Gaylord To Sell Hotel Brand To Marriott For $210M

Marriott International Inc., the largest publicly traded U.S. hotel operator, plans to acquire Gaylord Entertainment Co.'s namesake hotel brand and management company, for $210 million. The move would help Marriott expand its group and conference business.

Shares of Gaylord rose $2.10, or 6.1 percent, to $36.58 in midday trading. Marriott fell 45 cents, or 1.1 percent, to $37.87, both on the New York Stock Exchange.

Gaylord, a Tennessee-based chain of convention-focused hotels and entertainment venues, owns Gaylord Opryland in Nashville; Gaylord Palms in Kissimmee, Florida near Orlando; Gaylord Texan on Lake Grapevine near Dallas; and Gaylord National on the Potomac in National Harbor, Maryland, near Washington, D.C.

Marriott will take over management responsibilities of the four hotels under an initial term of 35 years; however, Gaylord will continue to own the hotels. Gaylord will also continue to own and operate the Grand Ole Opry, Ryman Auditorium, and other entertainment properties.

Both Marriott and Gaylord have well-defined cultures that revolve around putting people first and we expect Gaylord's [ employees] and Marriott associates will find significant opportunities for career growth in this combination, said Robert McCarthy, Marriott International chief operations officer. Gaylord customers will continue to enjoy the outstanding service for which that brand is known.

The deal stems from Gaylord's months-long assessment of strategic options. The company's shareholders must approve its conversion into a real-estate investment trust before the deal can go through. Gaylord will reorganize itself, effective Jan. 1, 2013.

The transaction will add about 2 million square feet of meeting and event space and roughly 7,800 rooms to Marriott's portfolio, the Bethesda, Maryland-based company said in a statement Thursday.

Marriott will be able to capture even a greater share of the major event market, Marriott Chief Executive, Arne Sorenson, said. Gaylord's 'everything-in-one-place' properties are very attractive to group meeting planners. As a new REIT owner, Gaylord Entertainment should benefit from improved hotel profitability associated with Marriott's ability to generate substantial cost savings and incremental demand.

The industry bellwether expects the deal will increase earnings in 2013 by 2 cents per share.

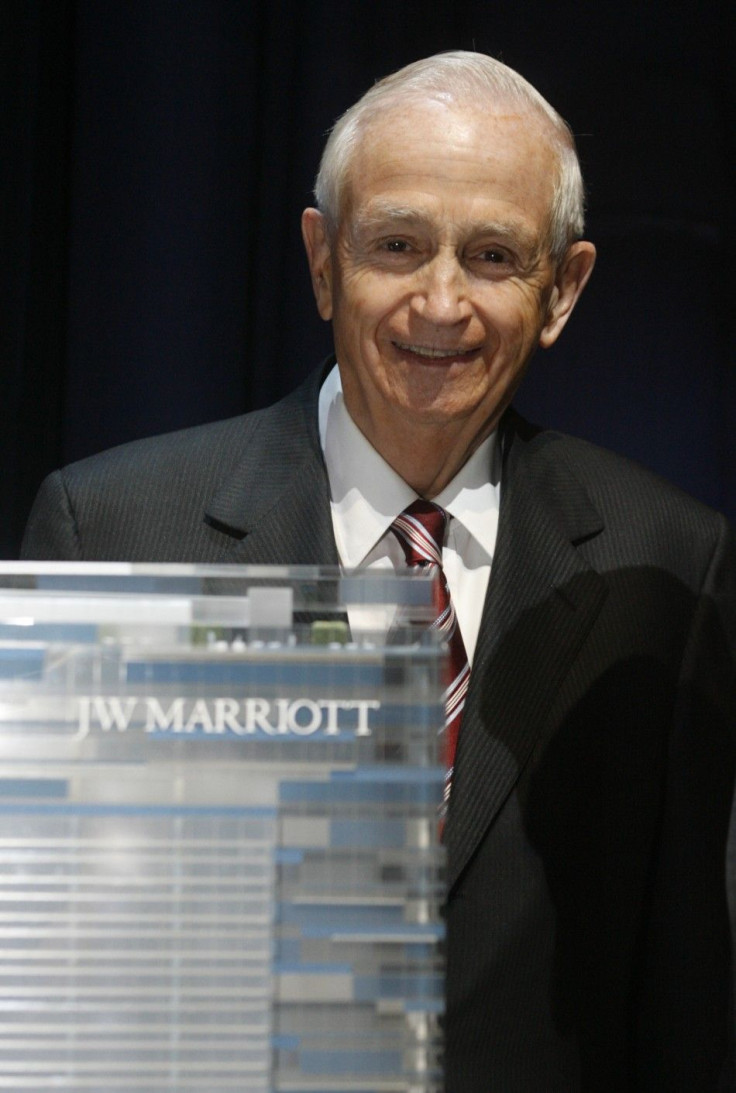

Colin V. Reed, Chairman and Chief Executive of Gaylord Entertainment Co., said the company chose Marriott because of its focus on providing the highest quality experience for both group and leisure customers.

According to a recent survey conducted on behalf of Gaylord in February of over 400 high-quality meeting planners, Gaylord ranked first in all under one-roof offerings and amenities and Marriott ranked as the number one preferred group destination provider overall due to its service standards and wide distribution, he said.

© Copyright IBTimes 2025. All rights reserved.