The Future Of Obamacare And Why Health Care Reform In The US Matters

Reforming health insurance could have far-reaching implications for investors in healthcare stocks, but while "repeal and replace" has passed in the House of Representatives, it's unclear whether it will pass in the Senate without significant changes.

Why reform matters

Despite adding millions of new members to insurance rolls, Obamacare has been a money-losing venture for most health insurers. In many cases, the high cost of providing care to previously uninsured individuals has outstripped premium revenue, forcing insurers to significantly increase premiums or to exit Obamacare marketplaces altogether.

For example, UnitedHealth Group (NYSE:UNH) , the nation's largest health insurer, removed itself from most Obamacare marketplaces after reporting hundreds of millions of dollars in losses from the program.

Obamacare has, however, been a big win for investors in insurers that manage state Medicaid programs. Companies like Centene Corp. (NYSE:CNC) , for example, have seen sales and profit climb as membership has grown because of Obamacare provisions expanding Medicaid enrollment criteria.

Obamacare has also been a winner for hospitals. Under Obamacare, the amount that hospitals have had to write off in charity care has fallen by billions of dollars per year, and that has boosted operating margins. For instance, operating margin at HCA Holdings (NYSE:HCA) , the nation's biggest hospital operator, ranged from 11% to 13% during the mid-2000s, but it has ranged between 13% and 15% since the law's implementation.

Obamacare has also arguably provided investor-friendly tailwinds for drugmakers and medical device and equipment companies, because it has allowed all those companies to sell their products to a larger pool of patients. According to a RAND Corporation study, uninsured patients who got private insurance coverage in 2013 and 2014 (when Obamacare was implemented) filled 28% more prescriptions in 2014 than in 2013. Patients who were uninsured and then got insurance from Medicaid because of Obamacare filled 79% more prescriptions in 2014 than in 2013.

What "replace" looks like

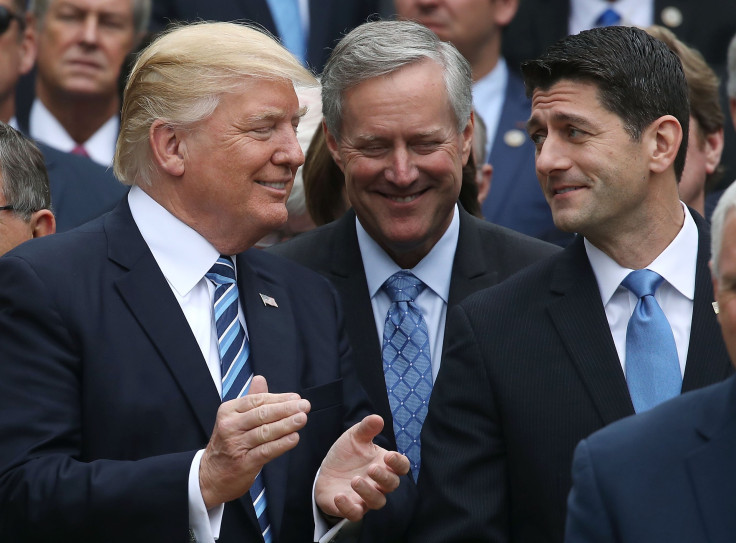

The House bill that passed today is similar to the bill tabled by Speaker Paul Ryan last month.

That bill -- the American Health Care Act (AHCA) -- includes significant changes to the U.S. health-insurance program, including ending Obamacare subsidies that reduce monthly insurance premiums for enrollees.

Instead of subsidies, the AHCA establishes a tax credit system that provides individuals with $2,000 to $4,000 per year, depending on age, up to a maximum of $14,000 per family. The tax credit begins phasing out for singles at $75,000 and for households at $150,000 in modified adjusted gross income.

The AHCA also increases pre-tax contribution limits for health savings accounts (HSAs), tying them instead to plan out-of-pocket limits, and it removes restrictions that prevent insurers from charging older members more than three times the premiums of younger members. The AARP has been particularly vocal in its opposition to that provision, calling it an age tax.

The replacement plan removes patients with expensive preexisting conditions from insurers' member pools and transfers them to government-subsidized high-risk pools, and it allows states to file for waivers to the requirement that insurers pay for specific "essential" benefits, such as annual physicals.

Furthermore, it caps Medicaid expansion in 2020, shifting Medicaid to a block-grant approach thereafter.

Hurdles in the Senate

The AHCA passed in the House by a thin margin of victory, with a final tally of 217 voting for it and 213 voting against it, including 20 Republicans. Republicans who voted against the AHCA predominantly hail from states that are politically more centrist, and in some cases, that have embraced Medicaid expansion.

In the Senate, the AHCA will face even stiffer opposition. Republicans' majority in the Senate is smaller than it is in the House; if it's determined that any provisions in the AHCA are incidental to the federal budget, those provisions might have to be jettisoned if Senate Republicans want to use the budget reconciliation pathway to pass the AHCA with a simple majority. The presiding officer of the Senate -- a Republican -- could ignore the Byrd Rule and still put the AHCA to a Senate vote even if provisions violate it, but many people think that's unlikely.

it's also important to keep in mind that there are 20 Republican senators who are serving from Medicaid-expansion states, and there are 16 Medicaid-expansion states that are run by Republican governors. That's a lot of political will that could lead to significant changes to the AHCA, particularly to provisions involving capping Medicaid expansion in 2020.

What's an investor to do?

The impact on the healthcare sector will be determined by negotiations in the Senate, and therefore, it's too early to pick investment winners and losers.

Broadly speaking, however, commercial health insurers like UnitedHealth Group probably have more to gain than to lose from reform, and changes in the Senate could insulate Medicaid insurers from the risk that their member counts will drop significantly if the AHCA passes.

Perhaps hospitals stand to lose the most if the AHCA eventually becomes law, because it's likely to increase write-offs again. The outcome for drugmakers and medical-products makers is tougher to gauge, because it hinges on the final analysis of how many people may lose insurance coverage under the AHCA. Previously, it was estimated that 24 million people could lose coverage, but those estimates haven't yet been revised to reflect recent changes to the bill. Investors will want to look out for those revised numbers.

Todd Campbell has no position in any stocks mentioned. His clients may have positions in the companies mentioned. The Motley Fool recommends UnitedHealth Group. The Motley Fool has a disclosure policy.