Here's How Much Social Security Benefits Are by Age And Income Level

The average Social Security retirement benefit paid to a retired worker is $1,413 per month as of June 2018. However, your initial monthly benefit could be much greater or much less than that amount, depending on your age and income.

While there's no way to know what your exact Social Security retirement benefit will be until you actually apply for it, we can get a pretty good estimate if you know your average income and the age at which you plan to claim your benefit. Here's a quick overview of how Social Security benefits are determined and how much you might be able to expect.

How Social Security is calculated -- the quick version

Here's a condensed explanation of how the Social Security Administration (SSA) determines your Social Security retirement benefits:

First, your annual earnings throughout your entire working lifetime, up to each year's Social Security taxable maximum, are adjusted for inflation. The 35 highest years of earnings will be used to calculate your initial monthly benefit.

These 35 years of benefits are then averaged together and divided by 12 to determine your average indexed monthly earnings, or AIME. This figure is then used in a formula to determine your initial benefit if you start receiving Social Security at your full retirement age. This figure is also referred to as your primary insurance amount, or PIA.

The formula that is used will be the one in effect when you turn 62, regardless of when you actually claim Social Security. In other words, if you turned 62 in 2015, that year's formulawould be used to calculate your benefit, plus any cost-of-living adjustments you'd be entitled to. And just to clarify, all of your earnings can be considered, even if you work after age 62.

For 2018, the formula to determine your PIA is:

- 90% of the first $895 in AIME

- 32% of the amount greater than $895 but less than $5,397

- 15% of the amount above $5,397

Eligible Americans can choose to start Social Security at any time between ages 62 and 70. However, if you start before your full retirement age (66-67, depending on when you were born), your benefit will be permanently reduced. Conversely, if you choose to wait until after your full retirement age, your benefit will be permanently increased.

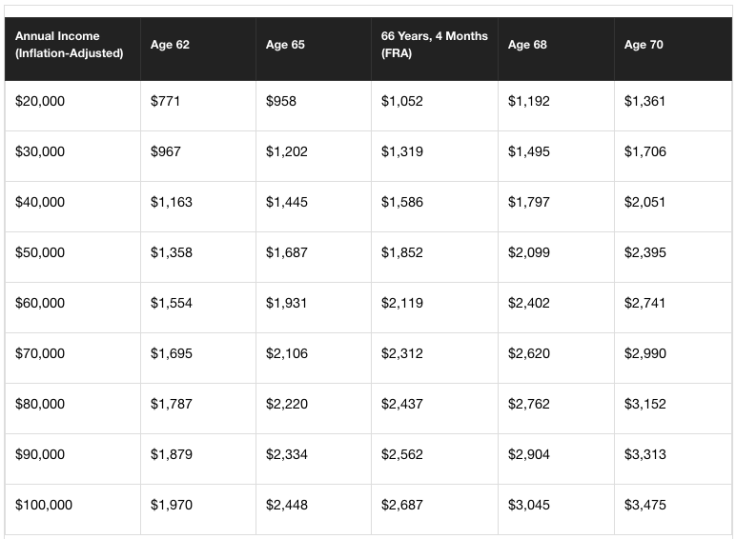

Initial Social Security retirement benefits by age and income level

Since we don't know for sure what the Social Security benefit formula will look like in future years (the dollar amounts in the formula are adjusted annually), let's take a look at how much someone turning 62 in 2018 can expect from Social Security depending on their average inflation-adjusted salary throughout their career and the age at which they decide to claim benefits.

To be perfectly clear, the figures in the table are for someone who turns 62 in 2018, and they are in today's dollars. In other words, if someone who turns 62 this year and has earned an average of $50,000 waits until they are 70 to claim benefits, they can expect about $2,395 per month plus any cost-of-living adjustments that are given over the next eight years.

If you're younger than 62, it's impossible to know for sure exactly how much your first Social Security check will be for, even if your salary is completely predictable. We simply have no way to know what inflation will be between now and when you reach the age of eligibility.

Having said that, this chart can give you a good idea of how much purchasing power your Social Security benefits could have in 2018 dollars. Or, for a good ballpark estimate of your future benefits based on your work record so far, you can view your annual Social Security statement by creating an account at www.SSA.gov if you haven't yet done so. Just keep in mind that Social Security benefits are based on your average income over 35 years, so unless you know exactly what your salary will be going forward, it's still a pretty rough estimate.

This article originally appeared in the Motley Fool.

The Motley Fool has a disclosure policy.