Three-Martini Lunch Credit: Why Some Are Irked By This Stimulus Measure

KEY POINTS

- A stimulus package could be signed by the president as soon as Monday

- Bill includes $600 stimulus payments alongside corporate meal tax credits

- 'Three-martini lunch' provision meant to keep restaurants in business

A massive relief package passed by U.S. lawmakers on Capitol Hill drew ire over a provision that would expand tax relief for corporate-related meals; a so-called "three-martini lunch" credit.

Combining an omnibus spending bill with a COVID-19 stimulus measure, Congress agreed on a $2.3 trillion package that would supplement state unemployment insurance with $300 in weekly support and send $600 stimulus checks to individual taxpayers. The bill includes support for schools, small businesses and vaccine distribution.

However, officials revealed details of the draft language of the bill to The Washington Post on condition of anonymity given the text is not yet publicly available. One measure includes tax relief for corporate meal expenses, a provision backed by the White House as a way to help the struggling restaurant industry.

As drafted, the measure backs the Payment Protection Program, a low-interest loan to keep businesses afloat and paychecks flowing during the pandemic, with $284 billion. The $600 direct payments to taxpayers, however, is half what it was in the CURES Act, the $2.2 trillion relief measure passed in March.

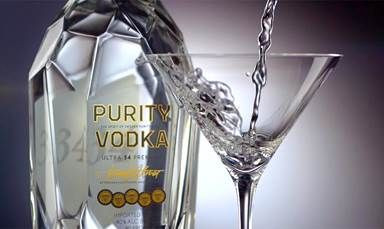

“Republicans are nickel-and-diming benefits for jobless workers, while at the same time pushing for tax breaks for three-martini power lunches,” Sen. Ron Wyden, D-Ore., ranking member of the Senate Finance Committee, was quoted by the Post as saying. “It’s unconscionable.”

Many bars and restaurants are defying state restrictions on indoor dining, arguing take-out and delivery aren’t enough to stay in business. Democrats supported the tax credit in exchange for similar relief for low-income families, aides told the newspaper on condition of anonymity.

Sen. Tom Scott, R-S.C., argued that increasing the allowable tax credit on business-related meals from 50% to 100% is a “pro-worker, pro-restaurant, and pro-small business bill [that] will lead to increased spending in restaurants and more income for staff,” the Post reported.

In May, the president presented the tax relief as a way to “bring life back to the restaurants,” though at least one tax policy adviser said it was not enough to offset the damage the pandemic has done to the industry.

“Months later it is still bad policy, and still not good economic relief for the current situation,” said Kyle Pomerleau, a tax analyst at the conservative-leaning American Enterprise Institute think tank, told the Post. “It just should not be in there.”

© Copyright IBTimes 2025. All rights reserved.