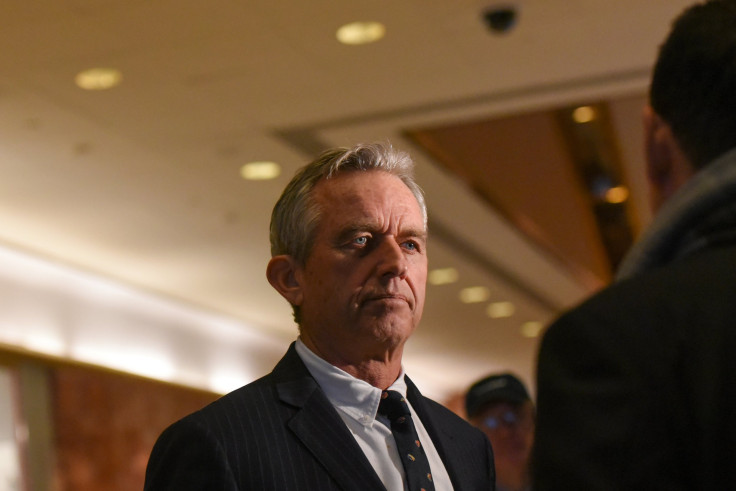

Robert F Kennedy Jr. Slams CBDC, Claims It Will Lead To Banning, Seizing Of Bitcoin

Robert F. Kennedy Jr. continues to ratchet up his concerns about central bank digital currency (CBDC), noting that in the long term, it would just lead to the government seizing and banning cryptocurrencies, particularly Bitcoin (BTC).

The government's plans for the creation of a CBDC greases "the slippery slope to financial slavery and political tyranny," the scion of one of the most famous American political families said in a tweet Wednesday after filing paperwork with the Federal Election Commission to run for president in 2024 as a Democrat.

The absence of anonymity in CBDCs could put the people in grave danger and enable the government to extend its reach, in terms of authority and intrusion into the lives of its citizens, he wrote.

The Fed just announced it will introduce its “FedNow” Central Bank Digital Currency (CBDC) in July. CBDCs grease the slippery slope to financial slavery and political tyranny.

— Robert F. Kennedy Jr (@RobertKennedyJr) April 5, 2023

While cash transactions are anonymous, a #CBDC will allow the government to surveil all our private…

"While cash transactions are anonymous, a CBDC will allow the government to surveil all our private financial affairs. The central bank will have the power to enforce dollar limits on our transactions restricting where you can send money, where you can spend it, and when money expires," Kennedy said in a lengthy tweet.

"A CBDC tied to digital ID and social credit score will allow the government to freeze your assets or limit your spending to approved vendors if you fail to comply with arbitrary diktats, i.e. vaccine mandates," Kennedy, who is an anti-vaccine activist, added.

Just like what the government did with gold in the 1930s, Kennedy believes a CBDC would pave the path for the state to start banning and seizing Bitcoin.

"The Fed will initially limit its CBDC to interbank transactions but we should not be blind to the obvious danger that this is the first step in banning and seizing bitcoin as the Treasury did with gold 90 years ago today in 1933," he said, adding, "Watch as governments, which never let a good crisis go to waste, use Covid-19 and the banking crisis to usher in a new wave of CBDCs as a safe haven from germ-laden paper currencies or as protection against bank runs."

Kennedy Jr.'s latest statement came after reports said the Federal Reserve plans to launch FedNow in July of this year.

FedNow, according to its executive sponsor Richmond Fed President Tom Barkin, will help create "a leading-edge payments system that is resilient, adaptive, and accessible."

Program executive and Boston Fed first vice president Ken Montgomery said, "With the launch drawing near, we urge financial institutions and their industry partners to move full steam ahead with preparations to join the FedNow Service."

© Copyright IBTimes 2025. All rights reserved.