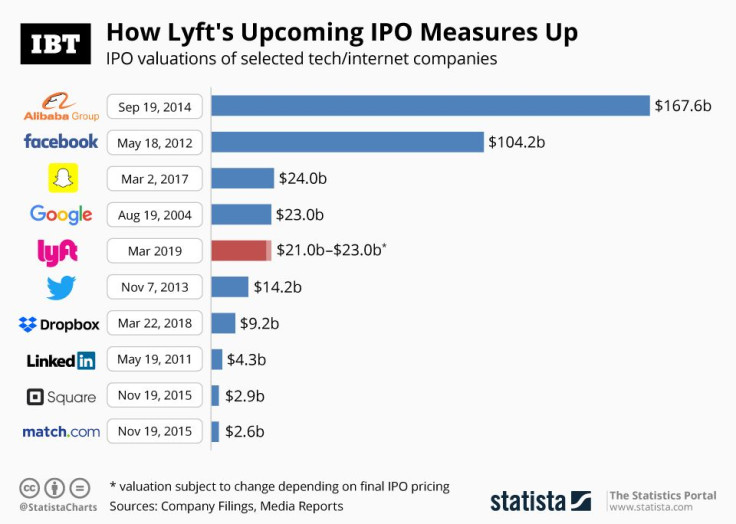

Infographic: Lyft's Upcoming IPO Valuation Versus Other Tech Companies

Ride-hailing company Lyft began its investor roadshow on Monday in preparation for its initial public offering expected for next week. According to its latest SEC filing, Lyft plans to sell 30.77 million shares priced between $62 and $68 a share, which would give the company a valuation of $21 to $23 billion.

As one of two dominant ride-hailing companies, Lyft was used by more than 30 million people across North America last year, generating $8.1 billion in gross bookings and $2.2 billion in revenue. Like its biggest rival Uber, also planning to go public this year, Lyft has yet to become profitable, with net losses amounting to $911 million in 2018.

Despite widespread doubts about the long-term viability of the ride-hailing business model, Lyft is reportedly seeing healthy demand for its shares. According to Reuters, the company’s initial public offering is already oversubscribed, indicating that the final price, to be set next week, could be even higher than the proposed $62-$68 range. As the following chart shows, another price hike could see Lyft’s IPO valuation surpass the $24-billion price tag that Snap received in its highly coveted IPO in 2017.