How Cryptocurrency Loans Are Reinventing Credit

Do you want to help people in Puerto Rico rebuild yet feel skeptical about indirect donations? In a few months, you could use cryptocurrency to offer a peer-to-peer loan for a stranger in need. Thanks to the security of blockchain systems, trust issues are no longer a nonstarter for P2P lending between strangers. The blockchain nonprofit Celsius, headquartered in New York, now has an initial coin offering to fund the launch of its beta loan platform for Americans in January.

“No one has done this before,” Alex Mashinsky, CEO of Celsius, told International Business Times. “It completely reinvents how you do things, why you do things and who benefits.” ICO earnings will go to a Celsius reserve, built to absorb half of all losses from loan defaults. People can use these tokens to activate loan contracts and diversify their lending portfolios.

Celsius is just one of the many blockchain projects creating new types of high-tech lending services. Blockchain-powered loans could completely reshape the way people around the world borrow money.

One of the biggest barriers for taking out a loan is credit worthiness. The traditional way banks and lenders assess credit is widely considered outdated in the modern economy. The Celsius team plans to overcome this obstacle by using blockchain-based identities on their platform.

Users will download the app and log in through Facebook or LinkedIn to authenticate their identities. Ebay or Amazon sellers can upload their transaction histories to show their reliability. Borrowers can even have a guarantor, say a friend anywhere in the world with a cryptocurrency wallet, put up her digital assets to boost your Celsius credit limit.

Borrowers receive their credit in dollars even though lenders are giving them ether. “Part of our mission is to bring the next 100 million users to the crypto community by solving their problems,” Mashinsky said. “Our belief is we need to build bridges between the old world and the new world.”

The startup partnered with several leading financial institutions, although Mashinsky declined to publicly name them, to convert concurrencies on the backend and make these funds available through mainstream credit cards.

The plan is to eventually go global. Meanwhile, a Buenos Aires-based startup called the Ripio Credit Network will soon offer similar cryptocurrency services in Latin America. Ripio will focus on short-term microloans, ranging in value from $20 to $2,000. Ripio founder and CEO Sebastian Serrano told IBT the bitcoin wallet platform already has 140,000 users, mostly in Argentina and Brazil.

“It has always been our idea to use the blockchain to create a completely global, peer-to-peer network,” Serrano said. “Lenders in developed countries who can lend to borrowers in developing countries can facilitate that flow of capital.”

Ripio’s ICO raised $40 million in a pre-sale earlier this month. The public ICO launches on October 24. These types of projects could bring far more low-income communities into the world of cryptocurrency. It will also open new doors for them in terms of traditional banking.

According to the World Bank, around 2 billion people still doesn’t have any type of bank account. Blockchain records of completed microloans could help disenfranchised people build verifiable credit. “Everything is completely transparent and some people start building a credit score in this way,” Serrano said.

Like Celsius, Ripio runs on cryptocurrency yet offers the loans in local fiat currency to help cryptocurrency newbies get on board. There are even local booths where users can go and buy a Ripio token with fiat currency, then learn about mobile wallets. “For most of our users, this is their first mobile wallet and the first time they are offered any access to credit,” Serrano said. “We’re going to remove a lot of the bureaucracy of lending. Our goal is to reach a lot of the people that are currently outside the [financial] system and include them.”

Like Nubank in Brazil and the fintech startup Tala in Africa and Asia, Ripio will also use cellphone data to help bolster the user's credit score. If you call your mom every day and have a selfie that matches your government ID, your verified identity probably has a lower credit risk. Interest rates will vary according to the user’s credit risk, just like any regular loan or credit card.

However, new types of crypto-enhanced lending services can offer more competitive rates because they don’t rely on traditional revenue streams. For example, Celsius lenders will be able to choose their level of risk and reap interest payment in ether tokens, which often increase in value.

