Charter vs Comcast: Cable Mergers With TWC And Bright House Differ In Key Ways From Failed Mega Deal

This time, things will be different -- or will they? Executives at Charter Communications Inc. and Time Warner Cable Inc. bent over backwards Tuesday hoping to convince analysts and shareholders that a proposed merger of the two cable companies will not face the same regulatory hurdles as Comcast Corp.’s ill-fated attempt to take over Time Warner Cable.

“We’re a very different company than Comcast, and this is a very different transaction,” Tom Rutledge, Charter’s president and chief executive, told analysts in a conference call.

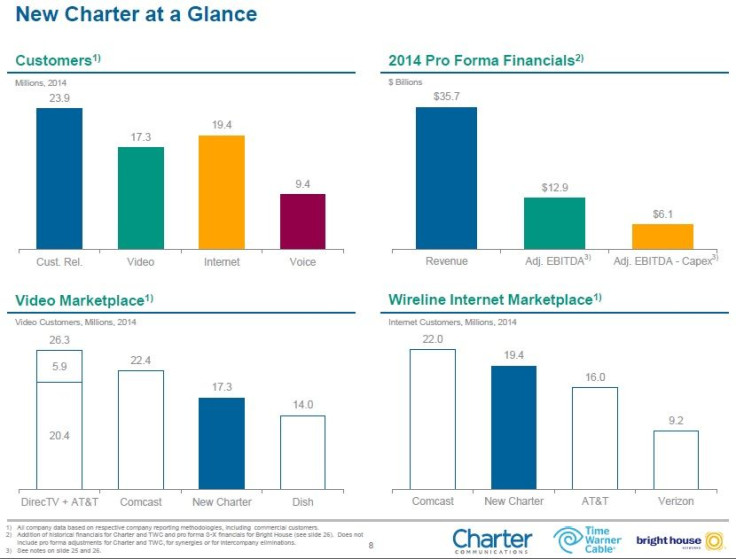

The $56.7 billion merger plan was announced Tuesday and follows Charter’s separate plan to acquire Bright House Networks for $10.4 billion. Combined, the two deals will turn Charter into the country’s second largest cable and broadband operator behind Comcast.

In the conference call, Rutledge was asked why he believes Charter will succeed where Comcast failed. It’s a fair question given that only a month ago Comcast abandoned its proposed takeover of Time Warner Cable after spending more than a year trying to convince regulators and consumers that the $45 billion deal did not raise a single antitrust concern.

Staff attorneys at the U.S. Justice Department disagreed and ultimately cooled to the idea of giving a single company control of more than half of the country’s broadband market, particularly at a time when Web-TV services and streaming companies are propelling a shift away from traditional cable viewership.

No Dominant Entity

A combined Charter-TWC-Bright House will look much different than a combined Comcast-TWC would have looked. If the mergers close, Charter will control less than a third of the broadband Internet market and will still be smaller than Comcast in terms pay-TV and Internet subscribers. The deals will give Charter 19.4 million Internet subscribers, compared to Comcast’s 22 million. Moreover, if the proposed merger of AT&T and DirecTV is approved, the new Charter will be the third largest pay-TV company, with 17.3 million video subscribers, compared to 22.4 million for Comcast and 26.3 million for a post-merger AT&T.

Given that the Charter deal will not create a single dominant entity, analysts say it is likely to raise fewer eyebrows in Washington. “I don’t think regulators want to be seen as impediments to market forces,” said Tuna Amobi, equity analyst at S&P Capital IQ. “Ultimately, the main question is, ‘How do consumers stand to benefit from this deal?’ I think, frankly, this deal could have more benefits for consumers than the Comcast-Time Warner deal simply because the new company is not going to be in the position to dominate the video or broadband market in any meaningful way.”

Charter is making the case that further consolidation in the cable industry is necessary if smaller companies want to invest in the infrastructure they need to compete with larger players. If the Charter mergers are approved, the company said it will expand its broadband offerings and invest heavily in Wi-Fi. Amobi added the deal would “recalibrate the balance of power” among the top five cable and broadband providers.

“It creates more competition for Comcast and AT&T,” Amobi said.

Rutledge also pointed out Charter does not own powerful media interests, as Comcast does through its NBCUniversal division. Analysts say the lack of a so-called vertical element to the mergers will alleviate concerns that Charter could use its increased market power to leverage better programming deals for affiliates -- a key point of contention in the Comcast-TWC deal.

“It is important to note that none of the three cable operators have significant interests in the content marketplace that would appear to create incentives for them to discriminate against unaffiliated content providers,” Randolph J. May, president of the Free State Foundation and a former lawyer for the Federal Communications Commission, said in a statement.

Consumer Backlash

The Comcast-TWC merger also faced enormous opposition from consumer groups who said the combined cable colossus would gain an unfair bargaining advantage and stifle competition from streaming companies like Netflix and Amazon. So concerted was the hostility, opponents of the merger formed “Stop Mega Comcast” -- an alliance of nearly 30 public interest groups, labor unions and for-profit companies bent on convincing regulators to block the deal.

Can we expect the same furor this time around? “I don’t think so,” Amobi said. “I think you’re likely to see some opposition, but not anywhere close to what we saw with Comcast. The company that we’re talking about is still going to be a pure distributor. It’s not going to own any content.”

Consumer groups often oppose consolidation in general, and some critics of the Comcast-TWC merger already have voiced concerns about Charter’s plans -- if not outright opposition to them.

“As with any potential cable merger, we encourage the FCC, the DOJ and other local/state regulatory authorities to make a thorough review to ensure that the public interest is served and to ensure that a cable monster isn’t born,” said Tim Winter, president of the Parents Television Council, a media watchdog group that wants to see an end to the traditional cable bundle. “Consumers and families should be able to pick and choose -- and pay for -- the programming they want; and to that end, we hope any potential merger between Charter and TWC will help to make that happen.”

Consumers Union, a group that had voiced staunch opposition to the Comcast-TWC merger, stopped short Tuesday of flat-out opposing Charter’s plans, but it said the merger should face “tough scrutiny” from regulators to ensure that consumers are not harmed. In a statement, Delara Derakhshani, the group’s policy counsel, said it remains to be seen whether the merger is in the public interest.

“Frankly, we’re skeptical,” Derakhshani said. “When it comes to cable consolidation, history teaches us to be very concerned about the benefits for consumers. Prices for cable and broadband continue to go up, and customer service is dismal.”

Perhaps the biggest vote of confidence that Charter will have an easier time than Comcast came from Comcast CEO Brian Roberts himself. “This deal makes all the sense in the world,” Roberts said in a statement Tuesday. “I would like to congratulate all the parties.”

Christopher Zara is a senior writer who covers media and culture. News tips? Email me here. Follow me on Twitter @christopherzara.

© Copyright IBTimes 2025. All rights reserved.