Marijuana Legalization 2015: EPA Issues Guidance On Marijuana Pesticides Amid Industry Uncertainty

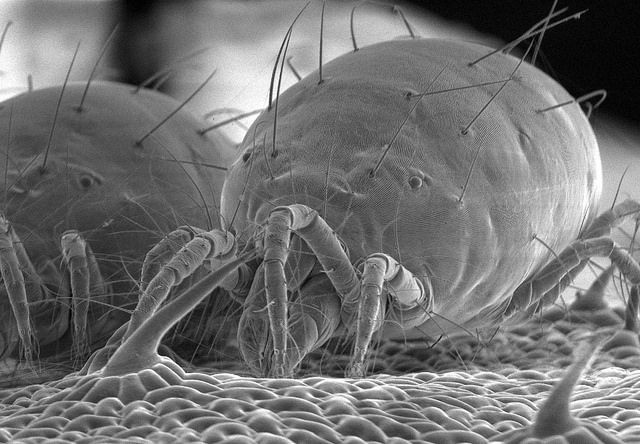

When he was managing a 3,500-plant medical marijuana grow facility in Denver, Adam Koh would have his staff thoroughly inspect his crops several times a week for signs of infestation. Tiny bite marks on the cannabis leaves could mean two-spotted spider mites were piercing the plant’s skin and sucking up nutrients. Small piles of what looked like powdered sugar could be the beginning of a mildew incursion.

Koh opted for natural crop management options, so if his staff spotted a problem, he’d isolate the infected plants or use organic pest control options. But a few times, when the infestation was out of hand, he’d destroy an entire grow room’s plants and start again. That option wasn’t cheap: His biggest flower room held 164 plants, and if he ever lost a whole crop in there, he could have been out 75 pounds of cannabis, which by the going rate for retail marijuana, would mean a quarter of a million dollars down the drain.

Koh wasn’t surprised that some of his colleagues would do anything they could to save an infested crop, even use pesticides that weren’t approved for marijuana use. “You hear about things where really intense chemical products were being used right before harvest to ‘save a crop,’” he says. “I unfortunately don’t think it’s uncommon.” It’s one of the reasons he got out of the grow-management business and now works for Comprehensive Cannabis Consulting, helping clients nationwide set up sustainable, all-natural marijuana grows. “I didn’t want to be associated with what I was hearing,” says Koh.

The legal marijuana industry is plagued by upheaval over pesticide use. In a business dependent on the health and vigor of a single plant, the lack of guidance over what kinds of cannabis pest-control measures are appropriate has left growers struggling to safeguard crops as they try to appease regulators and the public.

In recent months, tens of thousands of marijuana plants have been quarantined in Colorado over concerns they were doused in dangerous chemicals. Protesters in the state are picketing marijuana shops, claiming consumer health is at risk. And business owners are claiming that if the status quo continues, crops worth hundreds of thousands of dollars could sicken and die.

But now, for the first time, some relief for growers is on the horizon. The Environmental Protection Agency is offering a process through which pesticides could be approved for cannabis in states where medical or recreational marijuana is legal. By applying to register certain cannabis-related products as a “Special Local Need” as defined under section 24(c) of the Federal Insecticide, Fungicide and Rodenticide Act (FIFRA), the marijuana industry could have a comparatively swift and cheap way to obtain appropriate pest control options without running afoul of federal law. “I think it is a very positive sign,” says Mitch Yergert, director of the Colorado Department of Agriculture (CDA)’s Division of Plant Industry, who received the letter from the EPA detailing the process on May 19. “It allows us to move forward in a very normal manner on pesticides for marijuana, just like any other crop. I think it is a huge step forward for the EPA, the industry and us.”

But until marijuana pesticides are thoroughly vetted and fully registered by the EPA as safe for use wherever cannabis is grown, the 24(c) process is a stopgap measure at best. It remains to be seen whether pesticide makers will be willing to wade into the marijuana industry and attempt to register any of their products for marijuana use under 24(c) – and, if they do, whether the EPA will ultimately sign off on those attempts.

Lack of direction

Since pesticides are considered a potential public health risk, manufacturers work with the EPA to gain approval for each crop use for all but the most innocuous pesticides. But so far, the EPA hasn’t created a crop category for cannabis, and since marijuana remains illegal under federal law, it’s unclear whether the agency is able to do so. EPA spokesperson Catherine Milbourn declined to comment for this story, noting, “The [24(c)] letter is all we can say right now.”

Even if the EPA allowed pesticides to be registered for use on marijuana plants, it’s unlikely major pesticide companies would stomach the cost of collecting all the scientific data necessary to register their products for cannabis, considering the industry is still in legal limbo. “A registration for a pesticide for a company can cost millions and millions of dollars,” says Yergert. “I don’t think any of those companies is willing to go down that road until there is a clear federal framework as to what they should be doing.”

For years, regulators in states that had legalized medical marijuana largely avoided the pesticide issue as cannabis growers used any means necessary to care for their plants. But as recreational marijuana has rolled out in several states, state agriculture officials, who usually work closely with the EPA on pesticide issues, have begun to tackle the issue themselves. Washington State, Colorado and California have provided guidance on what sorts of pesticides can be used on cannabis. But according to Erik Johansen, Washington State Department of Agriculture (WDA)’s policy assistant for registration services, in most cases these lists “don’t cover the synthetic pesticides that most conventional growers use on wheat or apples or corn or just about any crop you can think of. If you get in an area where you have an outbreak that you have to control, these products [on the current state lists] are not necessarily the most effective products you want.”

