Why Isn't The Dow Setting More Records?

The stock market has defied every naysayer over the past 10 years, with a powerful bull market that has helped disciplined long-term investors fully recover from the carnage of the financial crisis in 2008 and 2009. The Dow Jones Industrial Average (DJINDICES:^DJI) has quadrupled from its 2009 lows, and more recently, the benchmark has rebounded from a tough period at the end of 2018 to rise 17% year to date.

Yet if you haven't noticed the Dow getting a whole lot of positive press recently, you're not alone. One big reason is that even though the broader stock market has done extremely well in 2019, the Dow hasn't found itself at all-time highs all that much this year. For instance, the S&P 500 Index's (SNPINDEX:^GSPC) record close on July 26 wasn't a record for the Dow, which remained more than 160 points below its most recent high.

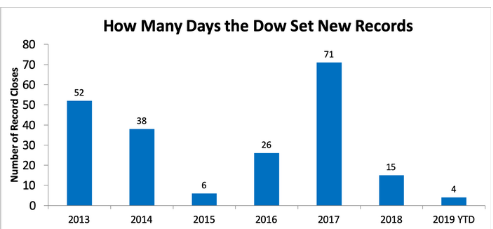

As you can see below, the four record closes for the Dow this year stand in stark contrast to how many record closes the Dow has seen during other strong years. The performance in 2017 was most noteworthy in this respect, with the Dow's 25% rise during the year coming at a measured pace that was quite steady in its uptrend. There was some volatility in 2017, but the list of nearly six dozen record closes included many days in which the Dow made only small moves higher into record territory.

There are a couple of factors at play that have hurt the Dow's record-making performance in 2019. First, the Dow had a big drop during the last part of 2018, falling more than 3,000 points in the final three months of the year. That forced the average to post a double-digit percentage gain before it could even get back to its previous high-water mark. Second, several highly weighted stocks in the Dow have had subpar returns compared to the broader market, with industrial and healthcare stocks suffering from nervousness about potential future regulation and global macroeconomic issues.

Record highs aren't important in themselves, but they provide a psychological boost to investor sentiment. The gains so far this year are surprising in part because there have been so few record closes to get the attention of those who don't follow the investing world day in and day out.

This article originally appeared in the Motley Fool.

Dan Caplinger has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.