U.S. Underwater Mortgages Down Slightly in 3Q: CoreLogic

U.S. homeowners with mortgages worth more than the value of their homes decreased slightly in the third quarter, according to a report from CoreLogic.

Nationwide, 10.7 million properties were worth less than their mortgages, known as underwater or negative equity. Those properties comprised 22.1 percent of all properties with a mortgage, a slight decrease from 10.9 million homes, or 22.5 percent, in the second quarter.

Although slightly down, negative equity remains very high and renders many borrowers vulnerable when negative economic shocks occur, such as job loss or illness, Mark Fleming, chief economist at CoreLogic, said in a statement.

An additional 2.4 million borrowers had less than 5 percent equity, known as near-negative equity, in the third quarter.

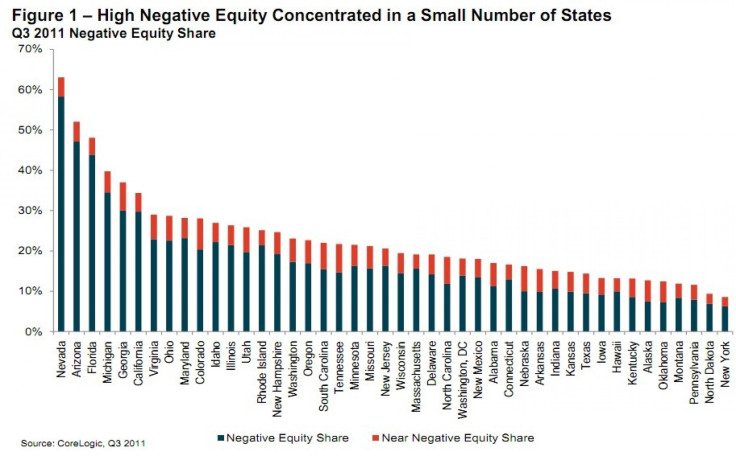

Underwater mortgages remained high in states hit particularly hard by the housing crash. Nevada had the highest percentage of underwater morgages at 58 percent, followed by Arizona with 47 percent, Florida with 44 percent, Michigan with 35 percent and Georgia with 30 percent. Georgia surpassed California in the percentage of underwater mortgages, entering the top five for the first time since tracking began in 2009.

CoreLogic's data differed from an earlier report from Zillow, which said 28.6 percent of U.S. homes were underwater in the third quarter, up from 26.8 percent in the second quarter. CoreLogic's data tracked 48 million properties, over 85 percent of all properties in the U.S.

© Copyright IBTimes 2025. All rights reserved.