Adobe introduces a groundbreaking AI Assistant in its Reader and Acrobat applications, reshaping how users interact with PDFs and documents.

OpenAI CEO Sam Altman seeks trillions in investments to revolutionize the semiconductor industry, responding to the Google's recent AI rebranding.

Nvidia's GeForce RTX 40-Series Super graphics cards are set for a phased launch. GeForce RTX 4070 will release on Jan. 17; RTX 4070 Ti Super on Jan. 24, and the flagship RTX 4080 Super will arrive on Jan. 31.

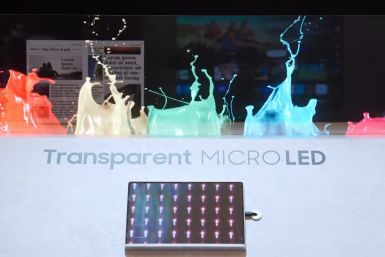

Considering Samsung's current pricing for its non-transparent MicroLED TVs, which stands at $150,000 for a 110-inch model, it may be some time before these transparent displays become widely accessible.

The penalties of $4.3 billion are one of the largest ever applied to a corporation in the U.S.

The employees are also demanding the resignation of the entire board of OpenAI.

The partnership with Hyundai includes the use of Amazon cloud services and adding Alexa to cars of the brand.

PayPal said its stablecoin, PYUSD, is just the "next evolution" toward its goal of continuously providing customers with "trust, confidence and ease."

Musk has over the years swayed prices of numerous crypto assets, especially DOGE with just his online posts. The tech billionaire can easily create his own cryptocurrency, but it appears that he is reluctant to officially launch one, and he hasn't explained why.

MicroStrategy is seemingly maintaining its bullish accumulation of Bitcoin showing no sign of slowing down as the fourth Bitcoin halving approaches and spot Bitcoin exchange-traded fund (ETF) approval by the U.S. Securities and Exchange Commission (SEC) appears imminent.

Budorin, who is a cybersecurity expert and currently leads a team of over 120Hacken talents, said that even though Shiba Inu and Pepe have proven it was possible to earn big money in crypto, the get-rich-quick mindset of some investors as well as their fear of missing out often allowed them to overlook the red flags in a crypto project.

The wallet also eliminates the necessity of retaining and recalling the complex 12-word seed phrase, significantly simplifying the process of creating a wallet, even for individuals unfamiliar with web3.

Meta's chief technology officer is quick to push back on assertions that the company has fallen behind rivals like ChatGPT in the explosive surge across the tech industry in generative AI.

"The majority of the world's population will have their first experience of generative artificial intelligence with us," Andrew "Boz" Bosworth told AFP at the company's recent Connect conference for developers.

Aside from support for the crypto wallet and its possible integration in the gaming console, no other details have been revealed.

The business world continues to evolve with new ideas, markets, industries and technologies.

"Game of Thrones" author George RR Martin and other best-selling fiction writers have filed a class-action lawsuit against OpenAI, accusing the tech startup of violating their copyrights to fuel its generative AI chatbot ChatGPT.

The Authors Guild, an organization representing writers, and several novelists including Martin, John Grisham and Jodi Picoult, accused the California-based company of using their books "without permission" to train ChatGPT's "large language models," algorithms capable of producing human-sounding text responses based on simple queries, according to the lawsuit.

Workers in Singapore are quickly adapting to the modern workplace concept as they have been upskilling themselves with AI-related skills, a new report has found.

Product innovation is the engine that propels industries forward.

Users on the social media platform X, formerly known as Twitter, will now be allowed to hide their once-prized blue check marks, the company says.

The software maker said the $347 million worth of Bitcoin acquired last quarter, purchased at an average price of $28,136 per coin, only represents the latest addition to the company's BTC holdings and not the total amount of the crypto asset it purchased.

This latest collection is the fourth installment of Reddit's popular Collectible Avatar series and is considered the biggest addition to its limited-edition NFT collection to date.

Web3 is the next evolution of the internet. Built on next-generation technologies like blockchain

Apparently, Bitcoin's presence in the source code was not a recent addition but was just retained even after Tesla suspended accepting BTC as a form of payment.

Two of the world's largest technology companies teamed up to build the foundation of an artificial intelligence language software that could rival industry leading ChatGPT.

Can Nvidia surpass ChatGPT? The company is developing a new supercomputer that promises to take artificial intelligence to the next level.

Federal investigators are looking into allegations that the Kraken co-founder interfered with computer accounts of the Verge Center for the Arts, and obstructed access to emails as well as other messages, according to a report.

China's Shanghai AI conference kicks off Thursday, but where are the U.S. companies that previously sponsored the event? Some are attending, but only as delegates.

Global Triangles, a leading IT staff augmentation service provider...

In an open letter, Cameron Winklevoss gave DCG CEO Barry Silbert an ultimatum to either accept the offer or get sued.

The lawyer's prediction is a little early compared to the forecast made by another pro-Ripple lawyer and crypto law founder John Deaton, who previously predicted, using data, that Judge Torres' judgment could come out on Sept. 6.