Tech Layoffs: Affirm Cuts 19% Of Staff, Shuts Down Crypto Department

KEY POINTS

- Max Levchin said slashing the workforce was the 'single most difficult' decision he made

- The Affirm CEO admitted he 'acted too slowly' when macroeconomic issues rose

- Affirm missed analyst expectations in its Q2 fiscal year earnings report

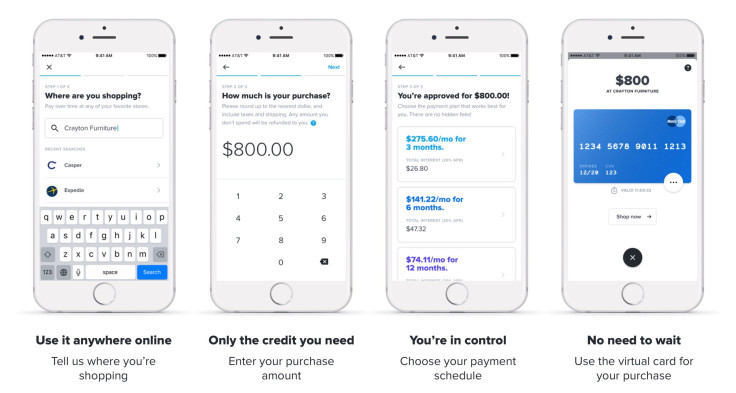

Fintech company Affirm announced Wednesday that it will cut its workforce by 19% or as many as 500 employees, citing decreased consumer spending in 2022. The San Francisco-based buy now, pay later (BNPL) provider also said it will shut down its cryptocurrency department.

Wednesday's layoff announcement was "the single most difficult" decision that the company made, founder and CEO Max Levchin said in a letter to shareholders.

The company reported that it had 2,522 employees in June 2022, which means the layoffs could affect about 485 workers, CNBC reported. Other outlets reported that the layoffs might affect up to 500 employees.

"I am deeply sorry to be taking this step; the responsibility for it and for the decisions leading up to it is entirely mine," Levchin said in a message to employees that he shared with the public.

Explaining the decision, Levchin said that Affirm, during the pandemic, "consciously hired ahead of the revenue required to support the size of the team," and while the revenue growth "gave us confidence" in the hiring strategy, "everything changed in mid-2022," when consumer spending was dampened.

“The root cause of where we are today is that I acted too slowly as these macroeconomic changes unfolded,” Chief Executive Max Levchin told employees in a note about the layoffs that was also shared to Affirm’s AFRM, -6.91% corporate site. pic.twitter.com/M4dwy3mrSY

— Stock Sharks (@stocksharks_) February 9, 2023

Levchin admitted that he "acted too slowly as these macroeconomic changes unfolded," adding that this time, the company now has to act to reduce operating costs.

Affirm shares slumped Wednesday, closing down nearly 7% and falling further by another 17.1% in after-hours trading, TechCrunch reported.

As part of the efforts to further reduce operating costs, the company will also shut down its cryptocurrency unit, Affirm Crypto, which was started in 2021.

News of Affirm's layoffs came several months after the U.S. Consumer Financial Protection Bureau (CFPB) indicated that BNPL firms such as Affirm and Klarna must be subjected to stricter regulatory oversight.

Agency officials at the time said the CFPB looks to oversee vendors in the BNPL industry and implement "supervisory" exams that complement requirements for credit card companies.

Author and editor James Ledbetter wrote in a New York Times column that the BNPL industry "is the victim of its own success," adding that aside from stronger competition from emerging rivals, regulators are also starting to raise concerns about how companies are handling disputes and customer privacy issues.

Ledbetter also noted that Jason Kupferberg, managing director at Bank of America's U.S. equity research, downgraded his Affirm stock rating to "hold" in December as the percentage of Affirm loans at zero interest decreased.

Also on Wednesday, Affirm reported its second fiscal quarter results wherein the company missed analyst expectations of $416 million in quarterly revenue when it posted only $400 million in revenue.

The company also reported Q2 operating income losses of $360 million, a gross merchandising volume (GMV) hike of 27% and a 39% increase in active consumers.

© Copyright IBTimes 2024. All rights reserved.