US Stock Market Performance Hit Record Highs Under Biden, Best In 75 Years

KEY POINTS

- The US stock market performance hit a new record not seen in 75 years

- The S&P 500 returns saw a nearly 25% rise since Biden won the election in November

- The only U.S. president to hit the record during the same period was John F. Kennedy

The U.S. stock market has experienced better returns during President Joe Biden's first 100 days in office than it has under any other president in at least 75 years, data from JPMorgan revealed.

In a note sent out to clients on Friday, JPMorgan analysts, led by John Normand, said the administration’s fiscal stimulus pushed equity returns to record highs. Not since President Dwight Eisenhower’s administration have returns been better during a president's first 100 days in the White House.

Normand wrote in a note that Biden’s time in office has already brought the strongest post-election equity returns in at least 75 years "due to record fiscal stimulus and despite heavy use of Executive Orders."

"Not bad for someone Trump labeled as Sleepy Joe during the campaign," Norman pointed out.

The S&P 500 returns has risen nearly 25% since Biden won the 2020 election. In comparison, former President Donald Trump only saw below 11.4% from the day he was elected to his 100th day in office.

The previous high-water mark for 100-day success was set by John F. Kennedy in 1953, when returns surpassed 20% during the initial 100 days of his administration, data from JPMorgan showed.

The data also indicated that the S&P 500 posted better returns in Biden's first 100 days than under any other command-in-chief since World War II.

The JPMorgan team said that Biden’s proposed tax hikes, which may double the capital gains tax rate to as high as 43.4% for high-income Americans, could become a drag on equities in 2021. However, the team noted that the tax increase would unlikely drive a big dip in earnings.

"But within a surging earnings growth environment driven by greater fiscal outlays and vaccine-driven reopening, our U.S. Equity Strategists have refreshed and expanded that original analysis this week, with no change to the year-end S&P target of 4400," JPMorgan said.

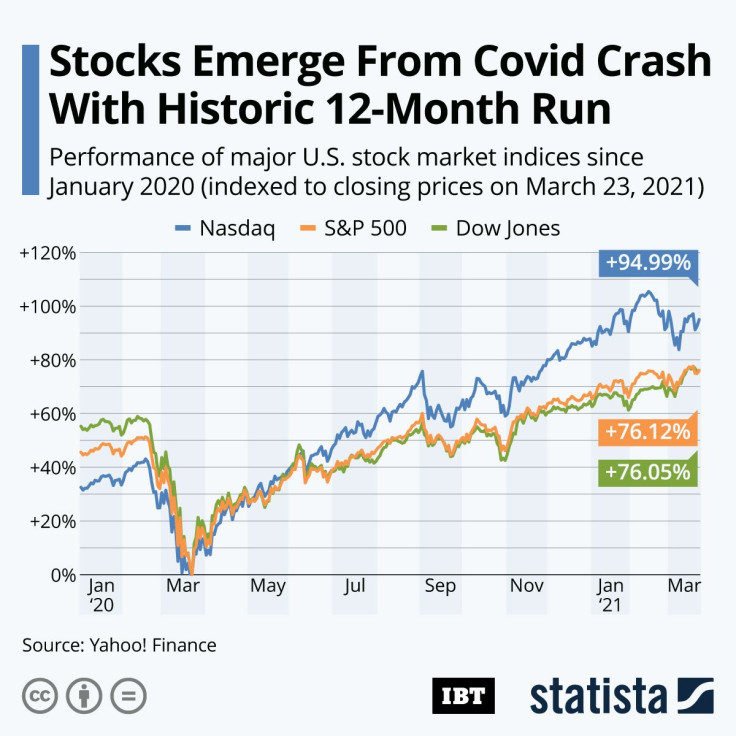

Some market strategists warned that it is difficult to judge whether the stock market was reacting to Biden’s inauguration or if there's been a continuation of the performance that started in late March 2020.

“Anyone that became president this year was going to have a pretty significant tailwind,” Art Hogan, chief market strategist at National Securities, said.

© Copyright IBTimes 2025. All rights reserved.