How to Apply for COVID-19 Loans

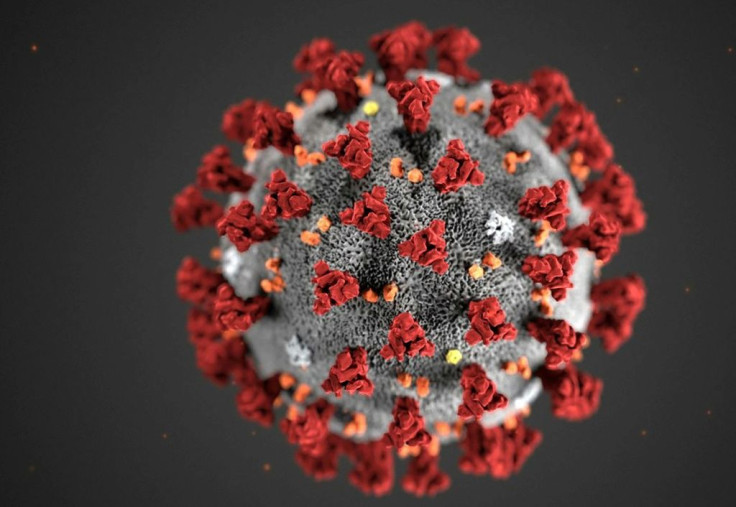

The coronavirus that has sent the U.S. into a national state of emergency has caused swift, brutal injury not only to individuals but also to small and medium businesses, who often lack the capital reserves to weather enforced closures or a sudden drop in clientele or street traffic. However, the Federal and several state governments have rushed to fill the economic hole created by COVID-19. Below is a list of loan programs--some new, some supplements to existing aid--designed specifically to help businesses cope with the viral crisis.

FEDERAL PROGRAMS

Congress has passed three stimulus measures, the latest of which is the Coronavirus Aid, Relief, and Economic Security Act, aka the "CARES Act." It allocates $2.2 trillion in total financial relief, including $349.5 billion for small businesses, defined as those with 500 employees or less. Much of this aid takes the form of subsidized, forgivable loans. The law also creates several provisions to sustain small businesses through the middle of summer 2020 including an employee retention credit, delay of employee payroll taxes and a modification of the rules for operating losses.

Most federal assistance is administered through the Small Business Administration (SBA).

The Paycheck Protection Program

The core of the CARES Act business-oriented offerings, the newly created Paycheck Protection Program will open to fast-track applications for small businesses and sole proprietorships on April 3rd and for independent contractors/self-employed individuals on April 10th. You must apply by June 30.

This program has a simplified form that is less complicated than the usual SBA application, requiring far less paperwork and time. It also waives the usual SBA requirement that applicants try to obtain loans elsewhere. You can apply through any existing SBA 7(a) lender or through any federally insured depository institution, federally insured credit union, and Farm Credit System institution participating in the program.

To be eligible, a business must have been in operation on Feb. 15, 2020. If yours was open then, but subsequently shuttered for a pandemic-related reason, you can still apply--provided you use the funds to rehire laid-off employees.

Who can apply for a Paycheck Protection Loan?

- Any small business with less than 500 employees, including sole proprietorships, independent contractors, and self-employed persons, private non-profit organizations or 501(c)(19) veterans organizations affected by the coronavirus.

- Businesses that have more than 500 employees, if they meet the SBA's size standards for specific industries.

- Small businesses in the hospitality and food industry with more than one location, provided they employ less than 500 workers. This is primarily for franchise owners.

Paycheck Protection Loan Details

- Loan repayments will be deferred for six months.

- Loans are eligible for full forgiveness if the funds are used for payroll costs, interest on mortgages, rent, and utilities. At least 75% of the forgiven amount must have been used for payroll.

- The basic terms: a loan of two years duration at a 1% interest rate. If the loan is used for expenses other than the above, the loan term can extend up to 10 years, at an interest rate of up to 4% (on the unforgiven balance).

- No collateral or personal guarantees are required.

- Loan size is determined by the average monthly cost of payroll, mortgage payments, rent/utilities, and other debts, up to $10 million.

- Neither the government nor lenders (the SBA delegates the financing of loans to private banks) will charge any fees. The SBA pays for 100% of the costs of originating the loans until Jan. 1, 2021.

The Economic Injury Disaster Loan Program

The SBA's Economic Injury Disaster Loan (EIDL) Program actually predates the current crisis, but the CARES Act and other legislation modified it to provide rapid assistance to businesses who've suffered a loss of revenue and other adverse effects for coronavirus-related reasons. Though the application is somewhat complex, it's streamlined by SBA standards (you may not need to fill out every part). These revamped EIDL loans will be available until Dec. 31, 2020.

Economic Injury Disaster Loan Details

- Loans offer up to $2 million in assistance.

