Apple Inc. Tries To Fix Apple Music By Making It More Like Spotify

At Apple's Worldwide Developers Conference on Monday, Apple executives offered the kind of tacit admission you rarely hear from Cupertino: We got Apple Music wrong.

While Senior Vice President Eddy Cue began his presentation by announcing the app had amassed 15 million subscribers in less than a year, he conceded that Apple Music required a substantial overhaul to differentiate it from its competitors.

“We want to give greater clarity and simplicity to every aspect,” Cue said. “The new structure makes it clear where you are.”

And yet Cue walked through a number of features that didn't so much build on Apple Music's distinctive features as make the service more like its competitors. It debuted a discovery feature similar to Spotify’s, designed to surface artists and songs that its subscribers might like, including daily playlists and specific songs and releases tailored to each user. It also debuted a mobile design that felt similar to Spotify's or Rhapsody's.

The presentation showed that Apple has also essentially hidden away Connect, a feature designed to look like a social media feed of content made by artists. When Apple Music was unveiled at WWDC last year, Connect was one of its core features. Other standout features, including Beats 1, got no updates at all.

Apple's moves are not solely about optimizing the streaming music experience for its customers. It's about trying to defend turf that it has been losing for years, first as digital music downloads became more commonplace and then as streaming began to take off. At one time, Apple was synonymous with digital music consumption, controlling as much as 90 percent of the market. Today, it controls around half that, and it may be starting to cede what had been a dominant role.

“Apple is the one that has the most to lose from the success of the streaming model,” Amy Yong, an analyst at Macquarie Capital, wrote in a report on the global streaming music market published last week. “Overall, we expect Apple share of the total market, including download and streaming, to decline, mostly in favor of Spotify and local players like MelOn and KKBOX in Asia.”

When Apple Music launched last year, there were a number of industry observers who expected that its arrival would totally revolutionize the nascent streaming music space. Rumors abounded that Apple's service would cost less than the competition, or cannibalize the company's billion-dollar downloads business.

From the record industry's perspective, Apple Music did raise the bar for how streaming services are expected to work with top artists. Beats 1, Apple Music’s radio station, gave artists ranging from Drake to St. Vincent their own shows, and with them an unprecedented platform to reach new fans; Bozoma St. John, Apple's head of global consumer marketing, said Monday that Beats 1 is on its way to becoming the largest radio station in the world.

The company also paid for content like a Taylor Swift concert film, music videos for Drake and an original digital video series executive-produced by Dr. Dre, moves that spurred competitors to step up their own artist marketing efforts. Earlier this month, Spotify hired Troy Carter, the highly influential artist manager and investor, to serve as the global head of creator services, a newly created role designed to amplify the rollout of artists’ releases.

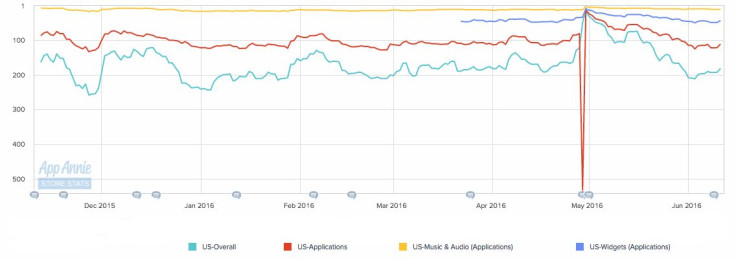

But Apple Music was also dogged by negative reviews, with columnist Walt Mossberg calling it "confusing," and it failed to register with streaming subscribers outside of Apple's device ecosystem. Aside from one brief surge this spring, when Drake's highly anticipated "Views" debuted as an Apple Music exclusive, the app has been an afterthought in Google Play, according to App Annie data.

While it could take years for a clear winner to emerge in the streaming music market, it's clear that Apple has revised its plans for how it plans to compete in it.

© Copyright IBTimes 2025. All rights reserved.