LLC Formation In New Mexico: Why Founders Express A Renewed Interest

The governor of New Mexico is constantly announcing new incentives for startups. Just by following the official press releases of the state, it is clear why some of those who depart California and New York, often choose this state to start a new business.

If you wish to form a new business in New Mexico this article could provide some useful insights. You should know that forming a limited liability company (L.L.C.) has many advantages. This business structure shields you from personal liability for business debts. If, for example, the company owes someone money, they will almost certainly be unable to pursue you to collect the debt. Furthermore, the names of L.L.C.'s members are not public records in New Mexico, effectively making L.L.C. ownership anonymous. Furthermore, the cost of forming an L.L.C. in New Mexico is significantly lower than in many other states, such as Nevada, Delaware, and others.

To set up your L.L.C. in New Mexico, you must fill out the Articles of Organization and file them with the New Mexico Business Services Division, which costs $50. Before completing the form, you must select a business name and a registered agent. Articles of Organization must be filed online in New Mexico and usually take one to three business days to be processed after the state receives them.

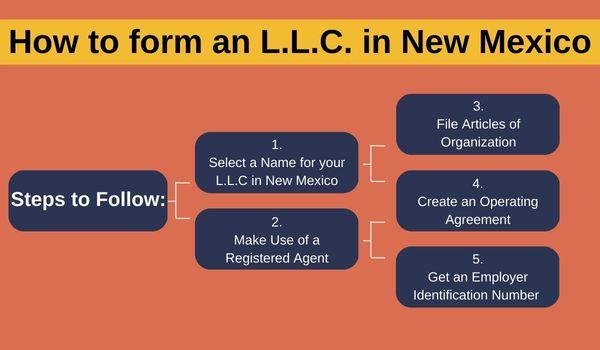

Keep reading to learn what else you need to know about forming your L.L.C. in New Mexico. But first, let's go over the steps you must follow!

Steps of creating an L.L.C. in New Mexico

- Select a name for your New Mexico L.L.C.

When naming your L.L.C. in New Mexico, there are two main rules to follow:

- The name of an L.L.C. must be distinct from the names of other current businesses in New Mexico.

- The name of an L.L.C. must include a phrase or abbreviation such as "L.L.C.," "Limited Liability Company," or "Limited Liability Company."

Availability.

After deciding on a suitable, use the New Mexico Secretary of State Business Search to confirm its availability.

Name reservation.

It's a good idea to reserve your L.L.C. name with the Secretary of State so that no other New Mexico company can use it before you file your Articles of Organization. To reserve the name for up to 120 days, submit a reservation application by mail. The filing fee is $20.

- Make use of a registered agent.

Forming an L.L.C. in New Mexico, like in every other state, necessitates selecting a registered agent service. They handle federal, state, and legal documents and service of process on the business's behalf. The registered agent must be a business entity, a New Mexico resident, or have a New Mexico Street address. A company or individual must maintain a business office in New Mexico if they are based out of state.

File your Articles of Organization.

In New Mexico, an L.L.C. is formed legally by filing Articles of Organization with the New Mexico Secretary of State. You can file online and pay a filing fee of $50.

Some common details in the Articles of Organization are:

- Name, email address, and address of L.L.C.

- Name and address of the registered agent

- L.L.C.'s term (if not perpetual).

- The goal of the L.L.C.'s business.

- Whether the L.L.C. has a single member, is managed by members, or is managed by a manager.

Foreign L.L.C. registration

A limited liability company formed in another state that wishes to conduct business in New Mexico must:

- Have a Certificate of Good Standing from the L.L.C.'s state of origin must accompany the certificate.

- Comply with the L.L.C. naming rules in New Mexico and confirm the availability of your preferred L.L.C. name.

- Fill out a Foreign L.L.C. registration application and submit it to the Secretary of State. The application must be mailed, and there is a $100 filing fee.

- Obtain a registered agent in New Mexico.

Create an Operating Agreement for your New Mexico L.L.C.

An operating agreement is not required in New Mexico for L.L.C.s, but it is strongly advised. An operating agreement is simply a written agreement between the members of an L.L.C. on how the company will operate. It will outline the rules for how the L.L.C. will handle dissolution, membership transfers, profit and loss allocation, and so on.

Get an employer identification number (E.I.N.)

Your New Mexico L.L.C. must have an employer identification number (E.I.N.), which serves as a tax identification number for your company. The I.R.S. will provide you with a free E.I.N. An E.I.N. is required for any business entity or individual who hires employees, and it is also required to file taxes. Your E.I.N. can also be used to create your L.L.C.'s business bank account. This procedure grants you the authority to conduct financial transactions in the state of New Mexico.

Annual L.L.C. Fees in New Mexico

New Mexico has low fees, for example, no required filings after formation. For $10 to $50, you can amend your articles, register a trade name, change your name or address, etc. However, having a registered agent in New Mexico is a priority.

Filing annual reports in New Mexico is not needed!

New Mexico does not make L.L.C.s file annual reports.

What tax requirements are there in New Mexico?

The new tax laws provide advantages to pass-through entities like L.L.C.s. These savings cover the cost of formation for many people. The taxation of limited liability companies is the most flexible of any business entity. They are taxed as pass-through entities by default and are not subject to double taxation. Forming a limited liability company can lower your overall tax rate while increasing the number of deductions available.

What benefits will you enjoy when you form an L.L.C. in New Mexico?

- Filing taxes is easy, and there are fantastic tax benefits.

- Forming, regulating, managing, running, and being compliant is simple.

- Protect your personal assets from your business's debts and liabilities.

- Filing fees are low ($50).

Final Thoughts

Forming an L.L.C. in New Mexico is not plain sailing! However, it does not have to be challenging either. The process is much easier with a firm like Cindy's New Mexico L.L.C. Formation Service. Visit this recommended resource to see how to set up your own LLC fast.