NFTs Vs Traditional Art: Which One Is Better?

Outside of physical structures, every artwork category can be made digital. And if something is digital, it can be tokenized to become a non-fungible token (NFT). The question then is, how do we view digital art pieces compared to traditional art, and what perks can NFTs add to the valuation equation?

What do sales tell us about NFT vs. traditional art?

During 2021, NFT trading volume grew to $23 billion from negligible levels a year prior. OpenSea, the top NFT marketplace, hosted the bulk of that NFT flow on both the primary and secondary market, at $14.6 billion. These impressive numbers indicate a major shift in the art scene.

The numbers speak for themselves. Compared to the traditional art market, the NFT market is not far off. From 2019 to 2020, the former dropped in sales by 22%, declining from $63.8 billion to $50 billion. This trend was followed by dealer sales as well, with a nearly 17% sales drop, from $29 billion to $24 billion.

Auction sales suffered the most, dropping more than 30%, from $25 billion to $17 billion.

Overall, according to Statista Research Department as of Dec. 7, 2021, the global art market is valued at around $50 billion. Another important indicator to consider is that average traditional art sales are significantly higher. Case in point, $1,580 average transaction size in the traditional art market vs. $939 on OpenSea.

This difference is substantial, as it indicates a higher barrier to entry in the traditional art world of auction houses and dealers. Likewise, NFT marketplaces are nothing if not convenient. One doesn't even have to leave their home or engage with any mediators and their costly fees.

After all, NFT marketplaces are automated because they run on smart contracts, the very same ones responsible for minting digital art pieces and creating their permanent record on the blockchain. Speaking of which, this leads us to the core of the issue — does digitized, tokenized art have the staying power of physical items?

What benefits do NFTs bring to the art table?

Traditionally, people have been buying artworks for multiple, not-mutually exclusive reasons:

- Tax deduction: While buying art is not a taxable event, once sold, it is liable to capital gains tax of up to 28%. However, that only applies if the sale is at a loss. More importantly, such personal purchases are not considered investments.

- Aesthetic appreciation: Buying art for the sake of enjoying it and rewarding the artist appropriately, so they could make more of it.

- Social status: If an artist has a degree of notoriety and cultural weight, acquiring their work is valued as well. In turn, this grants the art holder bragging rights, which can be monetized as a boosted social status.

The same dynamic applies to the NFT market as well. Generative art collections in particular, such as CryptoPunks ($2.4 billion volume) or Bored Ape Yacht Club ($877.63 million volume) are made ideal for plastering on social media platforms as avatars. Because the bulk of social life is now conducted in the digital space, we can certainly see a future in which NFT avatars are prized possessions for social status signaling.

For instance, popular TV host Jimmy Fallon bought BAYC NFT for $145k on Nov. 8, immediately deploying it as his Twitter avatar. Speaking of which, Twitter, the world's largest social platform with at least 206 million monetizable users, has already announced direct linking of NFT's smart contracts to users' profiles.

As promised, here is the first experiment. Feedbacks and ideas are welcome :) https://t.co/TDyhibCXfG pic.twitter.com/2ifru9T2Pa

— Mada Aflak (@af_mada) September 29, 2021

As a cherry on top, NFTs also allow exclusive VIP access. The Bored Ape Yacht Club NFT collection is not called that for nothing. Celebrities, business people, investors, professionals … can all buy apes to gain access to exclusive events for valuable social networking. Effectively, all ape holders become members of VIP clubs in real life.

After all, only they can verify their identity by showing their NFTs in their wallets, transforming art assets into passkeys. One such real-life yacht party already took place at the NFT.NYC conference, hosting leaders of the tech industry, such as entrepreneur Gary Vaynerchuk and Reddit co-founder Alexis Ohanian.

Gm & holy shit apes. There’s about 700 apes lined up wrapping the block surrounding the gallery on three sides. Despite pulling permits, cops are going to shut this down before noon at this rate. So here’s what we’re doing:

— Bored Ape Yacht Club (@BoredApeYC) October 31, 2021

Most importantly, on the artist side of the equation, the actual creators of NFTs stand to enter a new era. Because each NFT smart contract, embedded into a blockchain, can track sales and ownership, so too it can track royalties. Prior to such technology, this was exceedingly difficult, if not impossible to accomplish.

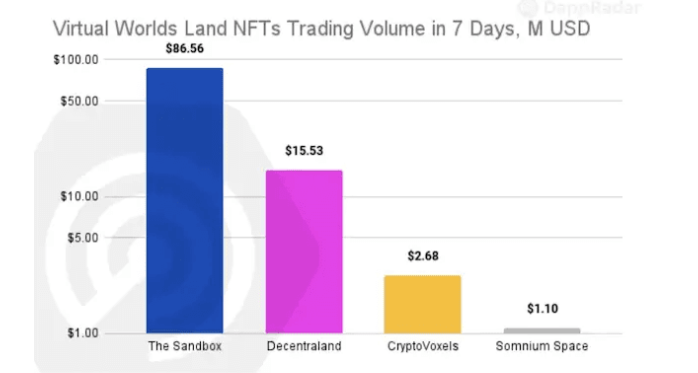

With NFTs, an artist can simply mint one with royalties included, thus gaining a steady income with each resale. By the same NFT token, virtual land plots can turn investors into virtual landlords, which explains the huge uptick in NFT land sales in the latter half of 2021.

Smart contract tech still not exploit-proof

In the end, we can recount NFT benefits, as a more fitting asset to own in a digital era, until the cows come home. Traceable proof of ownership, royalties, a greater range of art assets (video, animation, sound), and even new fractionalized ownership are just some of the pros on top of those already explained.

However, there have been reports of NFTs simply vanishing from users' wallets. This is like finding that someone broke into your home and stole expensive art pieces, except without leaving any trace of entry. In the case of NFTs, while you could always find and save the same digital file, it is not your NFT. Primarily, an NFT is a deed to a digital asset, so if lost, you lose it for good.

Suffice to say, these technical hiccups will have to be ironed out so NFTs do not lose their main appeal — smart contract inviolability. More robust blockchain platforms, such as Solana and Cardano, are certainly heading in that direction, with the latter being built as a comprehensive, peer-reviewed science project.

In the meantime, exceedingly rare smart contract exploits will have to be tolerated. With that said, the long-term future is definitely on the side of tokenized digital assets. After all, younger generations are more attuned to the digital world, while metaverses and blockchain games have yet to take full advantage of NFTs.

Rahul owns less than 1 BTC and 40 LRC.

International Business Times holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

© Copyright IBTimes 2025. All rights reserved.