SHIB's Soft Underbelly: Wallet Analysis Reveals Disturbing Fact About Whales

KEY POINTS

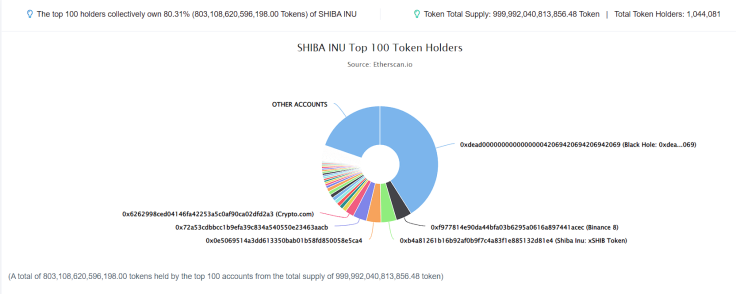

- Top 100 wallets own 80% SHIB supply

- One wallet owns more than 40% tokens

- Technical analysis reveals a bearish overhang on the coin

Shiba Inu, the self-proclaimed "Dogecoin Killer," is probably the most famous of all meme coins. Not least because of how cheap it is and how investors have made huge profits from it.

SHIB is the subject of discussion in numerous social media groups and a quick look in those boards seems to show that its loyal followers seem to make their investment decisions based on social media discussions than anything else. That has given the impression that the SHIB token sways to the community's tune. But a look at the wallet holdings indicates that however vocal the SHIB fans are, the real power to move the needle on the token's price lies with the whales — and inordinately so.

But first let's look at SHIB's price. The token has performed extremely well this year, rising nearly 830% in October alone. The all-time high for the token, $0.00008845, was touched on Oct. 28. True to the high volatility that comes with most cryptos, SHIB is currently 57.40% below its ATH.

Data from CoinMarketCap shows that as of 1:15 a.m. ET, the Shiba Inu token rose by 7.63% in the previous 24 hours to $0.00003769; its market cap rose 7.27% to $20.6 billion, ranking it at the number 13 slot among cryptocurrencies.

Whale wallet analysis shows disturbing data

A wallet analysis of Shiba Inu shows that nearly 80% of the total circulating supply of the coin is held by just 100 wallets. A deeper analysis shows that a single wallet owns nearly 41.025% of the supply, and the top 6 wallets together own more than 60% of the total supply.

It doesn't end there. Data from WhaleStats shows that among the top 1,000 Ethereum wallets, the top position in terms of dollar value is held by Shiba Inu.

Of course, there are other tokens where ownership is concentrated in a few wallets, like say Polygon. But in SHIB's case concentration of tokens in a few wallets would indicate is that ownership is not as much decentralized as the social media chatter would make us believe. And that comes with its own problems — theoretically the whales can manipulate the price of the coin easily — in this case very easily.

Jordan Belfort, a popular speaker and the real Wolf of Wall Street, had come out against meme coins, saying that they have no real value and their creators should be jailed. But the lead developer of the SHIB project recently announced that they are building a Shiboshi game and investigating metaverse opportunities. These increasing use cases and the coin burn associated with them are expected to ratchet up SHIB's price and transform it into something more than a meme coin.

Already 41% of the total supply of $SHIB has been burned so far, including via various initiatives by the community.

But that again will play into the hands of the whales who are holding the bulk of the supply. It is quite possible one of the whales can unload their supply to depress the prices. True, this is a problem with many cryptocurrencies, but with SHIB the magnitude of the problem takes a different proportion because of the highly concentrated holdings.

SHIB represents fast gains and, as a result, is a favorite of investors who are looking for massive short-term gains. However, the token hasn't performed very well in the past few weeks. Data from CoinGecko shows that the token is down 15% in the last seven days but is up 59,985,878.4% in the last year.

The whales' interest in SHIB has only increased. As per a recent tweet from WhaleStats, a popular Shiba Inu whale bought 28,236,296,316 SHIBA worth nearly $1,063,096 as per current price.

🐋 ETH whale "Gimli" just bought 28,236,296,316 $shib ($1,169,829 USD).

— WhaleStats - BabyWhale ($BBW) (@WhaleStats) December 3, 2021

Ranked #246 on WhaleStats: https://t.co/3bvrsUeq69

Transaction: https://t.co/R9JSWb4Zu7#shib #SHIB #ShibArmy

Another whale bought $2,613,140.28 worth of Shiba Inu, as revealed in a tweet by a Shiba Inu news account on Twitter.

JUST IN: An #Ethereum whale purchased $2,613,140.28 worth of #SHIB today. 🐳

— Shiba Inu News (@ShibReports) December 4, 2021

Shiba Inu price analysis

The SHIB price chart above shows that the 100-day Moving Average continues below the price action while the 50-day Moving Average continues above the price action. This indicates a short-term bearish movement. However, after the failed attempt to break out from the lower end of the Bollinger Bands, the SHIB/USDT trading pair is trying to move upward to reclaim the 50-day Moving Average, which is an important zone for the price action.

The RSI levels haven't entered the oversold region in the daily chart and are progressing with a positive gradient. But the gradient isn't sharp due to low volumes, leading to sluggish growth that might not last for long. The MACD indicator also provides a bearish outlook for the price action after a failed attempt for a bullish divergence due to a lack of volume.

The MACD line (blue) continues below the signal line (orange), indicating that lower prices for the SHIB token are certainly a possibility. The MACD histogram is also bearish, full of red bars.

International Business Times holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Parth Dubey holds Bitcoin (BTC), Ethereum (ETH), Solana (SOL), Cardano (ADA) and Polygon (MATIC).

© Copyright IBTimes 2024. All rights reserved.