Signature Bank Seizure Was 'A Strong Anti-Crypto Message,' Says Dodd-Frank Act Co-Sponsor

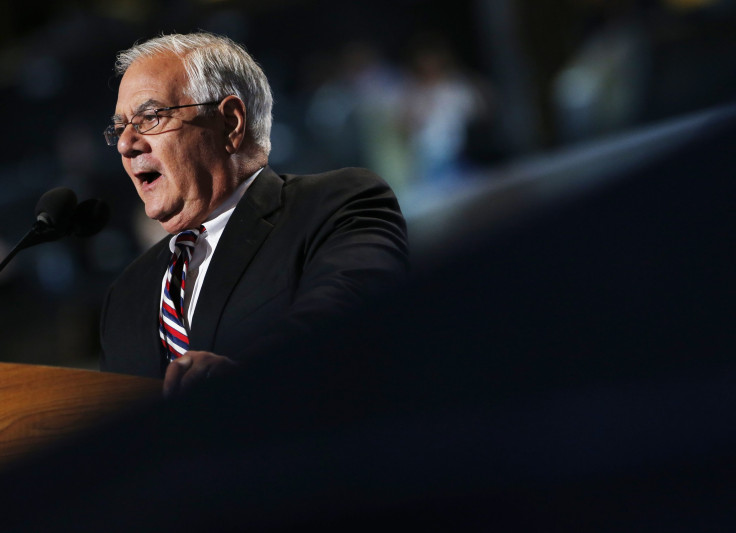

Former Congressman Barney Frank, the leading co-sponsor of the 2010 Dodd-Frank Wall Street Reform and Consumer Protection Act, one of the most far-reaching reforms that aim to prevent the excessive risk-taking that led to the 2008 financial crisis, has claimed that the Signature Bank's seizure was an "anti-crypto message."

New York lender Signature Bank saw over $10 billion of deposits leaving its coffers last Friday after regulators shut down Silicon Valley Bank when it faced a $42 billion bank run.

On Sunday, the New York State Department of Financial Services (NYDFS), along with the Federal Deposit Insurance Corporation (FDIC) seized Signature Bank and removed its top executives to protect its depositors, as well as the stability of the U.S. financial system.

Interestingly, former Congressman Frank, after the collapse of Signature Bank where he sat as one of the board members, partly pointed the blame for the bank's fall on cryptocurrencies.

"Digital currency was the new element entered into our system," Frank said in an interview Sunday. "A new and destabilizing — potentially destabilizing — element is introduced into the financial system. What we get is three failures," he added.

However, it appeared that Frank failed to address the reality that cryptocurrency was crucial in the growth of Signature Bank under his and others in the management department's direction despite concerns about the sector's known high volatility risk.

"I think part of what happened was that regulators wanted to send a very strong anti-crypto message," Frank said in another interview over the weekend. "We became the poster boy because there was no insolvency based on the fundamentals," he added.

For the Democrat and former chairman of the House Financial Services Committee, Signature Bank would have been fine if state regulators did not step in and seized it since withdrawals slowed down Sunday with the bank's top executive expressing optimism that they could weather the fierce storm.

For the board member of the fallen bank, the regulators' move to bolt down Signature was inordinately aggressive.

"I think that if we'd been allowed to open tomorrow, that we could've continued — we have a solid loan book, we're the biggest lender in New York City under the low-income housing tax credit," Frank said, adding, "I think the bank could've been a going concern."

Last year, Frank received $121,750 in cash compensation and $180,182 in stock awards for his role as one of the board members of Signature Bank, a company filing showed.

© Copyright IBTimes 2025. All rights reserved.