Does Your Credit Profile Affect Your Life Beyond Loan and Credit Card Applications?

Did you ever wonder why your loan application was denied or your health insurance premiums are so high despite you being in good health? There's a good chance that you have a low credit score. Today, your credit profile, which contains your score, loan repayment records, and loan utilization trends pretty much defines your creditworthiness in this digital world.

Major credit bureaus use the Fair Isaac Corporation (FICO) series model to generate credit scores that range from 300 to 850. The FICO model considers several factors like frequency of loan applications, repayment history, credit mix, and credit utilization to determine your credit score. The higher your score is, the more financially credible you will look and the better your chances will be at securing loans. The FICO website states that 90 percent of lenders actually check your credit score to determine your eligibility for loans. A poor credit score might also have implications beyond loan applications and insurance premiums.

According to major credit bureau Experian, a credit score between 670 and 739 is considered to be good, whereas any score above 800 is considered excellent.

Why Landlords and Employers Might Check Your Credit Scores

Landlords might check credit scores to understand if potential tenants would be able to pay their rent and bills on time. Millions of homeowners rent out their houses to create passive monthly income streams; some might even completely depend on it. To avoid tenants who might default on payment deadlines, a simple credit profile check helps them narrow down their search for a reliable tenant. Even if you have a high income, a mediocre credit score due to shaky repayment history might be considered a red flag by landlords.

Moreover, a poor credit score could creep up in your professional life and affect your job opportunities. If you want to apply for a job in finance or a higher management position, your potential employers will likely do a credit profile check to understand if you can securely and responsibly handle and interpret their company's finances. A poor credit score would therefore not look good on your resume.

Things to Avoid if Your Credit Score Has Dipped

Missing Payment Deadlines

If you have multiple credit cards, put your best effort into at least making the monthly minimum payments for each one before the payment deadline arises. When you miss a credit card payment deadline, you might be charged with a steep late payment fee north of $30. Furthermore, if you continue to miss deadlines or constantly repay late, your creditors will report the missed payments to credit bureaus, resulting in a dip in your credit score.

Maxing Out Your Credit Limit

Are you frequently maxing out your credit limit? More than stretching out your debt repayment tenure, a maxed out credit card or a high credit utilization might portray you as someone who is struggling to manage their finances, which credit lenders also pay attention to.

Frequently Applying for Loans or Credit Cards

Frequently applying for loans or credit cards could also affect your chances of securing loans and other financial products. When you apply for loans, lenders would go for a hard pull on your credit profile to determine your creditworthiness. A long summary of inquiries may stay on your credit report for years, and too many hard inquiries or loan rejections might make you look like a high-risk borrower. It may even keep your credit score stagnant.

Incorrect Entries in Your Credit Profile

Always check for incorrect entries in your credit profile. A Consumer Report survey of nearly 6,000 volunteers revealed that 34 percent of them found at least one erroneous entry in their credit reports. So, even if you make timely repayments and check on your credit utilization, an error on your credit report could lower your financial credibility and credit score.

How to Check Your Credit Score and Monitor Your Credit Profile for Free

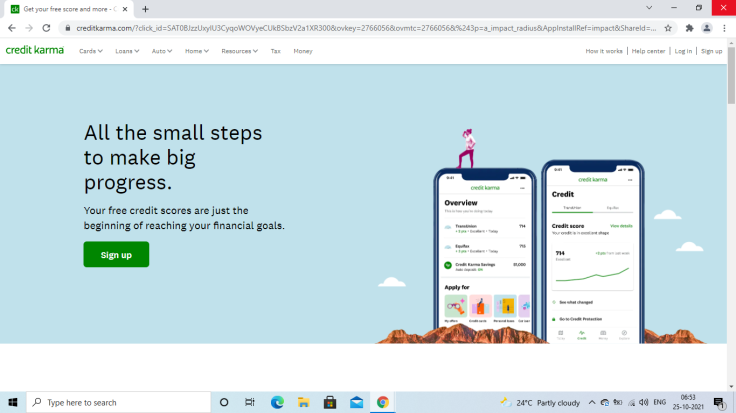

The rapidly-evolving fintech industry has gained massive popularity worldwide with financial and tech experts coming together to offer online financial solutions that cover the entire spectrum of personal finance. Credit Karma is a popular smartphone app that allows you to check your credit score for free, generated by two major credit bureaus, TransUnion and Equifax.

Credit Karma generates free credit reports for you with the option to avail of free credit and ID monitoring. This way, you could prevent identity theft, monitor data breaches, and correct erroneous entries or inquiries to prevent your credit score from taking a negative turn. If you ever find incorrect entries, Credit Karma has options on the app that will lead you to the concerned credit bureau website for you to dispute the entry and get it corrected as early as possible.

Credit Karma's user base of over 100 million also benefits from several financial insights and tools that aim to help people understand factors that might affect their credit score and make more financially aware decisions moving forward.