Could NFTs Be The Future Of Financing?

GoFundMe jumped the shark when it blocked donations to Canadian truckers. In an astonishing display of tyrannical arrogance, the centralized crowdfunding platform even at one point announced it would be using collected funds and sending them to their own charities. While GoFundMe is currently under investigation by four U.S. states, the lesson has been mainstreamed.

If a centralized funding platform can become unreliable, it most likely will be. Thankfully, blockchain technology makes GoFundMe relics of the past, if one takes advantage of it. Here is how the cogs of decentralized funding work.

NFTs + DAOs = Web3 Financial Autonomy

To understand where the current decentralized finance (DeFi) is heading, it is useful to remind ourselves what Bitcoin actually is. Most people know it as the largest cryptocurrency that at one point reached a $1 trillion market cap, mainstreaming the very concept of digital assets. However, at its core, the Bitcoin network is a DAO — Decentralized Autonomous Organization.

Without getting into the weeds of blockchain technology, the Bitcoin network allows collective ownership through smart contracts. Bitcoin's smart contracts are laser-focused on one aspect only — providing deflationary cryptocurrency as a counter to inflationary central banking. This is why they are rarely talked about as such.

What we understand as DAOs now is just a more customizable and flexible form of smart contracts. Ethereum expanded this flexibility drastically in the last two years, as a generalist smart contract platform, compared to Bitcoin's specialized one. We only have to look at Ethereum's total value locked (TVL) in its smart contracts to see this.

On the back of this expansion came non-fungible tokens (NFTs), growing to a $44 billion market last year. Although speculative, NFTs have proven themselves as a more attractive form of investment for newcomers. After all, much of the human brain relies on visual stimuli, so a tokenized digital artwork provides a more enticing on-ramp to owning digital assets.

In turn, NFTs are gaining more ground as funding vehicles for a host of projects. Keep in mind, everything that is legally conceivable is also tokenizable to become NFTs, not just pixelated CryptoPunks or wacky Bored Apes. Combined with DAOs, NFTs are creating the foundation for Web3, a new kind of internet in which the community holds ownership cards.

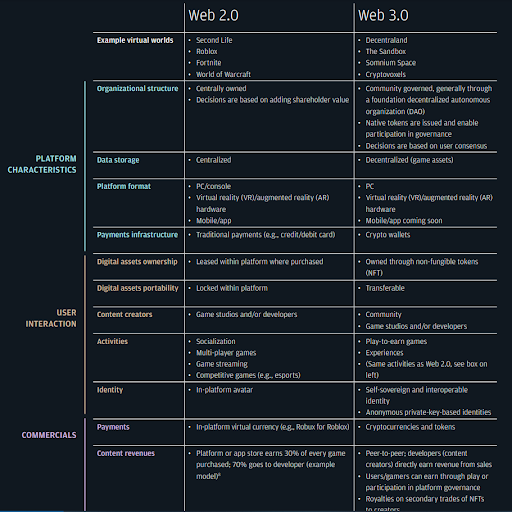

JPMorgan, the world's largest bank, recently created a useful Web 2.0 vs. Web 3.0 comparison, in its Opportunities in the metaverse report.

To best understand how NFTs are used in practice, let's take a look at some of the projects they fund.

Physical real estate

We all know that virtual land NFTs are selling like hotcakes, as shown by the likes of The Sandbox (SAND) or Decentraland (MANA). Case in point, during The Sandbox Summer Jam Land Sale, one of the NFT land parcels sold for 3.6 million SAND, which now translates to $10.5 million. Even Axie Infinity, as the top NFT blockchain game with over $4 billion total sales, had its record-breaking Genesis NFT land sales.

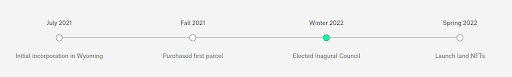

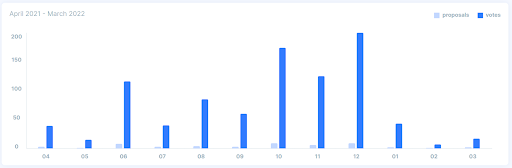

However, what is more interesting to see is the other way around, tokenizing real estate with NFTs. This is the goal of the Wyoming-based CityDAO. Through DAO's collective ownership, CityDAO serves as an online treasury to buy land and manage its development. Effectively, the end goal is to build “blockchain cities IRL.”

Although CityDAO made headlines for a fake land NFT drop, after one of the Discord moderator accounts was compromised, it is pioneering a trend. Because smart contracts allow for complete transparency on blockchain, they also boost confidence in how an organization is governed.

When legit land NFTs become available in Spring 2022, owners will be able to either individually or collectively own real estate, as NFTs. If the latter is the case, they can use CityDAO to vote on how that land is developed. After all, DAOs are effectively internet-native hedge funds, with the extra bonus of being transparent and decentralized.

