Apple iOS 9 Ad Blockers Pose Big Threat To Google, Facebook And Twitter

Apple’s decision to allow ad-blocking software on its Safari mobile browser for the first time has sent shockwaves of fear throughout the online publishing world. But some of the biggest tech companies in Silicon Valley are also facing the loss of crucial ad revenue, and Google Inc. stands to lose more than most.

It turns out, the Mountain View, California, search giant is more at risk from mobile ad blockers than some of its biggest rivals, specifically Facebook Inc. and Twitter Inc., according to new research from MoffettNathanson. Mobile ad blockers could put almost a third of Google’s revenue at risk, compared with 29 percent of Facebook’s revenue and only 14 percent of Twitter’s revenue, senior analyst Michael Nathanson wrote in a research note Friday.

All three companies derive the vast majority of their revenue from advertising. For Google, Nathanson wrote, an estimated 46 percent of its ad revenue comes from searches on desktops, but that is shifting fast to mobile, where it will be vulnerable. Ditto for the portion of its mobile ad revenue coming from its own Chrome app -- about 80 percent, based on second-quarter comScore data. That leaves 32 percent of its ad revenue at risk.

Facebook, meanwhile, fared slightly better as 92 percent of its mobile add revenue comes through apps that would not be affected by ad blockers. Similarly, Twitter gets 94 percent of its mobile revenue from unaffected apps.

Cache Of The Titans

The new research comes amid increasing competition for ad dollars between the tech sector’s largest companies. It’s probably no coincidence that Apple allowed ad blockers on Safari for the iOS 9 mobile software update, which also included Apple News, a news-discovery platform on which Apple is sharing ad revenue with publishers. As International Business Times reported last week, Condé Nast’s Wired magazine is already experimenting with a windowed publishing strategy that offers content exclusively to Apple before making it available online for non-Apple users.

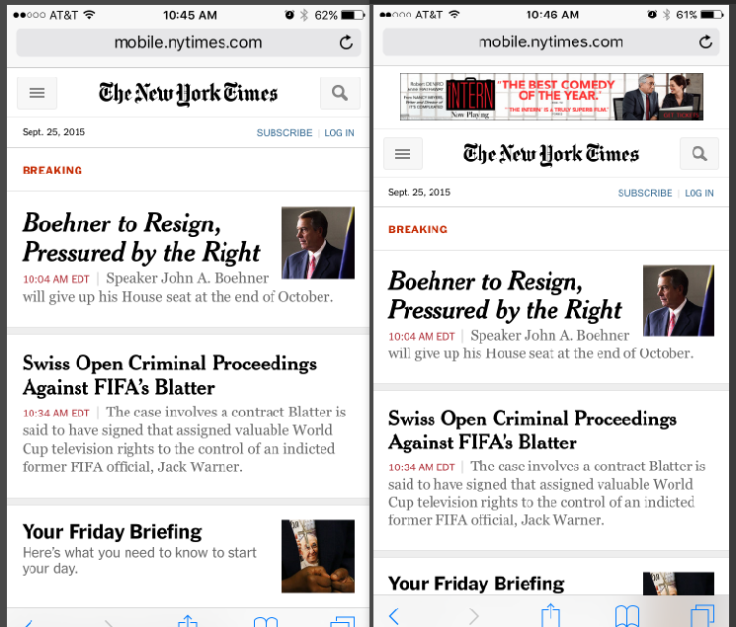

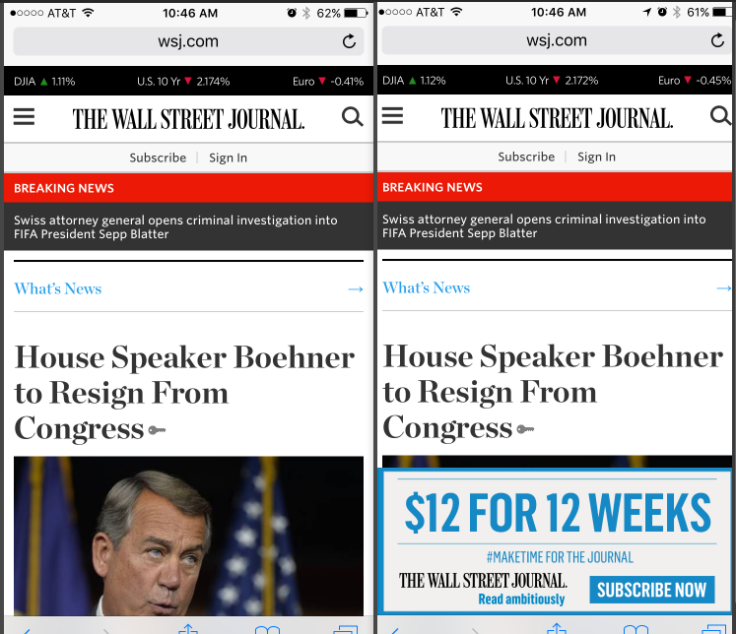

For its research, MoffettNathanson downloaded Crystal, one of the most popular Safari ad blockers, to test out how major websites like BuzzFeed and CNN differed with and without the apps. Nathanson said the firm was “surprised by how well Crystal worked at blocking ads and improving the speed of Safari.”

Native Ads Appear To Be Safe

At the same time, much of the tech companies’ ad revenue is likely to be unaffected by the rollout of mobile ad blockers, in particular revenue from native ads and sponsored content, which appear to escape the clutches of such apps for the time being. “To the extent that ad blockers remain largely ineffective in the native apps for Google, Facebook, and Twitter, these ad placements will be largely insulated,” Nathanson wrote.

There is one segment of the tech industry that is booming with the rise of ad blockers: companies that make them. As the Wall Street Journal reported Thursday, the U.K.-based software company that developed Crystal generated upward of $75,000 in just one week following the launch of the application.

Christopher Zara covers media and culture. News tips? Email me. Follow me on Twitter @christopherzara.

© Copyright IBTimes 2025. All rights reserved.