Nielsen Report: How You Watch TV Depends On How Much You Make

Amid all the dire predictions about the death of television viewing comes an encouraging reminder from research firm Nielsen: If you build it, they will watch. Nielsen released its quarterly Total Audience Report last week, taking a look at how Americans consume media. While the amount of time spent per day watching live TV has decreased by 20 minutes and the amount of time spent watching TV via DVR has stayed about the same, the amount of time spent watching media on a smartphone has nearly doubled.

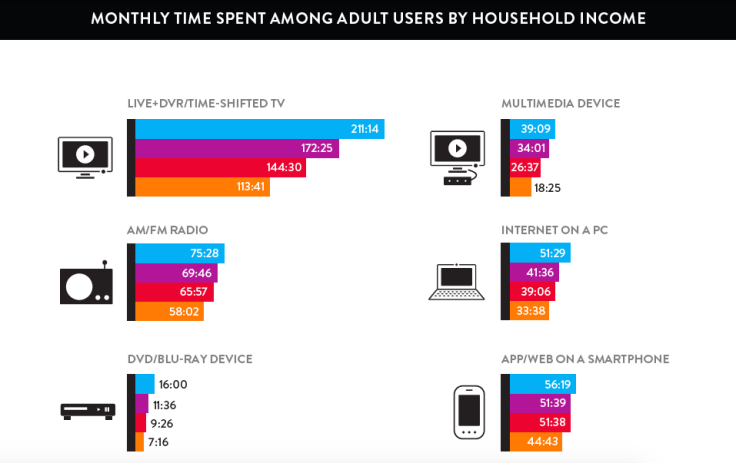

Nielsen also discovered that people with higher income levels might own more devices, but they don't use those devices nearly as often as those at lower income levels.

Take something like a multimedia device, i.e., something that allows one to use the internet on a TV set, like Apple TV or Roku. In Nielsen's study, only 12 percent of households making $25,000 or less had one while 34 percent of households making more than $75,000 had one. Yet the lower-income group used their multimedia devices more than twice as much as the wealthier folks used theirs, spending more than 39 hours a month watching content on that screen, compared with just 18.4 hours for wealthier users.

While the difference with devices like smartphones wasn't quite as stark, the overarching finding holds: With nearly every device you can think of — PC, smartphone, DVR, tablet, gaming console — Nielsen saw greater usage among lower-income households.

“We expected high-income households to own more devices, but we did not anticipate that low-income consumers of all devices had greater usage,” said Glenn Enoch, Nielsen's senior vice president of audience insights. “The media behavior of low-income adults may be concentrated in fewer devices, resulting in more minutes of usage for the devices they own, while high-income adults distribute their time among more devices.”

Income itself, though, is affected by several other factors, including race and age. Older people in general watch more television and are slower to adopt new technologies like the DVR and TV-over-the-internet. Americans tend not to reach their financial peak until around age 40.

Hispanic, Asian-American and black mobile customers, Nielsen notes, have a greater percentage of smartphone users within their demographics, compared to white mobile customers. According to Nielsen's data, 87 percent of black and Asian-American mobile subscribers (age 13 and up) have a smartphone, compared to 78 percent of white mobile subscribers.

Mobile ad spending has skyrocketed in the last few years, up to $30.45 billion in 2015, according to research firm eMarketer, meaning the uptick in mobile users will prove crucial for advertisers — and, thus, content producers.

© Copyright IBTimes 2025. All rights reserved.