Meaning, any major policy change has to be run through a smart contract vote. We can only conjecture as to its impact on traditional organizations like the massive Homeowners Association (HOA). With the benefits of DAOs and land NFTs employed, they are likely to be completely outdated in the coming years.

Collateralized loans with NFTs

Cryptocurrencies are still rather volatile, especially those with smaller market caps, under $10 billion. This is why over-collateralization is so common in DeFi's top lending protocols, such as Aave, Curve, or Compound. However, NFTs are illiquid assets that offer a different collateralization dynamic.

PleasrDAO investors are aware of this, so they used their treasury to put up four blue-chip NFTs to get a $3.5 million loan. Consisting of 75 members, PleasrDAO's treasury presently manages $79.1 million AuM (assets under management).

This makes PleasrDAO enter the market that was previously only reserved for the likes of Bank of America, which uses high-end art for a 50% of its collateral value. Furthermore, the $3.5 million loan is a DAO to DAO loan, facilitated with Iron Bank, a lending DAO launched by C.R.E.A.M Finance in January 2021.

Given how NFT sales on the secondary market are still profitable for the majority of traders, at 65%, we will likely see more NFTs used as collateral for large loans. Case in point, an anonymous borrower recently took out an $8 million loan collateralized by his/their collection of 101 CryptoPunks.

NFTs As Hollywood disruptors – BlockbusterDAO

Still in the take-off stage, BlockbusterDAO made the public spotlight as a tokenized revival of the iconic Blockbuster video-rental chain that went bankrupt in 2014. BlockbusterDAO launched with the goal to gather enough funds, as NFTs worth 0.13 ETH ($344), to buy Blockbuster brand (IP) from the current owner, Dish Network.

Although they set a $5million raising goal for that purpose, they also set a 20-year roadmap. The latter is far more interesting, as BlockbusterDAO aims to completely upturn how movies are made and distributed.

We are excited to announce the final results of our DAO brand sprint! ✨

— R3WIND (@R3WINDxyz) March 4, 2022

With 800+ participants, we have defined a 20-year roadmap and established the core personality & values of our org. This document is a testament to the future of Film & Web3.https://t.co/6o8heutmPn

As most people know, the movies we see are only those that pass through the centralized filter of a few Hollywood executives. With the memorable Blockbuster brand in hand, DAO's treasury would finance movies, TV shows, and even online streaming. The end goal is to become an Oscar-worthy platform with a $1 billion annual revenue.

This may sound too lofty, but all the technical requirements are there. Even streaming can be decentralized with LivePeer or a similar blockchain network. BlockbusterDAO could easily vote on adding such a service for on-demand video streaming, without relying on any centralized gateway for movie distribution like Amazon AWS.

More Hollywood-disrupting DAOs

Who says that one needs to acquire an old brand first before disrupting Hollywood? Certainly, not NextHollywoodDAO. One of the top contributors to this DAO, established film and TV producer David H. Steinberg, thinks that such a disruption is long overdue.

By his account, Hollywood has a massive problem in that it constantly merges smaller studios, draining the creative spark from them. One only has to look at the current landscape of movie financing.

To the best of their ability, the Hollywood studio and label systems are set up to monopolize financing, production and distribution. There are only a handful of companies that talent can approach to fund a major project pic.twitter.com/svM9ncbsB1

— NextHollywood (@nexthollywood_) January 18, 2022

As a response to this centralization, NextHollywoodDAO was formed as a treasury for movie making. While a strong case can be made that even DAOs need a filter to weed out projects, Mogul Productions presents itself as the only true decentralized movie financing.

Initially launched as another DeFi lending platform, Mogul is expanding into NFT-based funding of movie projects, after they have been voted on. Its native token STARS would be used for that purpose.

Mogul is the only #crypto project offering decentralized film financing and film-related NFTs not offered anywhere else. 💪

— Mogul Productions (@mogulofficial_) December 14, 2021

This gives $STARS users the ability to have their say in #Hollywood or collect a piece of it. 🎬 pic.twitter.com/Hih3YggnuN

NFT/DAO-based funding here to stay

In conclusion, DAOs and NFTs have long passed the phase when people called them bubbles or fads. DeFi protocols have proven their worth already by providing interest rates that traditional banking savings accounts can only dream of.

DAOs and NFTs are just an evolution of that trend, giving us an insight into the emerging Web3 landscape. In the coming years, one's crypto wallet is poised to become one's private virtual bank, pluggable into a rich ecosystem of smart-contract DApps. During this process, traditional corporations are likely to lose their appeal.

With that said, it will be interesting to see how federal agencies view online hedge funds. Will they be required to register as companies for dealing with unregistered securities? BlockFi's $100 million fine by the SEC certainly points in that direction. However, borderless DeFi protocols that expand into NFTs will be far more difficult to track and crack.

Rahul owns no cryptocurrencies.

International Business Times holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

© Copyright IBTimes 2025. All rights reserved.