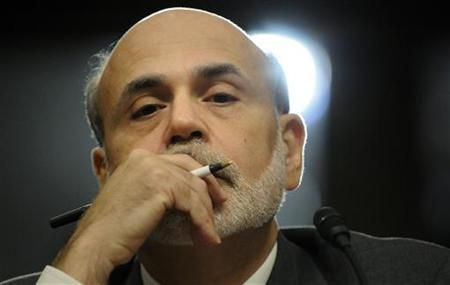

Markets Do U-Turn After Bernanke Speaks: Daily Markets Wrap

Fed Chairman Ben Bernanke said Wednesday job growth was better than expected and inflation under control, leaving markets thinking central bank intervention was a long way off. The upshot was a dollar rally that hammered gold, stocks and government bonds.

Earlier, stocks had risen to fresh highs on European Central Bank lending and better-than-expected U.S. fourth-quarter GDP numbers. The Nasdaq Composite Index even climbed over 3,000 for the first time in 12 years.

But once Bernanke began testifying before Congress, markets did a U-turn. Mining company shares fell especially hard with Newmont Mining Corp. down 4.23 percent and Harmony Gold Mining off by 4.04 percent.

Stocks. U.S. equity indexes snapped a four-day winning streak, but the Dow Jones Utility Index rose 0.1 percent. Europe's major stock indexes closed lower, but Asian bourses posted gains.

Bonds. An unidentified asset manager sold more than 100,000 futures on Treasuries shortly after Bernanke began speaking, triggering a wave of selling that at one point lifted yields on 10-year bonds above 2 percent.

Currencies. The dollar shot up 0.72 percent to 78.87 on the ICE US Dollar Index, which gauges the greenback against a basket of six major rivals. The euro slipped to $1.33.

Commodities. Gold dropped 4.3 percent, its biggest drop this year, and silver plunged 6.9 percent. Crude oil edged up to $106.81 per barrel, but copper fell. Agricultural commodities were mixed.

© Copyright IBTimes 2025. All rights reserved.