iPhone 4s: Is Advanced Micro Devices' Stock Headed to $8 and Beyond in 2012? - Stock Review

ANALYSIS

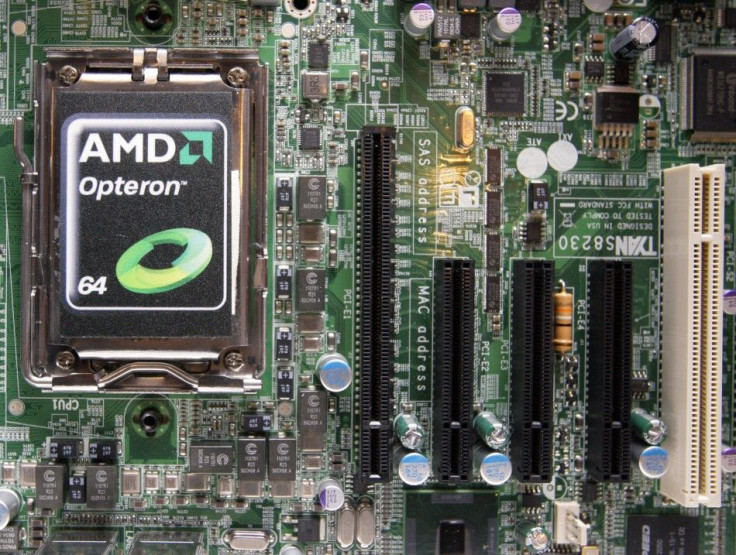

Apple's iPhone 4s has created a sensation, an iPhone 4s/5 Wave in the tech and multi-media sectors -- maybe the best thing to happen in tech since the launch of the original Microsoft Windows operating system. Hence, it goes without saying that I'm Reiterating my Buy call on Advanced Micro Devices (AMD), first discussed here at the International Business Times on Sept. 30, 2011 at a price of $5.31.

The evaluation here forwards that we're looking at a Camelot in tech -- one in which a variety of devices in tech, from several suppliers, will raise the profile of the value and utility of the gadgets -- including introducing a new segment of society to the products. Advanced Mico will likely benefit in several ways and that bodes well for the stock, long-term.

I.e. Advanced Micro Devices will benefit from a ripple-effect from the iPhone 4s/5 Wave. Hence, AMD is worthy of a stock review.

Sprint (S), as speculated, secured the rights to the iPhone 4s earlier in October, and to say the launch became a cause celeb in tech and media sectors circles would be an understatement. The buzz about the iPhone 4s was the most since perhaps Microsoft's (MSFT) hey-day and its much-anticipated launches of new operating systems.

Will AMD Benefit from iPhone 5 Wave?

What's more, if the iPhone 4s/5 can come close to matching its hype, it has the potential to spark an iPhone 4s/5 Wave, if you will, in the cell phone service provider and tech sectors -- in other words, a renaissance -- one that attracts new minds (translation: subscribers) that previously had not considered the iPhone 5 or even a smartphone, and other tech devices.

And that's good news, not only for iPhone 4s/5 newbie Sprint, but also for microprocessor and chipset maker Advanced Micro Devices. AMD's shares taded Teusday afternoon up 5 cents to $4.72.

Advanced Micro remains well-positioned to benefit from an upswing in both PC sales and notebook computers and other products. Look for 2012 revenue to rise six to nine percent to about $7.1 billion, after a one to two percent rise in 2011.

Advanced Micro should also benefit from new product introductions, and the company's market share in PCs and graphics markets should increase.

Margins also will likely widen to about 47 percent in 2012: all those iPhone 4s Wave customers will spark an increased demand for AMD chip-laden products -- allowing the company to maintain existing prices in most categories. Margins will also benefit from outsourcing.

Further, after a pedestrian 2011, Advance Micro's improved product portfolio, nimble operation model, and solid cash flow will lead to a substantially higher P/E ratio -- a P/E that's above the company's historical average. In a summary, with a P/E of about 5.5, Advanced Micro is cheap.

The Thomson Reuters First Call FY2011/FY2012 EPS estimates for AMD are 43 cents and 58 cents. Each EPS estimate looks about 10-15 percent lower, according to my analysis.

Technical Stats: Advanced Micro's shares slid roughly in-sync with the U.S. economy slowdown this spring/summer, falling from about $9.60 to the psychologically-significant $5 level. There is a gap-down to $5 from about $6, and my earlier calculation had support coming in strong at $5: it did not hold, but my still bullish on AMD. To be sure, AMD has to overcome technical hurdles in both the key 50-day and 200-day moving averages, and clutter in the $6 to $6.75 range, but once it becomes clear that tech will have a good year in 2012, institutional investors will make rear-view mirror work of those resistance levels. Advanced Micro should trade above $6.50 by the end of 2011, and above $7.50 by the end of 2012

Stock Category: Advanced Micro is ideal for investors who want a high growth stock with plenty of upside potential. Keep in mind that Advanced is a moderate-risk stock not suitable for low-risk investors. Also, there's a 10 percent chance you'll lose your entire investment with VZ over a 10-year period.

2011 Outlook: I view Advanced Micro devices as a long-term play, but if you're looking to sell AMD within the year, it's probably best to take your profits after it rises to $5.75-5.95, if it fails to rise above $6.

Stock Analysis: Advanced Micro Devices is a moderate-risk stock. If an investor has already purchased the company's shares, I'd hold them. If not, I'd consider buying a 50 percent position in AMD now and another 25 percent in one month, if the U.S. economy does not worsen substantially. I'd put a sell/stop loss at: $2.60.

- -

Disclosure: L.C. Jacobs of New York, N.Y. reviews stocks on a quarterly, semi-annual, and annual basis.

L.C. Jacobs has no positions in stocks reviewed, but does own federal, municipal, and corporate bonds.

© Copyright IBTimes 2025. All rights reserved.