FICO Reports First Decline In Decade: Average Credit Score Drops To 717

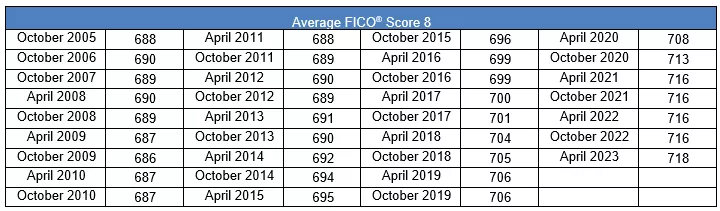

FICO, a prominent provider of credit scoring systems utilized by lenders, has reported a minor decline in the national average credit score. After experiencing a constant rise over the last decade, the average score plummeted from its peak of 718 in early 2023 to 717. This recent drop in the average consumer credit score in the U.S., marks a significant departure from the decade-long trend of steady increases.

Ethan Dornhelm, Vice President of Scores and Predictive Analytics at FICO, calls this shift as a "yellow light," cautioning against complacency in the face of potential economic challenges. He states, "It's a notable milestone that we've seen the average score decrease. This isn't a blinking red light, but it certainly is a yellow light."

Analysts note that the health of the American consumer has been difficult to gauge, with contradicting signals at times confounding economists and challenging recession predictions. Data from FICO's Senior Director of Scores and Predictive Analytics, Can Arkali, highlights worsening consumer credit metrics between April and October last year, including a rise in the 30-day-or-more delinquency rate and an increase in average credit card utilization.

Furthermore, the decline in average credit scores concurs with high interest rates and increased consumer indebtedness. As of October, the average credit card utilization stood at 35%, up from 33% the previous year, while the percentage of borrowers with a more than 30-day past-due missed payment increased to just over 18%.

"The recent decrease in the average consumer credit score underscores some emerging consumer weaknesses, particularly as interest rates remain elevated amid persistent inflationary pressures," explains Dornhelm. "This is the first time in well over a decade that the score went down."

Maintaining a good credit score is crucial for securing favorable loan terms, as borrowers with higher credit scores are more likely to be approved and qualify for lower interest rates. Ann Kaplan, founder of iFinance, emphasizes the importance of timely bill payments and keeping debt-to-credit ratios below 30% as key strategies for improving credit scores.

This decline in the average consumer credit score in the U.S. serves as a cautionary signal amid ongoing economic uncertainties. As consumers navigate elevated interest rates and mounting debt levels, smart financial management becomes increasingly essential to maintain creditworthiness and financial stability.

© Copyright IBTimes 2025. All rights reserved.