Restructuring the business models fueling the lending industry can create a new win-win scenario, especially if a cryptocurrency reserve is buffering any potential losses. NerdWallet reported the average credit card rate was around 12.3 percent in 2016, accounting for inflation. High risk users obviously had much higher rates. Mashinsky estimates his cryptocurrency-backed interest rates will range from five percent for low risk users to 15 percent for high risk users.

“You could never create this model with a bank because the bank doesn’t always act in your best interest. They want to maximize profits,” Mashinsky said. “As a nonprofit, our job is to be as inclusive as possible while offering as many ether loans as possible.” There are plenty of startups experimenting with new models while also profiting from the growing demand for cryptocurrency loans.

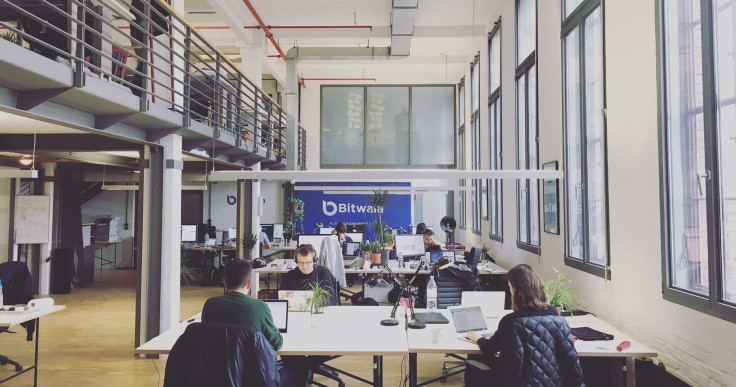

The Berlin-based startup Bitwala is moving into the digital banking industry over the next year, eventually offering investment brokerage and short-term, P2P bitcoin loans where customers choose their own payment schedules and interest rate options. There are even startups looking beyond the P2P model, such is the case with SALT Lending, based in Denver, Colorado.

The Denver-based startup has a more institutional approach than the above-mentioned projects. Its lenders are all accredited investors, vetted businesses or traditional firms. Borrowers must be cryptocurrency users who put their blockchain-based assets up as collateral. These asset-based loans are far less likely to leave the borrower swimming in debt if he can’t pay it back. “There’s still a risk of default,” Salt CEO Shawn Owen told IBT. “But you’re losing an asset and not your future earning potential.”

Salt has a KeepKey hardware wallet and a digital lending platform set to launch near the end of this year, altogether bringing in more than $45 million in revenue thanks to 25,0000 users. This company’s token sales model will continue selling tokens in perpetuity, not a limited-time offer like some ICOs. “We don’t view ourselves as lenders,” Owen said. “We see ourselves as a technology company with a solution for lenders.”

This startup plays matchmaker, helping lenders evaluate credit risk and what blockchain-based assets are actually worth. People can only borrow a value equivalent to what they already own. “Most of the lenders are institutions,” Owen said. “The reason why this is revolutionary is because of the ability to automate these contracts... It’s that this is an entirely new way to think about value.”

Judging a cryptocurrency’s value isn’t only about the current market price. A thorough assessment also needs to consider broader industry trends, volatility and liquidity. Theoretically, a cryptocurrency expert could already offer a P2P blockchain-based loan without using a service provider. The developer would simply need to write up a smart contract to execute direct transactions between digital wallets. But determining the value of those tokens would be pretty tricky.

Another risk factor to consider is the number of participants in a cryptocurrency’s ecosystem, plus how invested those participants are in the network. Researchers at Cambridge University found bitcoin was the most popular cryptocurrency among businesses, thanks in part to the passionate developer community building up bitcoin’s technology. The Cambridge study estimated there are between 5.8 to 11.5 million active cryptocurrency wallets worldwide.

“With public chains, you have a vast amount of information to base your assessment off of,” Owen said. “We’re looking at creating the credit infrastructure for what we believe will be the future of the token economy.”

© Copyright IBTimes 2025. All rights reserved.