Nord Gold May Pay First Dividend This Year - Report

(REUTERS) -- Newly listed Russian gold miner Nord Gold may pay its first dividend this year after net profit rose 89 percent in 2011, driven by higher demand for the precious metal.

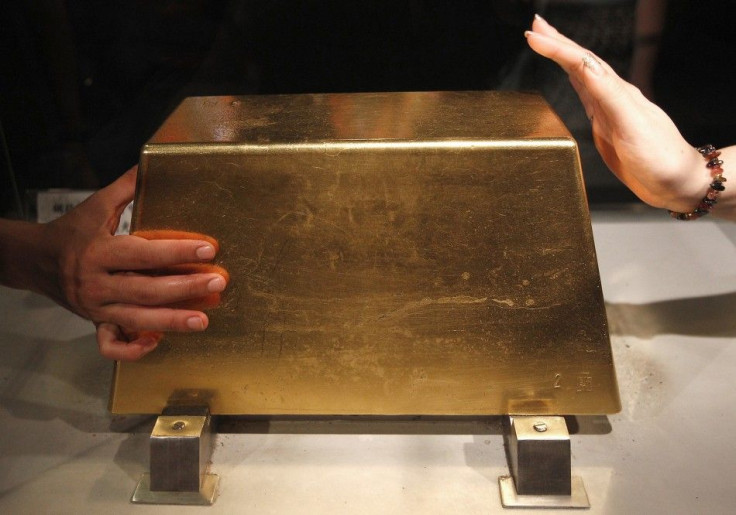

Gold has seen its price surge in recent years as global economic turmoil sent investors buying the metal, seen as a traditional safe haven. Nord Gold is Russia's third-largest gold producer and also has operations in Kazakhstan and West Africa.

We anticipate declaring a maiden dividend at the time of the interim results, Nikolai Zelenski, CEO of Nord Gold, said in a statement on Friday. Nord Gold targets an annual dividend pay-out of 25 percent of its net income.

The company said net income rose to $252 million in 2011 from $133 million in 2010. Its earnings before interest, tax, depreciation and amortisation (EBITDA) rose 55 percent to $574 million.

Revenue rose 57 percent to $1.18 billion in 2011, while production was up 28 percent, Nord Gold said in January.

Russian steelmaker Severstal, which is about 82 percent controlled by billionaire Alexei Mordashov, listed the London shares of its Nord Gold unit in London following a share swap.

Nord Gold may place a further stake in the company in the future to make its shares more accessible to investors.

Looking ahead, it remains the board's intention to seek to increase the free float significantly in the near to medium term, the company said in a statement on Friday.

In 2012 it expects production of 800,000-850,000 gold equivalent ounces. The company is also aiming to increase output to 1 million gold equivalent ounces in 2013 from 754,000 ounces in 2011.

Nord Gold plans capital expenditures of $470 million in 2012 and has net debt of roughly $200 million.

© Copyright Thomson Reuters {{Year}}. All rights reserved.