- Loans may be used to pay fixed debts, payroll, accounts payable and other bills that can't be paid because of the disaster's impact.

- Interest rates: 3.75% for small businesses; 2.75% for non-profits.

- Loan maturities are determined on a case-by-case basis, based upon each borrower's ability to repay. But the emphasis is on long-term repayments in order to keep payments affordable, up to a maximum of 30 years.

Other SBA Aid for Businesses

Along with the regular EIDL loans, the SBA is offering Emergency Economic Injury Advances. These provide up to $10,000 in immediate funds if you apply during your EIDL application or within three days of it. Since the money doesn't have to be repaid, even if your EIDL is declined or still pending, it's effectively a grant.

The SBA also offers express bridge loans for up to $25,000 for businesses that need funds before their full EIDL loans can be approved.

The CARES Act increases the maximum size of an SBA Express loan (fast-track financing, applications for which are processed in 36 hours) from $350,000 to $1 million.

Additional Details and Resources for Small Businesses

Business owners can apply for both the Paycheck Protection Loans and the EIDL loans, as long as they cover different expenses. There is a penalty if you apply for both loans to pay the same costs.

The SBA offers a helpful page that lists all its resources for small businesses affected by the COVID-19 crisis. The US Chamber of Commerce has also released a Coronavirus Emergency Loans and Small Business Guide and Checklist to help determine if and how you qualify for a loan.

Since the financing comes from private lenders, some borrowers may worry that they will be denied credit: After all, banks don't give away money for free. But these are unusual loans for unusual times. The final regulations for lenders on whom they must accept have not been issued, but signs are that banks will be generous, given that the loans are 100% SBA-guaranteed. "We'll have to collect some things that are just for basic bank regs that are around Know Your Customer and things like that, but that's it," said Koger Propst, President and CEO of Colorado-based ANB Bank. "There will be no financial statements required, there's nothing."

STATE AND LOCAL PROGRAMS

State and local governments have also created programs to help small businesses avoid serious economic damage from COVID-19, some of it from $150 billion in from the federal Coronavirus Relief Fund, the rest from their own disaster relief reserves.

A good place to start looking for information on those programs is a via Google search like, "disaster relief program in MY TOWN, MY STATE" (for example, "disaster relief programs in Mason, Co. Kentucky.") Or check your state's Dept. of Commerce, Treasury or Finance websites. The National Governors Association offers a list of governors' sites, which often post updates as programs and resources are being added daily. For example, the Kentucky governor's site has a banner: "For the latest information on the novel coronavirus in Kentucky, please visit kycovid19.ky.gov."

Other resources include:

- Benefits.gov's searchable page of all the disaster relief programs in the U.S.

- USA.gov's disaster relief information page

- Disasterassistance.gov's Find Assistance survey

Here's a rundown of resources for some of the hardest-hit states.

California

California has two programs to help businesses adversely affected by COVID-19.

The California Capital Access Program (CalCAP) is a loan loss reserve program that provides up to 100% coverage on losses as a result of certain loan defaults. Individual borrowers are limited to a maximum of $2.5 million enrolled over a 3-year period.

The California Disaster Relief Loan Guarantee Program provides loan guarantees of up to $1 million for small business borrowers in declared disaster areas.

Florida

Even before Florida Governor Ron DeSantis imposed movement and congregation limits on the state, he activated the Florida Small Business Emergency Bridge Loan Program.

This program gives short-term, interest-free loans to small businesses impacted by COVID-19. The loans have a duration of one year and can be for up to $50,000. It also offers emergency bridge loans.

New York

The following programs are available in New York, currently the epicenter of the COVID-19 crisis:

New York City Employee Retention Grant Program. According to their website, "This program is available to New York City businesses with one to four employees that can demonstrate at least a 25% decrease in revenue as a result of COVID-19. Eligible businesses will receive a grant covering up to 40% of their payroll for two months. Businesses can access up to $27,000."

NYC Small Business Continuity Loan Fund. This program is available for "businesses with fewer than 100 employees who have seen sales decreases of 25% or more will be eligible to apply for zero-interest loans of up to $75,000 to help ensure business continuity."

To me the eligibility requirements for the NYC Small Business Continuity Loan Fund businesses must:

- Be located within the five boroughs of New York City

- Demonstrate that the COVID-19 outbreak caused at least a 25% decrease in revenue

- Employ 99 employees or fewer in total across all locations

- Demonstrate the ability to repay the loan

- Have no outstanding tax liens or legal judgments

More states and municipalities will undoubtedly be passing emergency relief after the federal government passes a fourth stimulus bill that is reported to focus on more money for state and local governments. Those with programs in the works as of this writing include Arizona, Arkansas, the city of Denver Delaware, the city of Chicago, Iowa, Kansas, Michigan, Minnesota, and New Mexico.

© Copyright IBTimes 2025. All rights reserved.