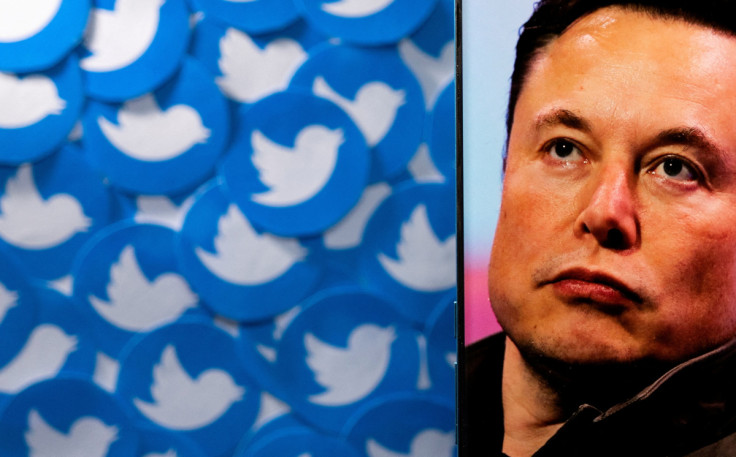

Musk-Twitter Buyout: 'Everyone's Trying To Get Out' Of $44B Deal, Says Investor

KEY POINTS

- A partner at MVP said "no one" thinks Twitter should be valued at $44 billion

- Investors are reportedly anxious about Musk's claims regarding Twitter bots

- Bankers are also reportedly not as excited about the deal as they were in April

An investment entity that agreed to put money into Elon Musk's takeover of Twitter said it no longer wants to be part of the deal as many investors reportedly believe the social media platform's buyout value of $44 billion is too high.

"We talked to the other investors, everyone's trying to get out of it, no one thinks the company should be valued at $44 billion," general partner at Manhattan Venture Partners (MVP) Andrea Walne said, as per a Business Insider report published Wednesday. "We're all trying to get out of it, to be honest."

One of the investors that agreed to back Elon Musk's Twitter bid says they want out of the deal https://t.co/rVxtwotjwz

— Business Insider (@BusinessInsider) October 12, 2022

MVP was among the venture capital organizations that agreed to invest in Musk's Twitter buyout earlier this year, but it appears they are now doubting the benefits of supporting the deal.

According to Wedbush analyst Dan Ives, one of the pressing issues investors are nervous about is the Tesla CEO's allegations against the social media platform he was initially invested in buying, Fortune Magazine reported.

More than a dozen investment groups committed to supporting Musk's Twitter buyout earlier this year, including AH Capital Management LLC, which pledged $400 million, and Fidelity Management & Research Company LLC, which pledged more than $300 million, as reported by the Wall Street Journal.

Other bankers have also expressed concerns about the willingness of backers to support Musk's Twitter deal during a time when inflation is high, the economy is in jitters and money is tighter than ever.

"I'm sure the banks aren't as hot to do this in October at these terms as they were in April at these terms," mergers and acquisitions partner at law firm Barnes & Thornburg, Michael Maimone, told The New York Times.

Banks that back the Twitter-Musk deal have had other problems to deal with and the Twitter fiasco is "an even bigger headache" for them, said Chris Pultz, portfolio manager for merger arbitrage at Kellner Capital.

Tesla CEO Elon Musk has reportedly proposed again to buy Twitter at $54.20 a share, the same price he originally proposed in April this year before terminating the $44 billion takeover deal. https://t.co/XXBzkqrbQU

— IBTimes 🇮🇳 (@ibtimes_india) October 5, 2022

Musk initially announced his desire to purchase Twitter in April, but in July, he declared that he no longer wanted the company, citing alleged misleading information from the social media platform regarding the exact number of bot accounts on the site. Earlier this month, he backtracked on his July declaration and said he wanted to buy Twitter again.

Musk and Twitter engaged in a legal battle that could result in a November trial if the SpaceX founder fails to seal the deal soon.

It is unclear how many investors are still willing to chip in for Musk's Twitter takeover. Some experts have sounded off alarms about the deal as being non-beneficial to both the tech billionaire and society.

"Twitter is a distraction that could keep [Musk] from what's really important," senior fellow at Harvard Business School, Bill George said, adding that the takeover "could do society more harm than good."

© Copyright IBTimes 2025. All rights reserved.