Wealth Disparity By Race: After 2008 Financial Crisis, Black And Hispanic Families Have Dwindling 401(k) Balances

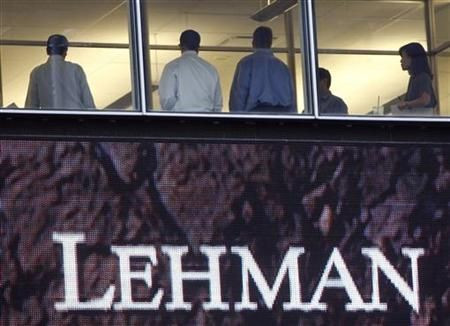

Eight years out, a new study shows that the 2008 economic meltdown has had lasting impacts on the savings accounts of primarily black and Hispanic households in the U.S. In the near-decade since Lehman Brothers collapsed, signaling the start of a downward economic spiral, the balances of minority 401(k) accounts have dropped while white future retirees have seen little change in theirs.

Since 2007, the balance for 401(k) and similar types of plans held by African-American working households has dropped by at least $14,700 — from $31,100 to $16,400 in 2013 — according to a recent Government Accountability Office report. That’s compared to white working households, whose balances showed no significant changes, and they were roughly three times larger than those of blacks and Hispanics at the end of 2013.

The report also noted that, in general, lower-income minorities were less likely to have access to 401(k)s and that disparity between lower-income and high-income access was massive. Among those at the lower end of the income bracket, roughly 25 percent had access to such plans. Meanwhile, 81 percent of high-income earners had access.

The disparity in access to retirement saving programs between racial groups mirrors the overall financial picture in which whites are disproportionately favored and have much more wealth accumulated. A typical white household in America has 16 times the wealth of a typical black household. That means the average black household has 6 percent of the wealth of whites. Hispanic households have just 8 percent of the average wealth of white families.

Wealth disparity like that can have broad ramifications for the economy in general. The World Economic Forum in 2014 identified increasing inequality as a source of more and more volatility internationally. When families are unable to afford basic levels of economic security, slight variations in the economy are more likely to have an impact on those families and, therefore, on the overall economy, the World Economic Forum concluded.

© Copyright IBTimes 2025. All rights reserved.