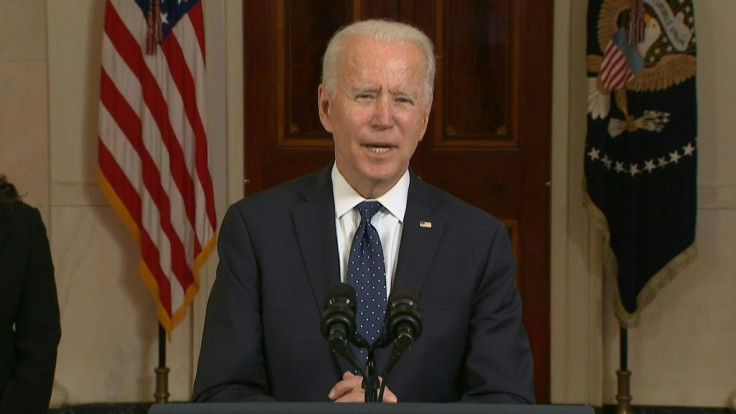

Biden Tax Plan Could Impose 61% Tax Rate On Inherited Wealth

KEY POINTS

- High-income families may see a tax rate of 61% on inherited wealth

- The top tax bracket of 39.6% would apply to the top 1% of Americans

- It is unclear how Biden plans to pass the legislation through Congress

High-income families may see a combined tax rate of up to 61% on inherited wealth as part of President Joe Biden’s American Families Plan.

Biden’s $1.8 trillion spending plan would raise capital-gains taxes to 43.4% from 23.8%, and tax assets as if sold when someone dies, thus eliminating a tax benefit on appreciated assets. The plan also restores the top tax bracket to what it was before 2017, returning the rate to 39.6% for the top 1%.

An analysis from the Tax Foundation found that Biden’s tax plan—combined with the estate tax, a near double on the capital gains rate, and a repeal of a tax benefit on appreciated assets—would bring total effective marginal rates to as high as 61% on inherited wealth.

An April study by the Institute of Taxation and Public Policy found that Biden’s plan would increase taxes by more than $100,000 a year in the top 1% who earn an average of $2.2 million a year.

"Households making over $1 million—the top 0.3% of all households—will pay the same 39.6% rate on all their income, equalizing the rate paid on investment returns and wages," a White House fact sheet read.

"Moreover, the President would eliminate the loophole that allows the wealthiest Americans to entirely escape tax on their wealth by passing it down to heirs. Today, our tax laws allow these accumulated gains to be passed down across generations untaxed, exacerbating inequality. The President’s plan will close this loophole, ending the practice of 'stepping-up' the basis for gains in excess of $1 million ($2.5 million per couple when combined with existing real estate exemptions) and making sure the gains are taxed if the property is not donated to charity."

The 39.6% rate would follow the measures signed into law during the Obama administration and only affect Americans making $400,000 or more a year. The tax rate may also apply to people on high-earning, high-cost coasts who may not consider themselves wealthy.

It is currently unclear how or if President Biden’s plan can pass the U.S. Congress. Moderate Democrats are also likely to push back on Biden’s tax plan.

However, only a small number of the wealthiest taxpayers could face the tax rate of 61%, while others may avoid it through tax and estate planning, CNBC reported.

“It’s a big number,” Brad Sprong, KPMG partner and private enterprise tax leader, told CNBC. “That’s why we’re telling our clients to be smart and start preparing now.”

© Copyright IBTimes 2025. All rights reserved.