from all walks of life.

"In February, the Consumer Price Index for All Urban Consumers increased 0.4 percent, seasonally adjusted, and rose 6.0 percent over the last 12 months, not seasonally adjusted," the Bureau of Labor Statistics reported.