Marijuana growers, then, have turned into gamblers: Do they use approved products that might not fully protect their crops from pests, or do they opt for stronger stuff and risk running afoul of the law? This spring in Colorado, some of those gambles proved unwise. In March and April, the City of Denver ordered 11 local cultivation operations to quarantine tens of thousands of marijuana plants that they suspected of being treated with unapproved pesticides, meaning they could continue growing but couldn’t be sold. The Cannabis Consumers Coalition, a citizens group, has begun waving signs like "No Pesticides on My Flower” in front of the companies that were part of the sting, and most of the quarantined plants remain on hold. Some of the plants, which can fetch several thousand dollars each when mature, have already been destroyed voluntarily.

Circumstances are particularly vexing for growers because two of the pesticides used that led to the quarantine – Eagle 20 and Avid – aren’t listed in Colorado’s rules on marijuana pesticides, which means there wasn’t clear indication they were prohibited. “It’s been devastating,” says Sean McAllister, a Denver marijuana business attorney who represents four of the growers affected. “People have had to borrow hundreds of thousands of dollars to cover their lost inventory. People are having to scramble to adjust because they were doing something they had no idea was unlawful.”

Toxic tokes?

Are pesticide residues on marijuana a health concern? That question led Jeffrey Raber, a chemist who runs the Werc Shop marijuana testing lab in Los Angeles County, to analyze the smoke generated from marijuana treated with pesticides. The results, published in the Journal of Toxicology in 2013, were striking: 70 percent of the pesticides applied to the plants could be exposed to the lungs when smoked in a device like a glass bowl. “That is pretty much like injecting it into your bloodstream,” says Raber. “The smoking didn’t destroy the pesticide molecules, so you could have some pretty significant amounts of exposure.”

Findings like this, plus the fact that neither Colorado nor Washington, the two states that allow recreational marijuana, have yet to launch full-scale product monitoring programs for pesticide and other contaminants, lead some folks to think it’s only a matter of time until marijuana companies start facing lawsuits over pesticide contamination.

It’s why some people think the lack of approved pesticides for the marijuana industry might be a good thing. Without these chemical crutches, maybe cannabis growers could lead the way in developing an all-natural agricultural industry. “The reality is you can absolutely grow quality cannabis with organic methods,” says Chris Van Hook, a lawyer and founder of the Clean Green organic cannabis certification program in California. “Many of the pests people are talking about don’t necessarily damage the flower.”

But others think an all-organic marijuana industry is an impossible ideal when you have pests like spider mites, powdery mildew and root rot that can quickly decimate a finicky, closely spaced crop like marijuana -- and these risks might be exacerbated as the industry moves toward large-scale outdoor grows and porous greenhouses where it might prove even harder to manage pests. “It’s very difficult for someone growing outdoors to manage their crops without pesticides and get the yields they want,” says Kurt Badertscher, co-owner of Otoké Horticulture, a Colorado marijuana consulting company. “Frankly, if you talk to anybody who is in high-production agriculture and say, ‘I am going to take away most of your pesticides,’ they will say, ‘I am selling my farm.’”

EPA weighs in

The need for more guidance on pest control caused the Colorado and Washington State departments of agriculture to ask the EPA in February whether FIFRA section 24(c) could be used to approve marijuana pesticides as a Special Local Need, leading to the federal agency’s response in May. Special Local Need registrations are a state-based process designed for localized pest problems or minor crops, where an addendum to a pesticide’s registered use label is more practical than the full-scale EPA registration process. According to the EPA letter, to get a marijuana pesticide approved as a Special Local Need, a manufacturer would likely have to identify a product that is federally registered for uses similar to cannabis, such as those used on food or tobacco crops that are grown under comparable circumstances. Pesticides that have potential, according to CDA’s Yergert, include the insecticides Imidacloprid and Spinosad and the fungicide Azoxystrobin.

The section 24(c) registration process could provide a way forward for states struggling to manage marijuana pesticide use without violating federal law, says WDA’s Johansen. “It gives a little more flexibility to the state, and the EPA doesn’t have to approve the registrant; they just have to say, ‘We don’t have a problem with it.’ It’s not an ideal mechanism, but it is a step forward.”

What’s more, a Special Local Need registration usually requires far less time and money than a full EPA pesticide registration. “It’s a shorter process and cheaper. We are hoping six to eight months [for a registration], if there is a company that is really interested in moving forward with this,” says Yergert.

But that's a big if. While Johansen says he’s spoken with pesticide manufacturers interested in the marijuana industry, will any of them be willing to invest in even this abbreviated product registration process? It doesn’t help that unlike other Special Local Need registrations, states and manufacturers can’t rely on the expertise of state university agricultural departments or the U.S. Department of Agriculture, thanks to marijuana’s federal illegality.

And even if pesticide manufacturers move forward with the 24(c) process, no one knows for sure whether the feds will ultimately sign off on it. “The EPA note reads something like, ‘Sure, you can try, and here is some guidance on how to build the case,’” said Badertscher of Otoké Horticulture. “There is no statement that anything will get an exception.”

It’s possible, then, that the pesticide industry could end up like the banking industry, where even with tacit approval from federal regulators, businesses have been reluctant to wade into the developing marijuana scene without further federal guidance. In the meantime, while state agriculture officials and industry stakeholders search for potential pesticide companies to partner with, growers like Koh will have to keep searching their plants for bite marks and powdery mildew, hoping to catch the pests before it’s too late.

© Copyright IBTimes 2025. All rights reserved.