Peabody Energy Warns Of Bankruptcy Risk, Adding To US Coal Industry’s Financial Woes

Peabody Energy Corp., the largest U.S. coal producer, could soon become the next mining giant to fall victim to gloomy market conditions.

The St. Louis coal company said it may have to seek Chapter 11 bankruptcy protection after it skipped a $71.1 million interest payment due Tuesday, CNBC reported. Peabody flagged the bankruptcy risk in a regulatory filing Wednesday after disclosing the delayed payment on its senior notes, setting off a 30-day grace period.

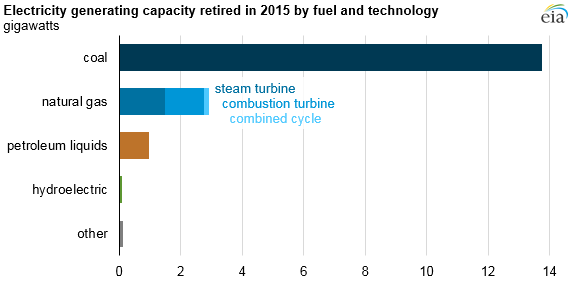

Peabody and its competitors are grappling with soaring debts and falling revenue as the U.S. coal market sours. Coal prices are down, federal rules for climate change and clean air are tightening, and demand from cheap, lower-carbon natural gas is crowding out coal in U.S. power plants. Arch Coal Inc., Alpha Natural Resources Inc. and a handful of other mining companies sought bankruptcy protection last year.

The long-term outlook isn’t bright for U.S. coal. Production last year fell to about 900 million short tons, its lowest level in nearly three decades, the U.S. Energy Information Administration estimated. The Obama administration’s landmark Clean Power Plan rules for power plant emissions are expected to shrink coal’s share of total U.S. electricity to 27 percent in 2030, down from 39 percent in 2014.

Arch, also in St. Louis, asked Montana regulators last week to suspend a permit application for its Otter Creek Mine project in that state. The multimillion-dollar project would have been the largest strip mine in the U.S. and was expected to ship coal to a proposed export facility in Washington state. Arch, which reported a net loss of $2.3 billion for the first nine months of 2015, also shuttered a related office in Montana.

Shares of Peabody (NYSE:BTU) were down over 42 percent Wednesday morning to $2.30 a share. The S&P 500 index, by contrast, was up 0.05 percent.

Peabody’s lenders have been pushing the company to restructure its debt through bankruptcy. The company has also pursued bond exchanges, CNBC noted. As of Dec. 31, the company had a total debt of $6.3 billion and cash equivalents of $261.3 million.

The threat of a Peabody bankruptcy has raised questions about the coal company’s ability to clean up its shuttered mines. Environmental and community groups said they worried that Peabody’s financial problems could jeopardize its ability to restore the land and protect water near the mine sites.

Peabody holds more than $2 billion in financial liabilities for the cleanup of its U.S. mines, according to the Powder River Basin Resource Council, a community group in Wyoming.

About $1.3 billion of that reclamation liability — or nearly two-thirds of the total — is “self-bonded,” meaning Peabody essentially gave its word to regulators that it will restore those sites. Coal companies can also issue surety bonds, which are backed up by third-party financial institutions, or put money into state-run pool bonds that guarantee some backup for mine cleanup if a company goes belly up.

Alpha, for instance, has roughly $411 million in self-bonded obligations in Wyoming and $244 million in liabilities in West Virginia. The Bristol, Virginia, miner promised about $61 million to Wyoming and $39 million to West Virginia through separate agreements, leaving both states holding hundreds of millions of dollars in cleanup liabilities.

“What has happened in other coal company bankruptcies is telling for what could happen in a similar Peabody bankruptcy,” the Powder River Basin group said in a note to reporters.

© Copyright IBTimes 2025. All rights reserved.